"When you own this business, you are leveraging off their ability to learn from the prior years of experience in manufacturing at scale and their ability to deliver timeously to their franchise owners. In other words, whilst the strength of their front end businesses is paramount and most importantly continuing to attract new (and retain existing) customers, the margin expansion in manufacturing continues to be more important."

To market to market to buy a fat pig Stocks had little or no guidance from either of the big markets globally, an unusual event in which we traded and no FTSE or no Wall Street. I suspect that there is possibly only one of these days per year. I found a rewind of five years back when the Bulls, Barca and the Bucs won on the same weekend, the good old days. I have converted to the Lions rugby team a while back, the highveld teams still have my heart however. A quick update for the record, now that Nike have thrown their weight behind Chelsea, I am liberty to say that I am now a returned supporter after years of being in the wilderness (and missed titles to boot). Special one or not, the blues now have an extra shirt wearer.

Who cares about my sports teams. I was thinking the other day, the players are allowed to change their teams, surely the fans should be allowed to? Or are you supposed to be married to the idea? Pfff .... enough of that. Recap from yesterday, stocks as a collective ended the session up just over two-thirds of a percent. Financials lower, pre-empting a ratings downgrade of sorts (or not) in a couple of days. In Germany stocks rallied a little, following a better Asian showing earlier in the day. The US futures market, which trades independently from the spot market during holidays, pointed to a greener opening through the day.

Nedbank, FirstRand, RMB and Investec were amongst all the losers, Aspen too (the Venezuelan situation is looking grim) had a day where the stock sold off over a percent. Remember that in their interim results "Revenue was unfavourably affected by R836 million due to the devaluation of the Venezuelan contribution." As far as I understand it, the opposition is getting a seat at the table with the bus driver. In the words of Merv Hughes to Javed Miandad (who called big Merv a fat bus driver, too un-athletic for cricket), tickets please! Socialist ideas may start with noble intentions, yet fail each and every time, they discount the human element. Tickets for the Venezuelan left, we wish. The collective capitalist we I use in this context.

Company Corner

Good news, Famous Brands results for the full year hit the screens yesterday morning. The same cycle over and over, the longer you do this, the more you get used to the fact that the company is going to report on the last Monday in May. These of course were for the full year to end 29 February - Famous Brands Reports Impressive 15th Consecutive Year Of Record Results. It is a pretty impressive track record and most especially against the backdrop of a consumer that was supposed to be under tremendous pressure. They are opening two stores a week here in South Africa, three a week across the group, and they refurbished four stores across the group per week of the financial year.

When you own this business, you are leveraging off their ability to learn from the prior years of experience in manufacturing at scale and their ability to deliver timeously to their franchise owners. In other words, whilst the strength of their front end businesses is paramount and most importantly continuing to attract new (and retain existing) customers, the margin expansion in manufacturing continues to be more important. If you can produce at scale, cheaper product to then on-sell to your franchise owners, that feeds straight through to the bottom line. Franchise owners have strict instructions in order to meet the lofty standards (that counts for all brands), which is why they have to buy everything from buns to serviettes from the company itself. In essence you are buying a logistics (huge network) business that services 2614 restaurants.

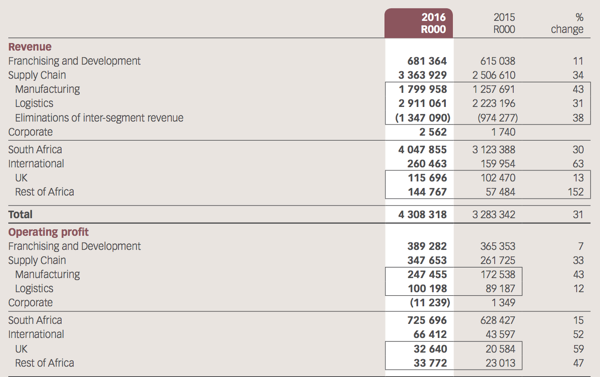

Herewith the divisional revenues and operating profits, equally across the different geographies. See that whilst Franchising and development profits grew only 7 percent, notice that the supply chain division (manufacturing and moving goods around) grew at a whopping 33 percent. Also quite noticeable was that the rest of Africa segment grew at an incredible pace. More importantly for shareholders, it is now bigger than the UK, in terms of revenues and profits. Still, the business is very South African, which isn't necessarily a bad thing:

If you recall last week the manufacturing division was dealt a shot in the arm, Famous Brands bought a french fries processing plant from Oceana. It is called Lamberts Bay Foods and currently processes 24 thousand tons of potatoes per annum. Of course remember that through their franchises such as Steers and Wimpy, the group sells a monster amount of french fries. There are over 600 franchised Wimpy's in South Africa, Steers has a similar number just below 600, there are 227 Fishaways, as you can see, nearly half of their brand presence needs french fries all the time.

The one that rich people talk about all the time is Tasha's, the founder Natasha Sideris still is very much operational. There are only 16 Tasha's, one in Dubai, one in Durban, one in Pretoria, four in Cape Town and the balance, the other half, here in Jozi. One in fact here in Melrose Arch where we are. I have been to 5 I think, including the one here. Yes, five. None outside of Joburg, as of yet. I recall seeing Tasha at the Sandton store, she was at the store on a Saturday morning being highly in tune with the restaurant. Getting staff to make sure presentation was perfect. I remember some plants were not quite up to scratch, there was a little dust on the top of a shelf, that sort of thing. Heck, I guess you don't get to be a highly driven entrepreneur without perfection. I wonder if she retained the 49 percent stake as per the 2008 deal, I guess she may have the finance backing of the banks if Famous Brands is the partner.

I think that is the other part of the model, recently Famous Brands have been looking for more casual dining experiences, fine dining without the pomp and ceremony. That is why they have been acquiring controlling stake in the likes of Salsa Mexican Grill (I have been there too, the single branch in Fourways is awesome), I think that one is going to be a massive hit. Lupa Osteria, the three branch spot in KZN, if any of you have been there, please let me know. Catch, there seems to also only be a single branch (as far as I can tell) in Bedfordview, my friends from the East, have you been there? And of course French bakery concept PAUL will be hitting our shores soon. A school dad will be running that business, I have had the time to chat to him and get insight, equally I have been to their bakery outlets in Paris, pretty darn awesome places.

What I find pretty amusing is that whilst the general rhetoric points to a gloomy outlook, the company suggests that they are opening 292 franchise restaurants this year. How bad can it be? They are adding in the next year over 11 percent to the existing base. Those stores will continue to require a strong manufacturing presence. As they say in the prospects column: "Famous Brands will continue to pursue further upstream manufacturing prospects and explore opportunities to grow the Group's presence in the casual evening dining segment, as well as outside of the traditional food service sector"

Howard Schultz was recently in South Africa for Taste Holding's opening of the Starbucks in Rosebank (I still haven't been), and being there a week after the actual opening, suggested that this market could be really strong in accepting of their brand. We like all the entrants in this space, Taste will have to execute carefully, they have the energetic management to do that, of that I have no doubt. The casual dining market, notwithstanding the current environment, looks in good shape.

As an investment, Famous Brands always looks (perpetually) expensive trading on (at the close yesterday of 121.45 Rand) a 22.5 multiple. Growing at that pace means that the PEG ratio (Price to earnings over the growth in earnings, which is 16 percent over the last 6 years) is 1.4 times. There is a very generous dividend policy of 1.3 times, the dividend for the year clocked 405 cents, after the 15 percent DWT (dividend withholding tax) the yield is 2.83 percent. Not a kings ransom, progressive nevertheless. We continue to own and accumulate the shares on weakness.

Big news, Bidvest and Bidcorp started trading independently of one another yesterday. This was well telegraphed, and you should have seen it coming from quite a mile away. It always catches one by surprise however, we luckily have built systems to be able to do this real time. The only thing unknown, and will be revealed on June 1 is the ratio, i.e. the price paid of the two respective businesses. We could see already that the there was a substantial rerating of both stocks, perhaps natural buying from funds and indices, perhaps a better understanding of the separate businesses and the value unlock that everyone has been waiting for.

For each 1 share of Bidvest that you held on Friday, where the stock closed up 4 percent to 370 Rand a share, you got one Bidcorp and one Bidvest, which effectively spun the offshore foodservice business off. The Bidcorp shares traded around 300 Rand a share (closed at 304) and the Bidvest (the South African assets) traded at 118 Rand, closing at 118.59. Add them together and you get around 422 Rand. Which is a WHOLE lot higher than the 300 Rand at the Nenegate event in December, a serious uplift of value.

The shares, based on the back of the matchbox ratio that I figured (0.292 for Bidvest and the balance 0.708 for the Bidcorp) closed higher. Much higher. Bidcorp closed up around 17 percent to 304 Rand and Bidvest at 118.55 Rand, up 7 percent. Together the stock added 52 Rand from the prior close, which means as a "whole", the market gave the different divisions a collective 14 percent higher. Yowsers. Is that for real, does Mr. Market really think that the two separate companies can operate that much better from one another? We will advise shortly on what we should be doing here!

Linkfest, lap it up

A similar study was done in England, the study is not too scientific due to them just comparing surnames from back then to surname's of the top tax payers - The richest families in Florence in 1427 are still the richest families in Florence

This is a nice problem to have and after seeing the images in this article I want to visit Iceland now too - Iceland plans Airbnb restrictions amid tourism explosion.

Due to low infrastructure spend in most African countries in the past, newer technologies are taking hold. Mobil operators for internet instead of fixed line operators and renewable energy instead of large powers stations that require power line infrastructure to transport the electricity - There's a logical reason why Africa's renewables landscape is better than a lot of much richer places.

Home again, home again, jiggety-jog. Markets across Asia are cooking, European markets are set to open higher. There is the small matter of non-farm payrolls this Friday, ADP data on Wednesday as the precursor to Friday and Fed anxiety is omnipresent.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment