"Democracy might be something that we take for granted, and it might well be 2500 years old, but the Economist Intelligence Unit suggests that only 25 countries, or 15 percent of the countries covered, representing 11.3 percent of the global population enjoy full democracy. Western Europe and North America are the winning continents, North Africa and the Middle East are the worst, as a collective they have a score worse than Sub Saharan Africa."

To market, to market to buy a fat pig. We were up in the earlier part of the morning, unfortunately markets slipped away here into the afternoon. Industrials mostly sold off, heavyweights such as SABMiller and Richemont, as well as British American Tobacco all sold off through the course of the day. The Rand, had that strengthened? The Rand is what it is, the levels, I sent a long term graph of the Pound sterling to the US Dollar to a client, in the 1930's five Dollars bought you a single Pound.

Or as I said to the client, my grandfather should have sold all his pounds and bought Dollars, and then he should have used those to buy General Electric shares. No matter how hard you try, I cannot actually find what the GE price was during the great depression, or earlier for that matter, I just remember that GE and Goldman Sachs traded at over 100 times earnings in the period leading up to the monster meltdown of equity markets. See a somewhat comprehensive piece titled The Valuation Levels Prior to the 1929 Crash Were Absurd.

That was a proper bubble, at 16.5 times earnings on the same said index right now, forward, does that sound expensive to you? Hardly. Keep clam chaps, really, keep calm, stay invested. That is how you generate superior returns over a number of years, buying the right companies in the right space. As you will see from a little lower however, that is not always easy. In fact it is harder than you would anticipate.

Equity markets in New York were marginally lower last evening, still flirting with the all time highs, which is a year better than the George Orwell book, 1984. Bizarrely this book was written in 1949, and if I remember right was more like what I would think North Korea is like today. Thoughtcrimes and doublethink, remember those?

Predicting the future is hard, the longer you go, the harder it gets. You would think that 25 years would be a relatively short period of time, as far as predictions go. It turns out that it is entirely a hit or miss affair. The WSJ turns 125 this year and they looked back at some predictions that they made in 1989, reflecting on what they got right and what they got wrong at the time: A Look Back at the Journal's Predictions for the Future-From 1989.

They thought that flight would be far easier, that it would take place (commercial aircraft) at far higher altitudes and be far quicker, suggesting that we would fly at 25 times the speed of sound. I guess the pesky much higher fuel prices has had something to do with stifling that invention. There was supposed to be broader usage of a wonder fat, called Olestra, that was discovered by Proctor & Gamble that would enable you to cheat all of the time. Instead nowadays you are being told to eat what caveman ate. I am pretty sure caveman did not have the same access to healthcare that his modern future generations have. The jury is still out on that one.

The one that they really got wrong was predicting that any reform in the USSR (yes, that large communist state still existed 25 years ago) was not going to take place any time soon. Five months later it was all crumbling. The hangover still continues, the crisis in the Ukraine is hardly over, but you get the sense that the reason the Russians are doing nothing is that they have want they want, the Crimea. That is the way that I see it anyhow.

Read the article, have a chuckle and then think for a second about your own circumstances 25 years ago and how different they are now. I was at high school. I had seen computers, but they were relatively new and very, very basic. I remember still writing letters home from boarding school, every now and again you used the tickie box telephone to make a reverse charge call, remember that? South Africa was a very, very different place than it is now, far more volatile and un-investable. Huge divestment from South Africa caused the currency to decline and inflation spiked, but ultimately the barriers were removed and liberty won. Liberty almost always wins.

Democracy might be something that we take for granted, and it might well be 2500 years old, but the Economist Intelligence Unit suggests that only 25 countries, or 15 percent of the countries covered, representing 11.3 percent of the global population enjoy full democracy. Western Europe and North America are the winning continents, North Africa and the Middle East are the worst, as a collective they have a score worse than Sub Saharan Africa. Democracy is relatively new to the globe. It is shown that with greater democracy, more freedoms, economic zones thrive and individuals and the collective thrive alongside one another.

Just to make you feel much older, Seinfeld, the series turned 25 years old on Saturday. For the next 25 years, I would envisage that the middle class globally is going to continue to expand rapidly, fuelling different parts of economic growth globally. The demand for services, healthcare, entertainment and all around consumer spend is going to continue to grow. Different focus on different parts of the economy mighty mean fewer people working in the primary economies without actually diminishing the volumes there. Less people doing more.

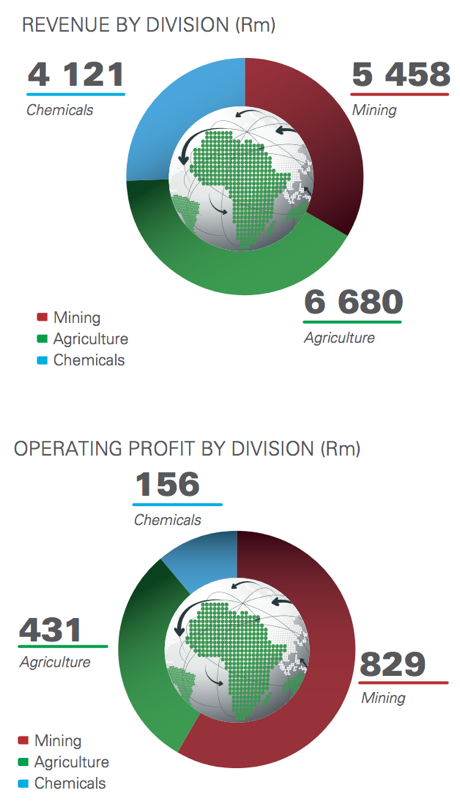

Omnia released their annual report for the year to end 2014 yesterday, you can download it and have a read: Omnia Holdings Limited integrated annual report. Not just any read I guess, the quality of our annual reports I find are quite good by global standards. If you needed a refresher of what the group sells and where they make their profits, from a revenue point of view it is pretty well separated into three parts revenue wise, but the profits are more heavily weighted to mining.

The piece titled Explosive farming that we wrote when the company had results a couple of weeks back cover the numbers in some detail and end of course with the conclusion that you should buy this company. The annual report talks about the importance of having commissioned another nitric acid plant, to meet the demand side:

"This has significantly improved security of supply to the mining and agricultural market, reduced Omnia's cost of inputs and allows the Group to more aggressively broaden its product range and expand into African markets."

Some of the reasons supporting the investment in Omnia as a result of strong demand for minerals across the continent, as well as being able to extract full value out of the under-utilised farming land are points well made.

Three paragraphs stand out for me with regards to the agricultural division and why fertiliser is increasingly important:

"The FAO (Food and Agriculture Organisation of the UN) states that by 2050, world food production will have to rise by 70%. Approximately 80% of this increase is projected to result from increases in yield and cropping intensity in developing countries."

And then more to the point about the fact that Omnia has a key role to play in feeding the continent:

"In Africa, farmers only apply 10% of the global average application rate of fertilizer per hectare. Omnia's agronomic expertise is extensive and supports optimal fertilization, while our knowledge of Africa's agricultural environment enables us to provide practical and sustainable solutions for food security issues."

And then lastly, for the agricultural division, in the 2015 outlook segment:

"Sub-Saharan Africa holds more than 60% of the globally unutilised arable land and investment in African agriculture can be expected to grow substantially during the next decade."

It is always fun to read the annual report, to see that the company is on track with your investment thesis. The company ticks all the right boxes and the agricultural element is exciting, the mining business is doing well currently and should continue to grow. The chemicals business margins are growing, and compliments the other businesses well. We continue to recommend Omnia as a solid investment to supplement the resources investments that we recommend.

Byron bests the streets

When it comes to investing patience is an absolute virtue. So is sticking to your guns if you believe in something. Of course if something fundamental changes then you need to reevaluate your position. Sometimes nothing fundamental changes but the share price doesn't go your way. That is when your patience really gets tested and you start questioning whether your convictions are correct. On other occasions there are short term changes or lets rather call them challenges which do have an impact on a shares performance but not enough to switch out of the stock.

In the case of Apple the last example is most fitting. Take a look at the share price over the last ten years. As you can see, from September 2012 to now the share price has had a really tough period. In fact it had nearly halved within 6 months. Wow that is tough to stomach as an individual investor.

But what actually happened? The passing of Steve Jobs is an interesting case study because it is impossible to tell where the company would be today if he were still at the helm. The fact of the matter is that competition, as you would expect, swooped into the smartphone market because Apple were reaping all the rewards. That is not sustainable, it is economics 101 to realise that competitors will come in and grab a piece of the pie.

This subsequently turned Apple into a cash cow as apposed to a growth stock. Revenue growth slowed and this was hard to swallow for the market who had become so used to such fast growth. Inevitably the share price pulled back and on a fundamental basis the stock started looking really cheap. But the business was still making huge cash and sales were still growing.

What spurred me to write about Apple today was 2 things. Firstly the share price is now 4% away from its all time highs, having improved nearly 20% year to date. Secondly I came across this article from the WSJ titled Tim Cook's Vision for ‘His" Apple Begins to Emerge. I'm not going to go into the details of article but I do urge you to read it. It basically says that at the time when Steve Jobs left us, Apple was in fact ready for a manager like Tim Cook as opposed to an erratic inventor genius. And to be honest I agree. Tim Cooks patient rational approach seems perfect for a company in Apple's current position.

What I do want to emphasis from this piece is that we stuck to our guns despite all the naysayers (and there were plenty). Not only did we hold Apple but we added at every opportunity. What an opportunity to buy shares of the best company in the world at a cheaper price. If you have a portfolio of 10-15 stocks there will always be a few that are going through a tough patch. Ironically those are the stocks that fickle investors are most likely to want to sell when in fact, if the long term story remains in tact, that is when you should be adding.

Home again, home again, jiggety-jog. The gift that keeps on giving is the Tour de France. Why? When it turns up each and every year we have a fat chuckle in the office on how Europe is "finished". Now obviously the Tour only starts in France today, having spent a few days in Great Britain. You know, Great Britain where Andy Murray comes from. The countryside is awesome, the natural beauty is amazing, the crowds were fantastic, nothing short of spectacular. The thousands of people lining the streets were not asking the cyclists for food, because they were hungry. The cyclists were not avoiding pot holes and crumbling infrastructure. No. It is all magnificent. Not all parts, but most of it.

And that is why it is a gift. To see that Europe is actually beautiful, the infrastructure is all working, people are rich. They are not finished. Three of the top five visited countries in the world are France, Italy and Spain. Germany and the UK come seventh and eighth respectively. We get over ten million visitors a year here, we should get more. If only we had high speed flight and folks could get here in a few hours, that would be great.

Markets are lower, the Rand has strengthened significantly. Human innovation continues to take place. Companies (not all) continue to make progress. Investors need to be patient.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment