"I think that without the 100 percent assurance of a Frankfurt listing that the appetite might be a little more subdued than otherwise usual, more especially if you are trying to attract a whole new subset of investors. What about the other shares? 150 million shares being offered to people with offshore money and 200 million shares being offered to the local shareholders. In this whole process however, controlling shareholders have agreed to renounce their rights."

To market, to market to buy a fat pig. Woo hoo! Dow 17000. The US markets closed earlier, because of the July 4th vacation today, a half day over that side. A very decent non-farm payrolls report before the market opened, two thirty our side, showed that the pent up hiring has accelerated.

There was a revision for the month of April in the Employment Situation Summary, with the Bureau of Labor Statistic (BLS) seeing 304 thousand jobs created for that month, rather than the reported 282 thousand. May was revised upwards too from 217 thousand to 224 thousand, a further 29 thousand jobs added to payrolls for those two months. The month of June saw 288 thousand jobs added, the unemployment rate went lower to 6.1 percent, the last time we saw a figure like that was just before the financial storm rained in all directions.

So that is good news, the US economy is improving at a faster rate than many people would have predicted a while back, the Fed are going to continue to taper and be non existent in both the mortgage backed securities market as well as treasuries, I presume that if they wanted to they could hold these fixed income instruments to maturity, not so? Nobody says that they have to sell them. Back to jobs quickly, to summarise, jobs were pretty broad based across the economy.

This news was all around good, stocks managed to ramp through Dow 17000 thousand and stay there for the very first time. Michael across the desk told me that this was the seventh fastest 1000 points run up in the Dow Jones, I said that is good, because this would have been the smallest jump percentage wise. 1000 points is a whole lot more from 1000 to 2000 points, but a whole lot less from 16000 to 17000. There was a fellow, someone who looks like he has been around and seen a few things on the floor in his day with a Dow 17000 piece of paper stuck on his cap.

Markets locally were very mixed, resources had roared up a percent, but financials and industrials were off one-third of a percent, in that sort of region, the overall markets were 30 odd points higher. Just below 52 odd thousand points, which was breached earlier in the day. The index fell back, dragged back by another possible ratings downgrade of South African government debt.

I searched the Moody's website for something on South Africa related to these comments that I saw in the media, sadly I found nothing official. Moody's simply said that the current round of strikes by NUMSA coupled with a poor investment landscape is not good for the creditworthiness of South Africa. More of the same seemingly. How is the strike impacting you, at a personal level? I would love to know.

First time highs for our favourite markets, over in Europe there was the unflappable Mario Draghi keeping rates on hold but announcing that meetings will now be six weeks apart, instead of every month. And, the ECB would now be keeping the market updated with minutes from their meetings, starting in January next year. Good, that always sounds like the best outcome. You know, where the minutes of the meetings of the ECB officials are now available to everyone.

It would have been more fun if these minutes were available in the lead up to the World Cup. Seeing the banter between the Italians, Germans and Spanish, as well as the French and the Portuguese over who would be the best of the bunch, and the reaction afterwards. Will it change the tone in the ECB meetings, will they be more careful with regards to what they say, because it is being published for public consumption? It would be fun, one way or another.

Sasol were in the news yesterday, via their website: ENH and Eni announce pre-feasibility study for large-scale gas-to-liquids facility in Mozambique. Eni Spa are an Italian based multinational oil and gas business with a market capitalisation of 73.87 billion Euros, or 1.079 trillion Rand. That is how huge Eni are, they are as close to a major by global standards as you can get.

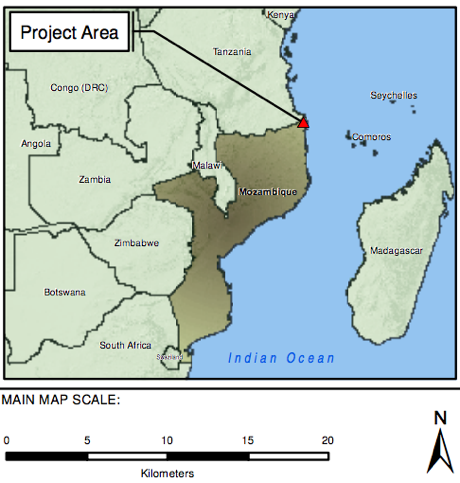

Who are ENH? Empresa Nacional de Hidrocarbonetos (ENH) are a Mozambican government owned oil company. You all know who Sasol are, right? Next question, where is the Rovuma Basin? Well, as far north as you can get in Mozambique, the basin overlaps with Tanzania. According to the release, Eni estimates that the specific block in question, a block called area 4. I found a story from last year, which suggested that Eni had sold a 20 percent stake in that block to CNPC for 4.21 billion Dollars.

Anadarko Petroleum, the US oil and gas business are also involved there, in the Rovuma basin, you can view a EIA report done by both Eni and the aforementioned Anadarko. How much does the block hold? Well, according to Eni, 85 trillion cubic feet of natural gas.

To put it into perspective, according to a liquefied natural gas (LNG) report from the EIA on Qatar, Russia exports around 7.4 trillion cubic feet of gas per annum. Or at least they did in 2012. So 85 trillion cubic feet of gas is a lot. Rovuma Basin? How far north?

As you can see, the Rovuma Basin is further north than the northern most tip of Madagascar. So even if Sasol decide to build a smaller gas to liquids plant up there, who would their customers be? Locally we have millions of customers on their oldest operations which are on their door step. This is Quitupo. This is Cabo Delgado province, with a total population of 1.65 million people.

Next door however, in Tanzania there are 45 million people living there. The penny dropped that the fuels from a smaller plant could be hugely beneficial for all the agricultural development that is likely to take place in the region in the coming years, diesel specifically for larger agricultural vehicles.

I am thinking that Sasol are also going to get more into regional energy supply, having successfully supplied the Mozambican government already with a gas electricity turbine. Good news for everyone and a sign that the rest of the continent still offers many opportunities. Remember however, this is just a pre-feasibility study, many have been done before which have not progressed further. That is the nature of the beast.

What? Steinhoff with another announcement, post the desire to become primarily a European company by listing, if not revenue, because they are there already. What is going to happen is simple (or not so simple), if you are a local shareholder you are going to be able to participate in a rights issue whereby the company will issue 16.58862 new ordinary shares for every 100 existing ordinary shares at a price of 52 Rand a share. Why 52 Rand a share?

Well, that was the price of the 150,100,412 Steinhoff ordinary shares that are going to be issued in Euros and Dollars (Eur 3.54 and USD 4.83 per share) that has been decided on for the book build that Barclays, BNP Paribas, Citigroup, Commerzbank and HSBC will embark on up to the 10th of July, that is next week Thursday when the new shares will list.

The shares will not be listed in Frankfurt though, because they being Steinhoff do not have a Frankfurt listing yet, that is still coming. So as far as I understand, these would have been priced in Euros and Dollars for the purposes of being listed there in the future. My word, it is not easy to understand and harder to explain without using the full explanation of when the Frankfurt listing is likely to happen. Very long, but worth repeating from the Steinhoff release:

In order to achieve the proposed Frankfurt listing, Steinhoff has engaged with the Financial Surveillance Department of the South African Reserve Bank ("FinSurv") to facilitate the inward listing of "Holdco AG", a company incorporated in Europe, on the JSE Limited ("JSE"). Steinhoff has received formal approval from FinSurv that Holdco AG will utilise its shares as acquisition currency for the purpose of acquiring the entire issued share capital of Steinhoff and within the framework of the Exchange Control Inward Listing Rules seek a listing on the JSE, accompanied by a listing on the prime standard of the Frankfurt Stock Exchange. Holdco AG intends to commence with the listing process as soon as possible, subject to prevailing market conditions and the required level of support from Steinhoff shareholders, after the release of Steinhoff's 30 June 2014 audited annual results in early September 2014. Holdco AG will become a South African tax resident before acquiring Steinhoff. Once the Frankfurt listing and inward JSE listing have been implemented, Holdco AG (including 100% of Steinhoff) will be managed from South Africa.

Easy right? I think that without the 100 percent assurance of a Frankfurt listing that the appetite might be a little more subdued than otherwise usual, more especially if you are trying to attract a whole new subset of investors. What about the other shares? 150 million shares being offered to people with offshore money and 200 million shares being offered to the local shareholders. In this whole process however, controlling shareholders have agreed to renounce their rights. All 175 odd million, of course most of that is going to the accelerated book build, including another 25 million. And the rest of the shareholders will follow their rights in Rand terms.

And what is the money going to be used for? "The net proceeds of the ABB coupled with the Rights Issue proceeds received from foreign participants will be repatriated to South Africa and used to strengthen the balance sheet and will give the company greater flexibility to continue the growth of its retail operations."

Read into that JD Group of course which they want to own all of, or 98 percent of (currently 86.2 percent I think), they have had to also sink 860 odd million into that one. So, 7.805 billion Rand is what they want to raise. Yowsers. That is big money. And dilutionary if you DO NOT follow your rights. I would, if you have the money, it is not expensive, plus I think that this management team have great plans afoot. It is all rather complicated for those shareholders who like to keep things simple, keep the number of shares in issue pretty constant.

Home again, home again, jiggety-jog. It is quiet today, really quiet. The TV channels, our favourite business ones are in slo motion mode with all the old reruns of course. It is fireworks on a epic scale in the worlds biggest economy tonight, but here, well not very much by way of fireworks.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment