To market, to market to buy a fat pig. The monthly jobs data clocked a much higher number than the market was anticipating and that had a huge positive impact on the rest of the market. The number is always a little tabloid in nature, people throwing out their predictions. The reason why I say that is because the number is hyped and has many different meanings for many people. For us around here it is just the trend moving in one specific direction that tells us recovery or weakness. For some it means trading like crazy. I don't envy that crowd. The numbers lifted the Dow Jones Industrials to another record high, I saw a Barrons (and not our Byron) article on the weekend looking at Dow 15000 by the end of this year and then 18000 at the end of next year. Check it out: The Odds Favor the Bulls. Odds? Barrons actually worked out the inflation adjusted levels, in order to surpass the record from October 2007: 15,651.80. I was around 150 points out. So, records are meant to be broken, no doubt we will get to that 15700 odd level at some stage in the coming years.

Locally we sold off in the last hour or so, the gold stocks gave a little back of that heroic rally on Thursday. Over ten years, as a collective, the gold stocks are down 7.4 percent, in Rands. The Sappi ADR has been far worse, down nearly 75 percent in Dollar terms. It would have made more sense to buy the Rand Gold price, in the form of the GLD ticker, which launched in November 2004. That has shown a nearly 430 percent return since then. The question as ever is, does one switch into the gold companies now, at these levels? Again, all one had to do was to look at the employment numbers in the local mining sector to get your answer there. The numbers are staggering. Equally are the numbers that 50 percent of all the reserves in the world came from under our feet. 50 percent? Sounds like a big number. Around one third of all gold above the surface was from here. I presume the difference in the numbers suggests that the rest is jewellery.

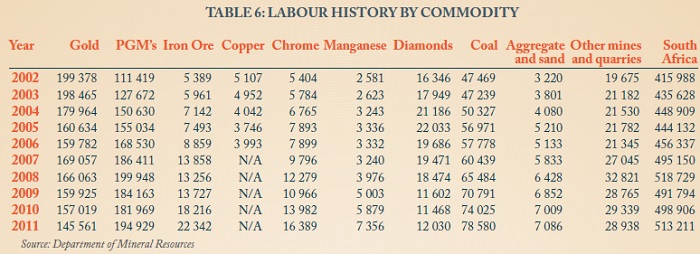

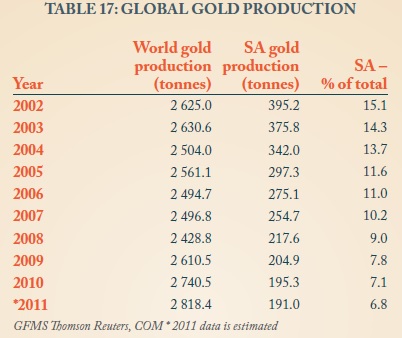

In 1996 South African gold mines were more than 20 percent of annual output, that number has fallen substantially, to 7 percent. We are 5th on the list in 2011, below Russia. Ahead of Russia is the US, then Australia and in top place is China. In 2006 we were 2nd and producing 84000 kilograms more. Production has roughly fallen by 30 percent since then. We are currently producing about as much gold as we produced 110 years ago. I managed to find a table from the chamber of mines that points to an actual overall improvement in mining employment in South Africa, thanks to PGM's, Iron Ore, chrome and manganese. And no thanks to gold and diamonds, which of course were synonymous with South African mining. Great table, courtesy of the Chamber of Mines annual review:

And then perhaps what I was talking about before, the fact that we have been slipping on the ranking table. Globally gold production has been increasing, sadly our deposits are deeper, more dangerous and the costs are just too much. And the average grades per ton have fallen from 4.3 grams to 2.8 grams in the ten year period from 2002 to 2011. The Rand sales of South African gold have increased by nearly 67 percent over the same time frames, but I guess the costs have increased by more. The more you tread water, the more tired you get. Here it is:

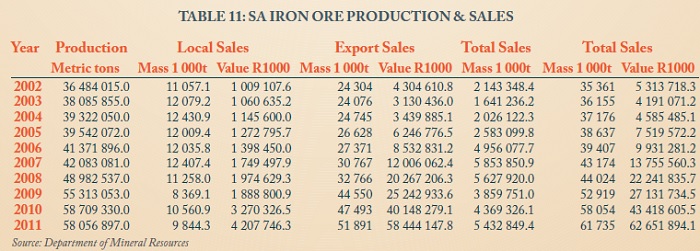

So what is the answer? To focus on the minerals that we must get out the ground as quickly as possible, because of the huge demand? In large part the industry has actually responded well, as well as they can. Iron ore export sales are twenty percent of all mineral exports, which was 282 billion Rands in 2011. Iron ore job creation is up five fold in the period 2002 to 2011. What is most amazing however is this next table, astonishing. And it all ties into that piece that we did a few weeks ago, titled You didn't make that iron ore price. Connect the two, being in the right place at the right time:

Massive increase in the Iron Ore price has made this an amazing industry to have been in over the last decade. Leading to expansion in production which is coupled with mining investment. A tale of two industries.

This morning we have interim results from Sasol, one of South Africa's biggest home grown companies. On the by market capitalisation ranking tables Sasol is in 8th place, 260 billion Rands. Just, and I mean just behind Naspers (265 billion), which have overtaken them in recent days. MTN is comfortably ahead of those two with a market cap of 331 billion Rand. And then there are the big 5, all with primary listings offshore. BATS, SABMiller, BHP Billiton, Richemont and Anglo American are those big five, remarkably SABMiller's market cap is more than double that of Anglo American. Over ten years SABMiller in Rand terms is up 872 percent, whilst Anglo American in the same time is up 97 and a half percent. A shrinking giant (relative) and a new giant, dominant in our home market.

Back to Sasol though. This company was formed, as a government parastatal, in 1950 with the intent of pursuing a coal to liquids technology that existed, but production at scale. Those were dark old days for South Africa, obviously the powers at the time wanted energy independence for the country. Sasol listed locally in 1979, the ADR listed famously on the day that Saddam Hussein's statue was torn down in Baghdad in 2003. Ernie Els bought the first ADR share, he was interviewed on the floor, I remember it pretty well. Condea was bought in Europe in 2001. Oryx was a monster achievement back in 2007, the Qatar plant started production back then, after having originally been commissioned in 2001. There were some serious problems at the start, but that changed as they managed to settle. More recently the Lake Charles announcement was a huge push to be taken seriously at a global level. In case you missed it, from last year December: Sasol. This changes everything. These projects are huge, and generally take a whole lot of time.

So the company continuously changes, in order to meet the needs of their customers and a changing market. The fluctuations in the oil price and the Rand to the US Dollar (their products are priced in Dollars) make forecasting this company a tough old business. Really tough. But having said that, the market usually trades the business as a function of Rand oil price. And on that metric, a mere two months ago the percentage of the Sasol share price to the Rand oil price was around the crisis levels. Leading some to believe that the company offered some of the best value around. The stock is up around 11.5 percent this year, moving higher as I write this. Jumping around a little in this message, Sasol is 7.2 percent the size of Exxon Mobil. I guess that is not bad. 13.6 percent the size of the ADR of Royal Dutch Shell. And 22.3 percent the size of the BP ADR, so I guess not bad at all for a "little" company down here at the end of Africa. Enough history and enough background, let us jump oily boots and oil into the numbers.

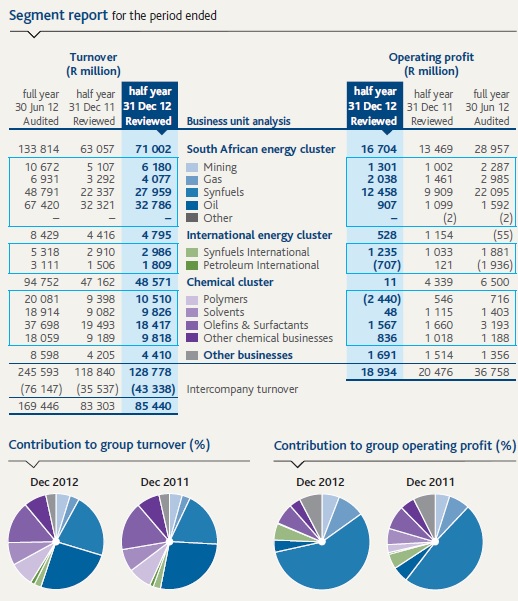

Sasol synfuels production increased ten percent. Operating profits increased 4 percent to 18.9 billion Rands, remember that these are half year numbers. This was on revenue that was 3 percent higher at 85.440 billion ZAR. Headline earnings per share edged up 2 percent to 24.01 ZAR per share, the dividend declared for the half is 5.70 ZAR, payable on the 15th of April. The enterprise value was five percent lower at 246.479 billion ZAR, mostly as a result of several write downs. Refresh your memory here, with this piece that we wrote: Sasol, you have to be patient here. The average crude oil price for the first half was relatively unchanged at 109.81 Dollars per barrel, the average Rand to the US Dollar over the same period was 8.48. The average currently is comfortably above those numbers. This excellent table tells you almost everything that you need to know about the business currently. The massive synfuels business is hugely profitable for their shareholders. A modest contributor to group revenues, but the most important contributor from a profitability point of view. Also, note that the Synfuels international business has similar margins to the local business.

So what do you get when you buy Sasol? A fairly well diversified business geographically and by segment, with reliance on one particular business, the local synfuels business. For their profits. And I guess, like we said earlier in the message, the Lake Charles expansion is possibly more key to this company in the medium term than anything else. And I guess the company is being priced for that, this is not a very demanding rating at all.

The execution risk of that project means that you have to be patient and trust that a company of this size and scale will get it right. The company is really cash generative and will have to juggle with their capital raising (so far so good) and using existing cash flows to fund a 21 billion Dollar project. I suspect that although this is not quite a swing for the fences approach, it is close. I suspect that if any company globally can bring off this type of project, we have to back David Constable and his current team. We continue to hold this business, and add on weakness.

How can one compare a time in history and say, this market feels like a specific year. How? The collective is not some strange living beast, it is all the buyers and sellers making a decision at one given time. Don't patronise the rest of us telling me that the price should be trading twenty percent lower, or higher. That implies that the collective are stupid. Mind you, that wouldn't be the first time. At the moment I am seeing a lot of, well this market feels like 1982, or 1951 or 2006. When someone says that, just ask the simple question, how many iPhones, Kindles, Galaxies and iPads had they sold back in 1951, 1982, or even 2006. The same answer each and every time. Zero. This market has no feel like any other time, because at each particular point more progress was made than the previous point. 2013 has a distinctly 2013 feel to it. That is all I think that I am trying to say. What is true however, when some people are trying to compare a certain era to another is that workers wages as a percentage of the entire US income have fallen to a record low. It turns out that machines can do many jobs for cheaper.

Plus, the other thing that I don't get is this whole idea that we are waiting for some sort of viscous pull back. I saw a fellow on the box, in the US, a few weeks back, when the Dow Jones Industrial had recaptured the 14 thousand mark again and was heading back or close to the all time highs. He pointed to the trading floor below him and said, me and 100 plus other guys have been expecting a pull back. Why? I suspect that there are a few things going on here, but perhaps the most important in my mind is that the financial services industry is under pressure. All the big banks have announced that they are reducing their head count. Barclays are planning to lay off ten percent of their investment banking employees this year. Google "bank layoffs" and you will see what I am saying. An NBC piece suggested that a Reuters poll estimated 160 thousand jobs have been lost or announced in the last three years alone. Of course some jobs since the financial crisis have been created too, so the losses are around half of that really.

Unfortunately the new jobs are non revenue generating (not all), and folks in the industry for a long time must be feeling more regulation against a backdrop of greater capital reserves and less risk taking. All that leads to substantially lower bonus pools, as the public sees the industry as the poster boys and girls for their personal financial pain. Less risks and less money made equals lower bonuses and job security is also not a given. In this environment it is easy to see why many could be very cautious and not overly optimistic about the future. I suspect that this might be forecasting based on personal outlook. I could be completely off the mark with this one.

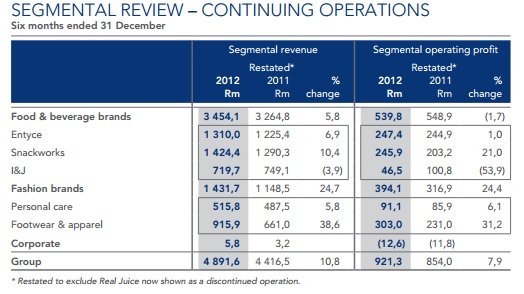

Byron beats the streets. This morning we received 6 month results for the period ending December 2012 form AVI. The table below tells a thousand words, explaining segmental revenue, profits and which businesses are growing and which businesses are slowing.

Within Entyce sits all the beverage brands such as Five Roses, Freshpak, Frisco and Koffiehuis. Snackworks includes the biscuits you dip into these beverages such as Bakers. It also includes Provita, Baumann's and Willards. I&J is a deep sea Hake fishing company which I am sure you have come across before.

Within the Fashion Brands division includes Spitz which is a leading branded footwear retailer. Green Cross which is their most recent acquisition is also a retailer in footwear. And Indigo brands which produces and distributes personal care products such as Yardley and Lentheric. Now that you know the mix let's go back to that table. As you can see the food production is still the biggest revenue driver and growing moderately while the fashion brands have the margins and are still growing fast. That Spitz business contributed around R250 million in profits for the 6 months. They bought this business for R375 million in 2005. You can safely say this was a great acquisition. But I am sure AVI were integral in leveraging off this brand. South African's are obviously very fond of fancy shoes. If it weren't for a weaker rand increasing input costs this part of the business would have done even better.

The table also shows us that the I&J business is struggling and as an effect becoming less significant. Fish are depleting, it is certainly a tough business to be in. I am sure they would sell this if an offer was put on the table. At 5% of profits i wouldn't be too concerned but I'd like to see it out the portfolio if possible.

For the group revenues grew 10.8% thanks to volume growth and higher prices. You see consumers had to absorb a weaker rand. Operating profit increased by 7.9% to R921.3 million which equated to headline earnings per share of 210c. Because of the luxury retail division, the second half of the year is usually well below the first. Earnings expectations for the year are closer to 360c. Trading at R57 we see 16 times forward earnings. I'd say that is pretty fair considering their business mix.

Except for I&J every single brand within the mix has a good future in my opinion. The food manufacture division will benefit from supply agreements with the likes of Shoprite and Massmart who are expanding throughout Africa. You already know my thoughts on coffee, tea has a similar future. The luxury retail segment fits within our aspirational consumer theme and we have already seen how well they are doing. I believe this will continue. On the back of a tough half which included a weak rand and a tough period for I&J the share price has flattened somewhat. I see this as a good opportunity to buy.

Crow's nest. All time highs everywhere, including here. Interestingly the risks earlier that would have scuttled any sort of rally seem to have less of an impact. The sequester is essentially the same thing now that it was on the first of January, but perhaps less skittish participants have not sent the market heading for the hills. Italy, the European issues don't get anyone anxious anymore. The world is better off now than at any other time in history. Even if it does not feel like it.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment