"I am going to end off saying that Mark Zuckerberg is one of those unique people that come around every now and again. His mission is not to make money. His mission is to connect the world. He lives in a modest home by his wealthy standards and lives a fairly ordinary life, I guess. In the last quarter one of the things the company has done that makes him most excited is the fact that internet.org (in conduction with the mobile networks) has helped 3 million people in the Philippines, Paraguay and Tanzania connect to the internet for the first time."

To market, to market to buy a fat pig. We closed flat here on the day, no, let me rephrase, we lost a few points on the day to end marginally in the red. And that was after a more than decent start, again Ukraine in the news, two military jets from the Ukrainian Air Force shot down by Russian Ukrainian separatists. I tried to explain my simple understanding of the situation in the Ukraine to two people and the conclusion was that I have no idea of the solution and what will happen next.

All I know is that the Europeans are preparing new sanctions, which prevents capital in financial services sectors from flowing both ways, in and out of Russia. 40 percent of the gas needs of Germany come from Russia, 80 odd billion Dollars of trade takes place between those two countries. It is as important to one another, remembering that Germany took an executive decision about nuclear power post the Fukushima Nuclear Power plant disaster. Of course the likelihood of a meltdown as a result of an earthquake and subsequent tsunami in Germany is obviously less than Japan, because of the tectonic plates relative to the respective geographies. You know what I mean.

Across the Atlantic on Wall Street, the S&P 500 closed on an all time high (a closing high) after having reached new intraday highs during the day. I made a note on my Vestact cap that said S&P 500 2000, the idea being that is the next stop. Just a number! It could be fun to see. The futures market this morning is pointing to a lower open, there are of course companies reporting through the next few weeks, so far so good. A pleasing first look at PMI data this morning might also do much to quell fears around a China slowdown. Earnings chaps, earnings, that is the most exciting part.

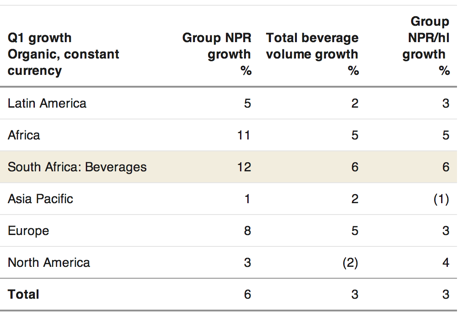

SABMiller released a trading update this morning. You can download them here: F15 Q1 Trading Update The best performing segment is local, you will be pleased to know. Many public holidays and Easter apparently leads to more people drinking beer and soft drinks. Why are they, "soft drinks"? Soft is not hard, and hard drinks are drinks that have alcohol in them. Here is a screen grab of the organic constant currency growth rates.

NPR stands for net producer revenue, I had to search for that. This company trades on a very lofty valuation. Very lofty. 27.5 times historic earnings. Now you might say to me, well that never scared you before, more especially if the growth rates in earnings keep pace. The only question I have when looking at SABMiller is simple, in a more health aware world, how much more beer do you think your customers can drink? Surely there is a limit. Unlike say for instance how much you can use your handset, or growth rates of users on the internet. Which dovetails nicely into the next piece. Forget the potential regulatory hurdles that companies like SABMiller face in the coming years.

Facebook reported numbers post the market close last evening. Once your base grows bigger and bigger it becomes a mathematical impossibility to grow at the same rate. Firstly, most of the users have adopted Facebook already that were keen to do so and secondly your potential user group gets smaller. I guess one could argue that if every human with a reliable internet connection had a Facebook account, the company could have a whole lot more than 1.32 billion users. Roughly 63 percent of that base use Facebook daily. Monthly active user growth is around 3.5 percent, which I think is astonishing, others are not wowed. 40 million users were added in the last quarter and now one in five people around the world log into their Facebook accounts on a monthly basis. Differently put 4 in 5 do not have a Facebook account.

Cast your mind back to when the business listed, their IPO price was 38 Dollars a share on 43 cents worth of earnings, the growth rates were that hotly anticipated that Mr. Market was hungry for the stock, the listing did not go as planned and the rest is history. The stock traded as low as 18 odd Dollars and everyone called the Facebook IPO a disaster and started to question whether or not the company would be able to monetise mobile. That was the real anxiety. Those concerns were quickly put to bed as the company showed their ability to keep up and modify what is a successful model.

We all like to know what our mates are up to. We would like to think that they would like to know what we are up to too, pictures of your dogs and kids and your wonderful time is actually of interest to me. For most people who have left school and tertiary institutions the platform is perfect. I could not care that teens are not too taken with Facebook, they see their frenemies friends each and every day. Once you have a life that involves working, a partner to share that with and little people (and pets), the natural way is to share that with others, that is the way we are designed. Communication is at our core. Fear of missing out is real.

The company sums it up perfectly in the about us segment on their investor relations page:

"Founded in 2004, Facebook's mission is to give people the power to share and make the world more open and connected. People use Facebook to stay connected with friends and family, to discover what's going on in the world, and to share and express what matters to them."

Anyhows, I am sure that there are many people preparing their respective theses on user patterns and how it impacts their lives, we are more concerned here on the business of their business. So let us start with the numbers. Revenue for the quarter was 2.91 billion Dollars, well up from the corresponding quarter this time last year, which was "only" 1.813 billion. That is a 61 percent increase. For the half year the company had revenues of 5.412 billion, on a per user basis that equates to 68.3 US cents of revenue per user per month. When you put it like that suddenly you can hop out of your chair and say, yowsers, that sounds like nothing and the potential to leverage off that base is huge.

Net income for the quarter was 800 million Dollars, for the half year 1.976 billion Dollars. Earnings per share, Non-GAAP, 42 cents for the quarter and 76 cents for the half. Whilst Facebook is still a value investors dragon to slay, they are ironically half the valuation of when they listed and double the price. In roughly two and a half years. Astonishing.

The anxiety of the company being able to monetise mobile? Ha-ha! Mobile advertising revenue represented 62 percent of total advertising revenue in the last quarter. Mobile ad revenue grew at a mind blowing 151 percent year over year. 1.07 billion people check out Facebook on their mobile phones and more amazing is that 399 million people ONLY use their mobile phones to check Facebook. That number is climbing all the time.

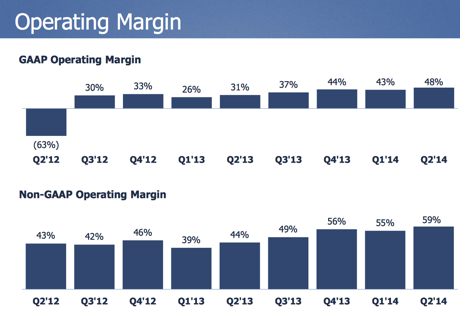

The most incredible set of numbers out of all of this is just how scalable this company is, notwithstanding the fact that they continue to add staff and expenses. I have taken this slide specifically from the Quarterly Earnings Slides:

Expanding margins on growing revenues leads to outsized growth on a per share basis. Obviously this cannot continue forever, there are a few key points to make about their current business. Firstly revenues are still very much cemented in the developed world, USA & Canada and Europe account for 43.9 and 28.2 percent of advertising revenue respectively, that is 72 percent in total. Asia accounts for 15.2 percent and the balance for the rest of the world. That means people like us are not really that active.

I am going to end off saying that Mark Zuckerberg is one of those unique people that come around every now and again. His mission is not to make money. His mission is to connect the world. He lives in a modest home by his wealthy standards and lives a fairly ordinary life, I guess. In the last quarter one of the things the company has done that makes him most excited is the fact that internet.org (in conduction with the mobile networks) has helped 3 million people in the Philippines, Paraguay and Tanzania connect to the internet for the first time. The internet is a library. You can teach yourself anything on the worlds open library, provided that you have the aptitude and correct attitude. The starting point is to connect the world, not too dissimilar to Bill Gates intentions all those years ago.

As you can see from the earnings, the company is wildly expensive on a fundamental basis. The options are open for explosive growth still, continuing to have what is the most pointed advertising platform currently. It is not a business that is for everyone to own even if the prospects look amazing. I definitely have a buy rating on the company and continue to believe that their adaptations to the world around us will continue to drive user engagements and subsequently higher revenues. Facebook will pursue a multitude of new business angles, from payments to software/hardware like Oculus. This company is mostly an advertising business with different interesting other segments to it. Sound familiar? Oh yes, sounds pretty much like Google. The market likes the numbers, the stock is up 5.5 percent in post market trade.

Home again, home again, jiggety-jog. Markets are lower here today, the currency remains strong. Chinese PMI and European PMI numbers were a beat, that is encouraging. In fact the HSBC flash Chinese PMI number was at a 18 month high.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment