"I think that this is one of the most fabulous investments that you can make, of course not for income and it certainly on a forward basis (modelling around 21 and half Dollars earnings) means that the company trades forward on 27 times earnings, this year. No dividend, quite expensive. And a year further forward, because earnings are expected to grow faster over the next two years."

To market, to market to buy a fat pig. It has all gone crazy, the world, all of a sudden. The loss of lives on both sides in Israel and Gaza is heartbreaking to see, so needless and so pointless in my mind, something that raises emotions on both sides. All I have to do is watch my Twitter stream to realise that this is a very emotional issue.

As needless and as pointless was the Malaysian Airlines flight MH17, a Boeing 777 shot out of the sky by a missile. 298 souls departed, many Dutch tourists and many folks on their way to an AIDS conference in Melbourne, trying to save lives. Three infants on board. An epic disaster, a civilian aircraft being shot out of the sky. This has happened too many times for comfort, since the beginning of World War Two, there are over twenty incidents according to Wikipedia.

In terms of the ones that caused a lot of tension, here is a heartbreaking account of these incidents: 7 times militaries have shot down civilian planes. And of course the subsequent repercussions, if any. As you can see, many times civilians are caught up in other peoples ideological beliefs. The First World War and the famous Canadian soldier and physician, John McCrae, who wrote "In Flanders Fields" did much to see war less as heroic and more as horrific.

As far as I can tell, I am the first chap to have not fought in a war in my family, or to have been in the army. Probably ever. So whilst this feels like the current landscape rings true the words to the Dr. Alban song, Fire in Bosnia and the Billy Joel song, We Didn't Start the Fire, armed conflicts are fewer in history now than at any other time. They are however a reminder that we use man made equipment to distinguish our fellow man. If we were all educated a little better and were more about humans rather than nationalities and ethnic origins we would be all the better for it.

The upshot of all of this is that equity markets sell off. The S&P 500 sold off nearly 1.2 percent, the nerds of NASDAQ much more, down 1.4 percent. The Dow Jones lost over 100 points, but nowadays that is less than a percent. I know that what the Fly said was sensitive, but it does make sense at some levels, he tweeted:

Oh no, another event that has nothing to do with corporate profits just occurred. Sell your stocks to me

— The_Real_Fly (@The_Real_Fly) July 18, 2014

Of course the longer term implications are completely unknown, let alone the shorter term implications. Markets will sell off. The tricky part for ordinary investors is to try and do nothing, if anything, use this as an opportunity to buy businesses. Remember, you own businesses and not markets or sentiment.

The sentiment part has a lot to do with short term price movements and volatility of equity markets, nothing to do with the company. The only part that irritates me is that the buzz around equity markets being overvalued and due for a correction, those types will say that they told you so, even if this has nothing to do with their thesis. That rubs me up the wrong way, just that, I can take in my stride the geopolitical events weigh on markets, not people that pretend they know what is going to happen next. Nobody knows that.

And if all that was not enough for you to take in, then you will have to pay 25 basis points more for your debt. Or, if you have savings, cash savings that is, you just started earnings more interest. Why? In case you missed it, the MPC raised the repo rate by 25 basis points yesterday, trying to keep the inflation genie in the bottle. Michael is seething mad. Food, transport and utilities prices increasing have got nothing to do with demand he says, he is of course right. Whilst you can do without beer and cigarettes (seen as defensive sectors somehow), you cannot do without transportation and food. And lights and water. I am going to leave the full lot to Michael, he is a whole lot more passionate about this than me.

Google released their second quarter numbers post the bell yesterday, they were very good, in my opinion. You can download the .pdf: Google Inc. Announces Second Quarter 2014 Results and Management Change. Revenues for the quarter of 16 billion Dollars (an increase of 22 percent), operating income was 4.26 billion Dollars, 27 percent of revenues. Nice. On a non GAAP EPS, excluding stock-based compensation (SBC) expense (what the hell?) that number was 6.08 Dollars.

This is still an out and out advertising business. The volumes, or number of paid clicks increased 25 percent in the second quarter, 2 percent over the prior quarter. The cost per click, or the price that Google gets decreased 6 percent over the first quarter this year and 7 percent over the comparative quarter last year. Traffic Acquisition costs, or the money that is paid to the Google partners (advertising sharing) was nearly ten percent higher when compared to the corresponding quarter.

Cash on hand? A whopping 61.2 billion Dollars, they generated nearly three billion Dollars of cash in the quarter. As a percentage of the 395.7 billion Dollar market cap, that is 15.4 percent. Of course Google still does not pay a dividend. As they are a growth company (they hired around 2200 people over the quarter), meaning that costs are not exactly front and centre. They spent more on R&D, 14 percent of revenues, than JNJ, who spend just a little less than 12 percent. Astonishing how they encourage their workforce to express themselves, to find the next big thing. It is still just an online advertising business, that is it.

I think that this is one of the most fabulous investments that you can make, of course not for income and it certainly on a forward basis (modelling around 21 and half Dollars earnings) means that the company trades forward on 27 times earnings, this year. No dividend, quite expensive. And a year further forward, because earnings are expected to grow faster over the next two years. Quite quickly the forward multiple reduces to a 22, earnings for 2015 as per the analyst community are expected to be over 27 Dollars for the year.

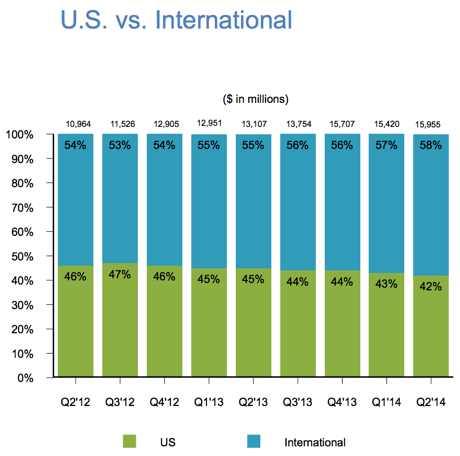

This businesses revenue mix has also changed, it is now less of a US business and more of an international business, as per the graphic from the presentation slides:

Almost a percent per quarter shift, as a shareholder you want more geographies, more languages, more businesses and more customers from all around the world. The internet of things, in which everyone will be connected will of course have many advertising platforms, from your fridge, to your car, to buildings, to everything in-between. Fibre, that is going to be big, the company is certainly teeing up for all their other businesses. Apps, content in the "store", that is set to become bigger, there are hundreds of Android users out there looking for apps. We continue to add to what is an amazing business now and what I consider the General Electric of the 21st century and a must own.

Michael's musings: The SARB – Growth and Inflation

Interest rates were very slightly raised yesterday afternoon by the SARB to bring our Repo rate up 25 basis points to 5.75%.

The main reason for the raise is due to the sole mandate of the SARB being to try keep inflation between the 3% and 6% range. Currently CPI is sitting at 6.6% mostly due to what is called "imported inflation" because the inflation arises from a weaker currency which makes imported goods more expensive.

The most visible and probably most powerful weapon that the SARB has at its disposal is the Repo rate which has an immediate impact on consumers' pockets and lending rates for corporates. The theory goes that raising interest rates puts a lid on people spending too much and thus prices should go up slower.

The problem in South Africa at the moment is that most of the inflation is not from too much spending but from costs that the consumer has no control over. If we remove petrol (oil price), electricity (above inflation price increase) and food (we have to eat and can't control crop yields) core inflation is 5.5%.

Add to that the growth in unsecured lending growth is at its lowest since 2005, and consumer lending levels are not growing; it starts to look like raising interest rates is a fairly ineffective weapon at the moment. The hope is that a raised interest rate will encourage money inflows from people looking for higher interest rates, with the money inflows strengthening our currency.

A stronger currency will then lower the pressures of imported inflation. The big problem though is that our interest rate does not have a huge impact on our currency. Yesterday we saw the Rand strengthen right after the decision, but as soon as the jet crashed in the Ukraine the currency did an about-turn. The next time there is an "emerging markets crisis" or even worse South Africa drops one more place in the ratings to "Junk" status the Rand will weaken again.

South Africa is not going to even grow at 2% this year and rates going up will not help the situation. Growth is not the goal of the SARB but keeping inflation under 6% is, so they almost had no choice but to raise rates. The one good thing about a small rate rise now is that when the developed economies start to raise rates next year, we won't have to have big and quick rate hikes. We are now in a situation where rates will probably rise slowly back to "normal" levels.

Home again, home again, jiggety-jog. Markets have sold off, the Rand is stronger, just by a little, I was perhaps expecting a bigger sell off. I see that S&P 500 futures are marginally positive. And of course it is Mandela Day, that is to make you feel at least a bit better about the man that graced our country. A magic person whom we can all feel warm and fuzzy, do your bit today, or this weekend, or each and every day. A little bit each and every day!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment