"For the seller, SABMiller who say, will extract 11.7 billion Rand (630 million Pound Sterling), this is hardly a big deal. Their London market capitalisation was 54.63 billion Pounds as on Friday's close, this is a mere 1.1 percent of their market capitalisation. Again, this represents a deal that is massive in one parties life and tiny in another, and that is why I think that this is excellent all around."

To market, to market to buy a fat pig. Friday was an off day for the US markets, and if you want to know why it impacts global markets so much, then you should take a very quick look at this page: National wealth. Total wealth in the US, as per the first quarter was a whopping 81.8 trillion Dollars, Japan is in second place at 28.4 trillion (although this is an old measure), if you add up Germany and France, those two European countries are collectively one third of the Japanese and the Americans combined. Obviously on a per capita basis it is a little more equal, France and the USA are similar to one another, Germany and Japan are nearly equal. Japan and the USA (445 million) have combined populations less than the entire European Union (combined 505 million), but far greater than France and Germany together (144 million).

As such, having more rich people with bigger capital markets leads to more liquidity for global markets, when the US or Japan are closed for the day, the rest of global markets will suffer as a result. Of course there are all sorts of participants in capital markets, we have tried to point out many times that all of their agendas are the same, they want to make money. Some have five whole seconds as the time frames (milli seconds even), some have five decades. Unfortunately in this market if your way of making money is very short term in nature, the problems arise when there is a distinct lack of volatility. The S&P 500 has made 24 new highs this year, but is up less than 7 percent. Which is great for those who have been in one direction and staying long (thanks Harry and Niall) but completely awful, almost crippling for certain trading types.

For instance, this graph has been the topic of lots of conversation recently, no, loads of conversation recently. This is a screen grab taken from Google Finance for Volatility in the S&P 500. We are not only trading near 52 week lows, but we are also trading near multi year lows in Volatility.

The important part of that five year graph is the last bit, the three big spikes is when everyone made serious money (and lost no doubt) and now there is very little volatility, possibly because there is a whole lot more stability and certainty in markets. Of course volatility returns, there will always be times that are more uncertain than the present. Even though to some it hardly feels like it, it does not feel settled with northern Iraq in a state of turmoil, the Ukrainian conflict still a reality. For all of that we have companies that are a whole lot more settled and the visibility for earnings is better.

The last cog in all of this is that financial institutions have been blamed by lawmakers as the people responsible for the last crisis (law makers failed to point out their short comings, obviously), which has lead to greater regulatory overreach. Which has translated into lower risk taking by financial institutions and as such their profitability has fallen. Lower profits from in particular trading arms of the financial institutions have lead to less chances of super profits, translate that to lower remuneration too. It is not surprising to hear many people from financial institutions describing capital markets solid performance as puzzling to them, in large part (and this is an opinion only) because their personal circumstances and what they can see around them is not as profitable as before.

I prefer to listen to what the businesses say about their businesses, for me that is more insightful. Don't get me wrong, many risk takers have been well rewarded through this time, there have been a multitude of smart hedgies (largely independent) who have done astonishingly well, there are Bridgewater (Ray Dalio) and Paulson & Co. (John Paulson), Quantum (George Soros), as well as Baupost (Seth Klarman) and Appaloosa (David Tepper) that continue to profit hugely from selected bets. Their relative size to the markets overall makes them able to do this, perhaps this is going to be the very best thing about the last financial crisis, the fact that many talented people in our industry will be forced to go it alone because of the larger institutions adversity to risk. That would be a good thing!

Quite an interesting way of going about it, the cat and mouse between government, the ruling party, the ANC and Anglo American taking place. Right now and of course over the last two decades, mining has been at the centre of our economy for a long time, Johannesburg was founded as a result of gold mining activity. A province to which nearly 13 million South Africans call home was largely unpopulated 200 odd years ago. Mzilikazi, the founder of the Matabele kingdom made these surrounds his home for a while, but the travelling boers defeated him and forced the Ndebele people north to modern day Matabeleland, a province of Zimbabwe. History is by its very nature ruthless and often tells the story of the victor.

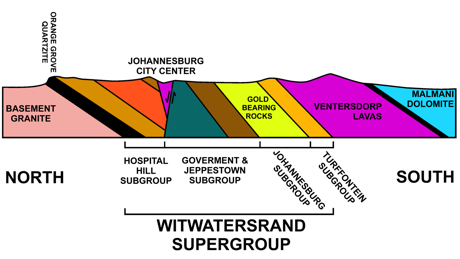

There is nothing glamorous about our province, sure if you have money here it is nice to live, the weather is predictable. You may or may not know, but Johannesburg is according to Wikipedia the "world's largest city not situated on a river, lake, or coastline". No gold equals no real settlement, the city was founded as a result of a gold rush. Today the province and city have fewer reminders than in years gone by, although 40 percent of all the gold ever mined and 50% of the world's found gold reserves are from South Africa. Just quickly, check this cool cross section I found from Wiki of the Witwatersrand.

That unfortunately is history. The country has undoubtably a better infrastructure and more advanced capital markets as a result of the exploration of minerals, you just need to cross the borders into the continent to see that. Our economy might be only the second largest in Africa now, after Nigeria, but the infrastructure is pretty decent. Although, as ever, more can be done.

Where am I going with all of this? Well, Anglo American have been told that they should not sell their platinum mines, it would be bad for the countries image as an investment destination. That is all very nice, but as the pockmarked south, east and west Joburg countryside can attest to (mine dumps), the mines are only as profitable as you can get the stuff out the ground at. In other words, if it costs you 101 cents to get something out the ground that you sell for 100 cents, you won't not only avoid doing this for very long, but you are not going to invest in the infrastructure. I understand where the ruling party comes from, from a investment destination point of view, but reality is a horrible, horrible thing.

If you cannot operate because the mine is unprofitable, it is not going to happen for very long. We only have to wait two weeks today to see, Amplats results which will no doubt reveal some reorganisation of the assets.

At the same time, Anglo have announced that they would be selling their noncore 50% interest in Lafarge Tarmac to Lafarge for a minimum value of £885 million ($1.5 billion). Or, around 4.2 percent of their market cap in Pound terms, which at Friday's close was 21.14 billion Pounds. So, this is neither a huge deal, nor a completely small one.

A number of conditions need to be met, including the merger between Holcim and Lafarge, which is obviously far more important for those two. Those two are currently working hard with regulators (more government intervention), trying to shed around 5 billion Euros in assets before the two are from a regulatory point of view allowed to merge. It is complicated, but in the end, should this Anglo sale go through, I would think that this is good to shareholders, this business was always noncore to the group.

SABMiller this morning has announced that they will be exiting their Tsogo Sun investment, the brewer owns a 39.6 percent stake in the hotels and entertainment group. According to the annual report from March 31, SABSA held 36.8 percent, perhaps excluding the treasury shares it is far greater, all you need to know is that 435 247 904 shares were held by SABSA at the end of the year. All that matters to Tsogo shareholders is that there is a seller of 305 015 346 shares by SAB South Africa (SABSA). The shares will be sold in a book build process, with the results expected next week Friday it seems, according to the release.

So those shares (305 million) will be sold to selected institutional parties, it makes sense for all concerned that strong hands hold these shares. Of course I would expect a discount for those coming in, and those going out (SABSA) will have to accept a liquidity versus cash settlement discount on the closing price of 26.90 ZAR on Friday. For the record the 52 week high for Tsogo is 28.99 ZAR, some time in May. The stock however has been lower than 25 ZAR in recent times too.

That accounts for 305 million shares, there are still 130 million then outstanding, where to for those ones? Well, and this is the only tricky part of this deal (if there is such a thing as a straightforward deal), SABSA has agreed to sell the shares back to Tsogo to a purchase price of 2.8 billion Rand, or "equal to the lower of 81.4% of the Placing Price or ZAR21.50 per Ordinary Share." Whichever one is lower, that is the price that the company will pay for these shares. More importantly, the company (Tsogo) will then cancel these shares within five days of having bought them back, thus reducing the numbers of shares in issue from nearly 1.1 billion shares to 967 million. How will the company pay for that? Existing reserves and debt facilities.

Included in the repurchase is the executive loan facility provided to the directors of the business, 200 million Rand made available to facilitate the funding of the purchase. You could argue that this is a sweetheart deal for the execs, but if you were HCI (Hosken Consolidated Investments Limited), owning 453 million shares, you would want management to be in boots and all.

I suspect that this is good for all parties. Good for the management team of Tsogo and good for the main shareholder of Tsogo, who now cement managements position and no longer have another shareholder without the energy for these assets. What do I mean by that? For HCI, a 46.8 percent shareholder of Tsogo post the repurchase and cancellation of the shares, this will be worth (even at the depressed price of 25 ZAR currently) 11.325 billion Rand. HCI has a market capitalisation of just shy of 20 billion Rand, so this is a very big deal to them, roughly 57 percent of their current market value.

For the seller, SABMiller who say, will extract 11.7 billion Rand (630 million Pound Sterling), this is hardly a big deal. Their London market capitalisation was 54.63 billion Pounds as on Friday's close, this is a mere 1.1 percent of their market capitalisation. Again, this represents a deal that is massive in one parties life and tiny in another, and that is why I think that this is excellent all around. Remember how SABMiller got this share in the first place, in the end it was always going to be not core to the overall group.

African Bank shares are on a tear this morning, around 20 odd percent up at their best. Sadly 20 odd percent higher means that the share price is a little over 8 Rand, a level where the company raised money not so long ago, towards the end of last year. Sanlam have said publicly that they think ABIL needs to raise between 2 to 3 billion Rand more, which might not sound like a lot, but unfortunately ABIL's market capitalisation was all of 10 billion Rand on Friday. So why is the ABIL price up so much this morning? Well, they have said (not a lot) that they have "entered into negotiations regarding the possible disposal of Ellerine Holdings Limited and its subsidiaries which, if successfully concluded, may have a material effect on the price of the Company's securities."

To whom and at what price? That would be the trickiest two questions to answer, possibly even trickier to ask. I have not heard the talk about town suggest any names, you would hardly think however that a beaten up business (they have indicated as much) would be sold for too much. Remembering that the purchase price (back in January 2008) was 9.139 billion Rand (306 263 893 ABIL shares at 31.01 ZAR) back then. The whole of ABIL is worth 10 billion odd Rand, with many more shares in issue now, 1.5 billion odd shares. I suppose being up 20 percent on the day is another 2 odd billion Rand to that! Rather than speculate, let us wait and see what transpires.

Home again, home again, jiggety-jog. Markets are higher here today. Good thing, the Rand is weaker that is not good! Djoko is a king, Federer is the best loser ever (he did make around 56 million Dollars last year) and Hashim Amla is a genius. Let us stick to markets!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment