"The point worth making is that Europe is still intact. "Grexit" never occurred. Nor did the Germans go their own way. "Brexit" won't happen, it will be a market event though, as the time draws nearer, anxiety no doubt will be elevated."

To market to market to buy a fat pig Locally we managed to catch a bid in the last little part of trade Friday, the weakening currency was responsible for that to some extent. Financials lagged, resources and industrials led the overall market higher. The Jozi all share index ramped up 0.28 percent by the close, adding over 650 points from the lowest point earlier in the day. I guess you could say that it was a pretty heroic all round market gain. At the top of the leaderboard was Naspers, perhaps it was closely linked to the Friday news that Apple had invested in the Chinese cab hailing app, many of those booking are made via their platform WeChat. That is not new news, rather a reminder of the Chinese landscape and how attractive it may still be for investors.

At the bottom end of the scoreboard was a poor time being had by Mediclinic, I am wondering if the Brexit scenario is starting to weigh on the stock. I couldn't find any specific news on the company, I did see that it traded a lot more than usual, over 50 percent above the usual volumes. Perhaps an ex insider of Al Noor taking the money and running? The year end results and presentation is set for next week, on the 25th of May.

Everything is pretty new, and that includes UK investors who will for the first time be inside of the combined group. Mediclinic is a relatively big businesses in the private hospital space. American business HCA is one of the big daddies of the industry, the companies operates nearly 170 hospitals and has a market cap of 30 billion Dollars. By contrast, Mediclinic operates across less than 100 hospitals and clinics across three regions (including a stake in another healthcare business, Spire).

Mediclinic's market cap is "only" 6.2 billion Pounds. There is certainly much scope for consolidation in this industry and I expect that to happen. I expect Mediclinic to continue to grow their business and access cheaper funding (as was the stated intention) in the UK, in order to expand their business. Possibly geographically too, working together with government health systems, as is the case of Spire Healthcare in the UK.

Over the seas and far away in New York, New York, stocks were trashed in the second half of the session, retail stocks in the news again, this time Nordstrom. What made me laugh is that US retail sales came in really strong, the strongest gain in over a year, the WSJ reports -> Retail Sales Gain Is Fueled by Web. Inside of the report was the news that Department store sales sank, online shopping grew. Now, who would have thought?

If you read the article (again, sorry it is behind a paywall), you can see that Amazon is now the second biggest seller of apparel after Walmart according to Morgan Stanley. Out with department stores, in with Walmart and increasingly Amazon. So when Macy's say the consumer is having a tough time, perhaps they should say that they are having a tough time deciding what to buy on Amazon. Ouch! And guess what, now Economists are starting to upgrade their calls for US GDP growth. Sigh, that dovetails nicely into the next little piece. Before that, quick scoreboard check, the nerds of NASDAQ fell just over four-tenths of a percent, the Dow Jones off over a percent and lastly the broader market S&P 500 sank 0.85 percent.

Remember the PIGS? The acronym given to Portugal, Ireland (another I was even inserted for Italy), Greece and Spain. All the worry children of the European Union back then, just after a US housing market turned into a European sovereign issue as global growth hit the skids. It feels a little like that now, two paced growth, worries around the second largest economy on the planet (credit problems), China and still some unresolved geopolitical issues. Serious ones at that, Syria seems to be the presently unsolvable issue. Heightened tensions around who accepts migrants and who doesn't is seeing parties with unconventional ideals gaining more support. The Greece example is there for all to see. Whether or not Greece is being made to pay for previous sins committed in another era is another question altogether.

The point worth making is that Europe is still intact. "Grexit" never occurred. Nor did the Germans go their own way. "Brexit" won't happen, it will be a market event though, as the time draws nearer, anxiety no doubt will be elevated. I love the FT's (paywall) cartoon associated with the story Rival historians trade blows over Brexit. You will have tons of information of what this or that will mean.

I suspect that ultimately the vote will be in favour of the status quo, it is never going to be perfect as every single country tries to push their own agenda. The naysayers may want to eat some more humble pie, over the weekend Ireland's credit rating was upgraded by Moody's Investor Services and the country continues to enjoy a "positive outlook" which suggests that the next move in a rating could be upwards, see the WSJ (paywall) article -> Ireland Hails Moody's Upgrade as Sign of Confidence.

There is always going to be a low and a high road scenario. Europe has not gone to the wall, nor did the US in those dark days of the last quarter of 2008 spiral into financial Armageddon. Beware of those foretelling of doomsday scenarios. As humans we always tend to think of the worst, hope for the best. In markets, as there are real life savings at risk, and the prospect of financial freedom never being reached as a result of a disaster, I often see people worried about the low road scenario. There is a whole lot of macro analysis on this scenario or that scenario. For us, as straight up equities guys, companies paths are more important. Spend more time worrying about the companies and less time worrying about the macro picture, companies make provisions accordingly.

That is the way that we will continue to operate, for in the end, the only thing that we have any control over is the companies that we own and when we buy (or sell) them. We don't own Brexit (nor do we have a say), we don't own Chinese economic policy, we don't own global conflicts (we wish we could solve them timeously), we don't own US elections and their candidates (be it whether you like them or not), we don't own US Fed or ECB policy, we don't own any government policy and we certainly do not have a say over how economic policy is decided.

We do have choices over whether we choose to invest offshore in different currencies, owning global businesses that are in attractive territories. If Caterpillar is struggling in China, or Yum! Brands is struggling in China, that might not be the same for Nike or Starbucks. All consumers in a single territory are not necessarily the same. All I am try to say is that there is talk, and then there is action. If you worry about x or y, then do something about it. If you are a client of ours, speak to us. If you want to be a client of ours, equally, speak to us. Action trumps words. Always, and even someone who shares that name knows.

Linkfest, lap it up

This video is a bit mesmerising, it also highlights the control and skill required to sing opera - Watch MRI footage of a world-class opera singer performing

Byron found this article from 2 years ago relating to the incredible size of WeChat (Owned by Tencent) and Didi (the guys Apple just put $1 billion into) - 21 million taxi rides have been booked on WeChat in the past month. This highlights the value of having users on your platform, once you have users you are able to cross sell them on other products that you have. "Didi Dache gets an average of 700,000 bookings per day via WeChat"

I know that you all want to be the next Masterchef. What would you shell out for a bespoke handmade oven made to your spec? 19 thousand Dollars? You better believe it, via Bloomberg - The Greatest Stove on Earth

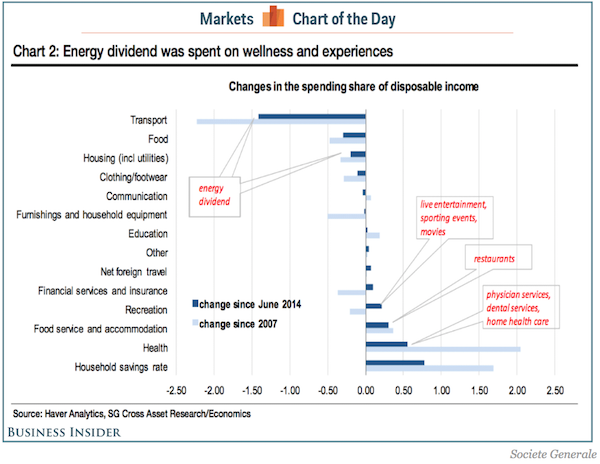

Oil prices dropping have resulted in consumers having more money to spend on other things, here is how they are spending it - How Americans are spending all that extra money from lower oil prices. I think the stat highlights that people are becoming more aware of the need to save.

Home again, home again, jiggety-jog. There is a local inflation read this week, perhaps a little respite from a while back. The weakening Rand for matters local and present mean that one segment of the market may well get a boost, whilst another will definitely not. Mr. Market has an uncanny way of keeping you on an even keel, even if your theory is that it is not the master of all. The market is the collective, the collective is always right, whether it suits you or not.

Ask the crazies in Venezuela, who want the president to declare a state of emergency as a result of Washington this and the coup in Brazil that. Pfff .... I feel absolutely desperate for ordinary people, either way it is coming to some sort of conclusion -> Maduro threatens seizure of closed factories. Radicals always think it will end differently. Strangely it never does. And in-between the people suffer.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment