"The only point to be made out of the markets and the Federal Reserve, trying to second guess when rates are going to rise and what the outcome is going to be on market sentiment is not investing in companies. That is what we do. Buy companies. If you are focusing all of your attention and getting anxious about one thing or another that the Fed are going to do or not do, then I think (with all due respect) that you are doing it wrong."

To market, to market to buy a fat pig. It was left overs, another look in at the day before where industrials sold off and led the local equity market lower. The big names again. In the background we have heightened tensions in the Middle East, more specifically Israel and the Gaza strip. I will never understand and I will not pretend to understand, the issue is that emotional that South Africans who have never lived a day in the region in their lives, even their forefathers are distantly removed geographically, but because there is a religious connection there is an emotive connection.

If you removed that element, allowed people to just be people, I am sure there would be speedier resolutions. Ouch, I think I just tried to solve issues that have been around for millennia, as you were sir. Anyhows, I am supposed to stay away from this particular subject, along with politics, not so? Too hard.

Markets across the seas and far away in New York, markets recovered from the small sell off recently, the Federal Reserve minutes are available for reading here: Minutes of the Federal Open Market Committee

June 17–18, 2014. What is always amazing is the number of people present and how there are almost no leaks ahead of these releases, in part because everyone has read the statement from the FOMC decision. We are in a low interest rate environment globally, more so in the developed world were ZIRP (Zero Interest Rate Policy) is set to be the status quo for the foreseeable future.

What is of course is the part that everyone wants to hear is when rates are going to rise. Now everyone knows that the tapering, the slowing down of the mortgage backed and treasury securities buying monthly is going to end, the question is when? Well, it seems with one last 15 billion stop, and that would be in October. The end of a program that was designed to instil confidence in both the financial institutions, businesses and by extension individuals. Rates will rise when the Fed realise that they need to rise.

As Michael said, there, I did not even know the world was ending this morning when I stepped out of my door. What does he mean by that? He is being sarcastic of course, this time last year the anxiety that had gripped short term market participants into believing that the extra liquidity provided by these programs would now cause asset prices to fall. Well. That never happened. Equity markets have actually been grinding higher. The 40 year return on the S&P 500 has been 2272.62 percent, thanks to Google Finance for the awesome graphics and data!

All these market ending events that we see from time to time are completely topic de jour. I did a long term 35 odd year return performance of the S&P 500, IBM, GE, Exxon Mobil and surprisingly, IBM under performed the index significantly, whilst GE outperformed marginally and Exxon Mobil outperformed hugely. I am pretty sure that if I had put that to you earlier in the conversation you might have had different views at this point.

The only point to be made out of the markets and the Federal Reserve, trying to second guess when rates are going to rise and what the outcome is going to be on market sentiment is not investing in companies. That is what we do. Buy companies. If you are focusing all of your attention and getting anxious about one thing or another that the Fed are going to do or not do, then I think (with all due respect) that you are doing it wrong. There is nothing that you can do about the rates environment next year, the year after and into the next decade. There is absolutely everything that you can do about where you allocate your capital, to which businesses that is.

Review time, this time for one of the smallest client holdings across the client portfolios, Holdsport released their annual report in the last couple of days. Annual reports are part glossy, but because the levels of financial reporting are always heading in the direction of more transparency. The optimist in me likes to think that the good businesses remain good, because they are of course committed to all the standards that we try and live by. I remember an older investor, whom I have an enormous amount of respect for, said to me once, something along these lines: "Nobody goes into business to try and do bad". I guess what he is saying is that people take risks, make investment decisions in order to get the commiserate return based on an opportunity that exists at that time.

We are getting off the topic a little, but those are points worth making. Investors want to see financial transparency from within, but above all else they want to see the best return for the risk that they are assuming. The annual report is a good place to see that. It is a good place to see the progression from start up phase to the next growth phase. It is inward reflection too.

A reminder, Holdsport is the business that owns the Sportsmans Warehouse (35 stores), Outdoor Warehouse (20 stores) and performance brands, Capestorm, First Ascent and specialised cycling equipment by BBB. Those last three brands contribute only 3.7 percent to group sales, Outdoor Warehouse (camping and adventure activities) account for 22.8 percent of sales and the bulk of the businesses sales (73.5 percent) come through their most well known brand, Sportsmans Warehouse.

The locations are pretty much countrywide, from presences in Cape Town, to PE and East London, up the coast to Durban (and of course Martizburg), through to the Highveld and Gauteng, as well as away towards the secondary cities in South Africa, Nelspruit, Polokwane, Kimberley, Bloemfontein and Rustenburg. Obviously the urban population has more money to spend on outdoor activities, both earnings power and point up energy! There is only one store outside of South Africa, in Windhoek where a new double Outdoor and Sportsmans Warehouse concept under one roof is being piloted.

Business wide sales topped 1.417 billion Rand last year, up only 3.1 percent for the year to end February 2014, headline earnings grew 3 percent to 173.2 million Rand. There are 43.2 million shares in issue, earnings per share increased a mere 3.1 percent to 402.6 cents, the progressive 1.9 times dividend cover translated through to 220 cents for the year, post the 15 percent dividends tax that amounts to 187 cents free and clear for you the shareholder.

The share price last traded at 40.89 ZAR, the historic valuation metrics see the company trade on a price to earnings multiple of 10.15 times (2014 earnings) and a post tax dividend yield of 4.57 percent, more than you will get in interest from a savings account. It seems very cheap, trading at a 30 percent discount to Truworths and Foschini, at a marginal premium to Lewis. So you get the sense that Holdsport is definitely in the same grouping as these companies, which have seen a poor showing in the credit cycle currently, middle income South Africans struggling to meet their obligations against the backdrop of weathering the storm through price increases in transportation, food and utilities. We all pay for transportation, unless you cycle to work. We all pay for food and utilities, unless you live in a cave and hunt.

So why own the company? Sporting equipment comes with middle class expansion, emphasis on healthier lifestyles comes with having established oneself in the middle classes and great weather which we have here in this country cannot be replicated anywhere else. Sure it has been cold over the last few days here on the highveld, nothing that a beanie and a pair of tights cannot solve. It is not snowing or blowing a gale. No, it is just a little cold. On the weekends there are folks out in their droves, running or cycling.

I for one, having skipped a decade of being in a big race was astonished at the size and scale of the Two Oceans this year relative to back in the early 2000's. There are quite clearly many more people on the roads. We have in the form of the Argus and the 94.7 Cycle Challenge, many more people looking to compete and take part in cycling. People are not afraid of dropping serious money on a pair of running shoes, or weights, or even gym equipment such as a treadmill. Cycling? Much more expensive, although they (Sportsmans) would be competing with niche operators.

Not only at that level, bicycling, but also at other levels, Nike, Puma, Adidas have all opened and operate presences here in South Africa, making the landscape a lot more competitive. The general investment theme associated around sporting equipment sales is simple, the richer your population gets, the more time (and more importantly money) they have for leisure activities. As that specific segment has been under pressure, so the respective outlooks for consumer discretionary has come under pressure.

Interestingly the three year performance of The Foschini Group and Holdsport is not too dissimilar, thanks to Google finance, I can see that they are up 32.6 and 31.07 percent respectively over the last three years. Truworths is up a mere 2.1 percent over the same time frames. So I would say that quite clearly, the market as a result of lack of scale compares the very tepid growth rates of Holdsport to the geared retailers, who have been selling fashion (jewellery/cell phones and homeward) on credit. To be clear, Holdsport does not sell any goods on credit, they are a cash retailer.

I think that it is going to be a while before they are a lot more profitable. Middle to upper end South Africans might continue to buy food, but discretionary spend is exactly that, discretionary. I think though that if you hold this stock, you are going to have to be patient, at this dividend yield at the bottom of the cycle with a strong bunch of institutional shareholders (Coronation - 21.3%, Stanlib - 7.5%, Investec AM - 13.9%, GEPF - 4.7%, Allan Gray - 5.2%) which adds up to 52.6 percent of the shares in issue. Add to that the strong management teams shareholding, Kevin Hodgson the CEO (11.6%), Toni Haarburger (she used to be at Woolies and Holdsport and is a founder of this business) (7.4%), as well as other directors (3.4%) own 22.4 percent. Stick those two together (management and institutional) and you have three quarters of the company in safe hands. When the opportunity arise, we suggest you add this to your portfolio. If you own it, hold on and be patient.

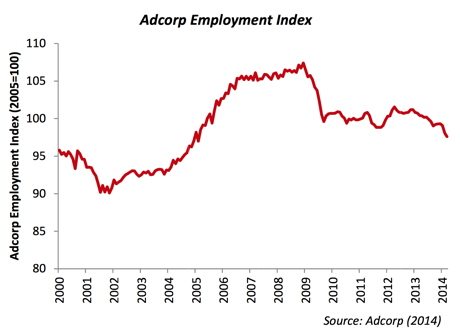

Just as a quick aside, and you may be interested in the latest Adcorp employment report. Personally I am just interested in the trend -> Adcorp Employment Index, June 2014: "Significant job losses were observed in mining (2,000), manufacturing (15,000) and construction (1,000). The public sector continued to create jobs during the month, amounting to 11,000 in government and 7,000 in state-owned enterprises." Government is seen as an employer, the private sector is not seen as an employer. The graph is also very telling:

So it is what it is. The only point I wanted to make is the one you know already. About the Telkom restructuring though, some Unions are taking the company to court about them wanting to slash half their workforce. Yowsers. It is no coincidence that many of the unemployed in South Africa view their best employment chance as the government, which is not that good in the long run.

Home again, home again, jiggety-jog. Markets are getting sold off here, some poor French and Italian manufacturing data is seeing to a sell off in Europe, which has filtered through to the rest of the global markets. And we are part of that too!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment