"The weaker Rand has helped but it is great to see that the international division of the business is becoming more and more significant. And trust me they are pushing it hard. In fact a friend of mine was in Angola last month and saw none other than Whitey Basson sitting opposite him at the restaurant. I doubt he was there for pleasure."

To market, to market to buy a fat pig. So is the Portuguese banking crisis a distant memory now? Seems so to the broader market, which marched on, the S&P added around half a percent, the Dow Jones closed above 17 thousand again. Locally we managed three quarters of a percent, driven by industrials and resources. Citi had numbers pre the market, it was a handsome beat. That was if you were only having a look at the headline numbers, the company had also agreed to pay a 7 billion Dollar settlement that comprised of 4 billion Dollars civil penalty to the US Justice department, 2.5 billion in consumer relief and the balance is to the FDIC and some of the states in which they were conducting poor mortgage business.

Criminal charges could still be brought against some of the employees. Wow. And all of this relates to what US attorney general Eric Holder describes as egregious conduct. Egregious means outstandingly bad; shocking, that is what the online dictionary tells me. Too many fines from too much poor behaviour in the go-go period could lead to lower risk taking and lower earnings. Perhaps more predictable earnings, which might make them more investable from a dividend flow point of view.

Not all banks are the same, quite simply because different banks act in different ways and engage in different forms of business. Some of them do the same business, but some do it much better, that is the nature of business, not everybody does the same thing the same way, Samsung, Apple, Nokia and Blackberry are examples of handset manufacturers, not all are equally profitable. Here are Citi (C), Wells Fargo (WFC), Bank of America Merrill Lynch (BAC) and JP Morgan Chase (JPM) compared to one another over ten years.

See that? You could have owned Bank of America and Citigroup and thought that banks as investments stunk, or you could have held Wells Fargo and JP Morgan and thought that everything was just fine. JP Morgan has a yield of 2.84 percent, Wells Fargo has a yield of 2.73 percent, Citi pays 1 cent a quarter, which translates to a yield of 0.08 percent. Ditto with Bank of America, one cent a quarter which translates to a yield of 0.26 percent. Not really that good.

I guess that tells a story in itself, free cash to send to shareholders means that capital buffers are comfortably inside of the respective ratios that the regulators set. Financials over the last twelve months have under performed the broader market, in our minds, because of the cyclicality of earnings we tend to avoid banks as investments.

The next World Cup starts on the 8th of June 2018, that is a LONG, LONG way away from now. It is only when you try and recall memories from the prior World Cup that you realise how long four years is. By that time some of the social networks that we still regard as relatively new will be a whole lot more mature than before. I was pretty interested to see the interaction between ordinary people and social networks, no, not ordinary people, soccer football fans.

Facebook statistics were interesting: WORLD CUP: Final Match Is Top Sporting Event In Facebook's History. It turns out if you were a young man, between the ages of 18 and 24, and in the USA, then you fell into the demographic that discussed this event the most. Interesting, right?

On Twitter the most tweeted per minute moment was when Germany won the World Cup, check out the entire Twitter Data. There have only ever been 8 winners of the world cup, Brazil (5 times), Germany and Italy (4 times), Argentina and Uruguay (twice), and once apiece for France, England and Spain. Germany have been in 8 finals matches, more than Brazil. Those two countries hold the record for most last 8 qualifications, 17 apiece. Twitter has only been in two finals. Facebook in three.

For many young people Twitter and Facebook (and even old people like me) are the go to news platforms, where it can be discussed and dissected with opinions. There are many opinions on Twitter and Facebook. Perhaps in four years time there can be another platform, or these ones will be stronger, their status with advertisers and the global reach has certainly been enhanced by events like this.

Byron's beats are bigger than Apple's Dr. Dre's

Following the Massmart update last week we received one from Shoprite yesterday which reiterated my assumption that customers have had a pretty strong first half of the year. Let us look at the announcement and then we can take a closer look at the details.

"For the 12 months to June 2014 the Group increased total turnover by 10.5% to about R102.2 billion, compared to the corresponding 12 months of 2013. Growth on a like-for-like basis was 5.1%. The Group saw an improved turnover growth of 11.4% in the second half of the year, compared to 9.7% in the first half.

The continued pressure on consumers' disposable income reflects in the slow-down in sales in the South African supermarket division, the largest division in the Group, which grew sales by 8.7%.

When converted to Rand, the turnover of the 169 supermarkets the Group operates outside the borders of South Africa, increased by 26.8% compared to the 2013 reporting period. Taken at constant currencies these operations grew by 16.2%.

The furniture division grew turnover by 12.2% even though the highly competitive market conditions remained unchanged."

Lots of interesting information there. We can see that the first half of this year has in fact been better than last year. For Shoprite that is. And 10.5% overall for the year is a very strong number. Retailers in other parts of the world would kill for that kind of growth. Growth on a like-for-like basis which was 5.1% tells us that inflation has been heavy and that price increases have been absorbed. Don't forget though that Shoprite are also opening up lots of new stores which boosts sales of course.

The obvious kicker there is the massive growth we are seeing outside of South Africa. The weaker Rand has helped but it is great to see that the international division of the business is becoming more and more significant. And trust me they are pushing it hard. In fact a friend of mine was in Angola last month and saw none other than Whitey Basson sitting opposite him at the restaurant. I doubt he was there for pleasure.

12.2% growth in the furniture division is very commendable when you consider how tough that environment has been. With brands such as OK Furniture and House & Home I can only think they have been stealing market share from the likes of Lewis, JD Group and Ellerines who have not been having a great time out there.

All in all a good set of numbers and the market has followed suit. In fact the whole retail sector is up 9% so far this year after a shaky start. Like I mentioned in the Massmart coverage, I still think the ride will be bumpy but stick with the quality and you will be rewarded over the long run. Woolworths and Massmart remain our preferred stock picks in this sector.

Michael's musings: The world moving forward - Better for everyone

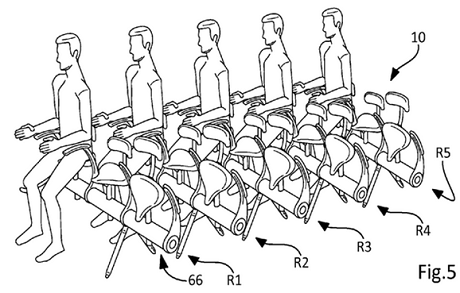

Below is a picture from a recent application by Airbus to the US patient office. My first reaction was to think why would they want to make the customer experience worse? Thinking about it further, the airlines are doing more with the resources that they have, meaning tickets will cost less and more people will be able to fly.

On short flights, airlines will be able to get more people on board, reducing the cost of tickets and allowing the consumer to have more money to spend elsewhere. There would still be seats with more leg room that you can pay up for, so you have options.

Here is a link to a clip that Sasha directed me to titled Everything is Amazing and Nobody's happy", the comedian talks about how technology has improved over the last few decades with particular reference to the airline industry at 2.45 minutes in the clip.

Another great article The good old days, which I think Sasha put a link to a couple of months ago, compares the cost of appliances today compared to 30 years ago. A dishwasher 30 years ago cost the average worker 48.5 working hours, compared to today where the average worker would only have to work 26.7 hours to afford one. Add to that, modern dishwashers are 123% more energy efficient, more savings.

The world gets wealthier as we find more efficient ways of doing things with our limited resources. I'm not a fan of less leg and arm room on an aeroplane but it will result in more efficient travel and society becoming wealthier.

Home again, home again, jiggety-jog. Markets are marginally better this morning, a fraction really. The German football team arrived back home to thousands of people getting excited. Good for country morale no doubt.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment