To market, to market to buy a fat pig. The Dow Jones crashed through the all time highs yesterday as the markets in New York opened. Records are meant to be broken, but this was a long time waiting, from the beginning of October 2007 until now we had to wait for a fresh new high, according to the WSJ, 1004 trading days. Check out: Dow Leaps to Record. My headline says it all, Dow Jones Industrial Average hits 116 year high. The index of 30 stocks was founded on the 26th of May 1896 by editor of both Dow Jones and Company and the Wall Street Journal, Charles Dow. All this according to the Wikipedia piece on the index.

What is quite incredible though is that there is only one stock that has had real longevity, General Electric which has been in the index since the beginning really. Initially the index was designed to be an industrials only, there were 12 stocks, none of them the railways of course, which were the most important back then. If you had invested 100 Dollars back then, let us say at the all time low of 28.48 points back in the middle of 1896, you would have had a 500 fold return. 100 Dollars in 1896, when I run it through the trusty inflation calculator is 2716.24 Dollars by the end of 2012. So, even working backwards (and I hope that I have the math correct), the returns factoring in inflation is a nearly 19 fold increase. Stocks trump inflation by a whopping margin.

It sounds amazing and it is. But as Byron pointed out, we must rather get more excited about the S&P 500. I said yesterday also that one should ring the bell and get excited when the S&P crosses through 1565, there and there abouts. Around two percent away. I was interested at how fast things actually change in our world, so whilst we might want investments to be thought of as generational, the truth is that the environment actually changes quite quickly. I said yesterday on twitter, just observations: "Dow Jones high in Oct. 2007, the Kindle hadn't been released, the iPhone was less than 4 mnths old & the iPad didn't exist." True story. The Kindle was only launched in November of that year. The iPad much later. Now we are used to the iPhone, even though we are looking at version 5 currently. The Amazon stock price is up 195 percent since that last high, the Apple share price is up 180 percent since then. Forget the tens of millions of these devices sold since then, I was just trying to make the point that the world is different now. Also, the point that I made the other day was that on an inflation adjusted basis, another ten odd percent from here would bring it realistically back in line.

Hugo Chavez lost his battle with cancer and died last evening, leaving Venezuela without a leader. Now, you know my view on the guy, I didn't like his policies at all, because the country did not benefit under him. He might have halved poverty, but he also created some pretty oppressive rules and sent the country backwards, economically. In the long run that will not benefit the masses. High inflation rates do not help the poorest of the poor unfortunately, and in fact impact on low earners more than anyone else. He certainly has many detractors, but judging from my twitter stream, many sympathizers. He tried to change the lives of many, but in my opinion went about it the wrong way. Lower oil production and government revenues almost reliant on this one industry did not help I suspect in the long run. The country finds themselves almost completely reliant on this one industry for export revenues, 94 percent as far as I can read. According to one article that I read, the Venezuelan oil company, PDVSA wanted to produce 5.8 million barrels per day by 2012 (the target was set in 2005), but produced less than half of that at 2.8 to 3 million barrels.

Well, that was actually according to the Economist, who have an interesting piece from last evening titled Venezuela after Chávez - Now for the reckoning. The public service workforce doubled under Chavez's 14 year rule. The oil price did not rise because of Chavez. Remember those pieces that I wrote, you didn't make that iron ore price, the same holds true for the oil price. Demand from new customers, the Chinese, the Indians, the Indonesians, heck, even folks on our continent, even though it is still early days for that. Some of his successes were down to luck, but for many it is being in the right place at the right time. Even though his intentions might have been noble, the company that he kept were not exactly savoury people.

And on the complete flip side of socialism is libertarianism. I really like the "stuff" that Milton Friedman says. Or said, he would be over 100 if he was still alive, he is of course not. I stumbled across another interesting lecture in which he quite clearly suggested that the problems of the poor are for society and people in general to solve. Not governments. He is quoted as having said in a 1978 lecture: "First of all, the government doesn't have any responsibility for the poor. You and I have responsibility. People have responsibility." And then of course he offers his own resolution of what should be done to alleviate suffering: "Second, the question is how can we as people exercise our responsibility toward our fellow man most effectively. So far as poverty is concerned, there has never in history been a more effective machine for eliminating poverty than the free enterprise system and the free market."

What does he mean by this? Well, a simple example is that 120 odd years ago, folks were wondering which country, the US or Argentina would be the richest in years to come. You know the answer, but how? Well, through improved education systems. And freedoms. And less government action, Friedman points to schooling levels being higher so that there would be no need for minimum wages. If everyone gets the same education, you enable someone and equip them. Some lessons to be learnt here for all and sundry. And if you needed reminding: Argentina's downward spiral continues.

One of the most important companies that we here at Vestact have invested our clients funds in over the years is MTN, and that company reported numbers this morning for their full year to end 2012. Their earnings are now more than the share price that we initially bought the stock at, for those clients who have been around for a long time. Well, almost. In April of 2003 we were buying them around 12 Rands a share, they certainly looked expensive back then and the yield was negligible.

The company had less than 10 million subscribers back then, that number was first breached with the 2004 interims, back in August of 2004. The total subscriber base now stands at 189.3 million, that was up 15.1 percent for the year. Revenue increased 10.9 percent to 135.112 billion Rands. HEPS however only increased 1.9 percent to 1089.1 cents per share, the final dividend was 503 cents per share, up 10 percent on the year. Add in the interim payment of 321 cents and you get to a total annual dividend of 824 cents. Both the earnings and the dividend numbers are worse than the market anticipated. So, at the closing price levels of 17960 last evening, the stock trades on a historical multiple of 16.5 times and a dividend yield (before tax) of 4.5 percent. That sounds OK, more on the expected growth rates a little later in this analysis.

Voice is clearly maturing, the one thing that you expect to get cheaper over time strangely is technology. And the reason why I say ironically is because as technology improves and is adopted by more and more humans, the prices of hardware and software come under increasing pressure. Voice revenues across the group increased by 4 percent, but traffic volumes increased 24.6 percent. Cheaper call times means that people talk for longer. It is interesting to however note that voice accounts for 63 percent of total revenue, down from 65.2 percent in the prior period. Data was where huge growth was, revenues for that division increased by 58.5 percent, traffic increased however by 65.9 percent. Of course, again cheaper rates during the year. Tariffs in Dollar terms have been reduced dramatically over the last five years, whilst revenues have grown strongly.

Nigerian revenues are catching South African revenues in Rand terms, the currency weakening here relative to the Naira boosted MTN Nigerian sales. EBIDTA contributions by country sees Nigeria stand out comfortably head and shoulders above the country we live in. Collectively the two countries, Nigeria and South Africa contribute 63 percent to group EBITDA. Essentially the company operates in 22 territories, but these two, with the relatively rich South Africans and the many Nigerians are still the most important places that the company operates. Inside of all of those territories the mobile penetration rate is around 50 percent, so whilst those folks joining are at much lower ARPU's than before, the scope to grow still definitely exists.

Phew, they invest an enormous amount in their business, over 30 billion Rands last year, 6.4 billion in South Africa, 13.733 billion in Nigeria (more than double the prior year), 1.1 billion in Iran, nearly 1.1 billion in Ghana and 903 million in the Ivory Coast. A whopping 1.336 billion Rands in Sudan, which is nearly 62 percent of local revenue.

Margins have been decreasing over the last three years, but still are a very comfortable 42.9 percent of EBITDA. That is down 110 basis points since the 2010 year. Data has seen huge growth rates, but yet because most of it is being driven by South Africa, continues to be only 10.8 percent of group revenue. Smartphones on their networks have more than doubled to 21.9 million (around 11.5 percent of the overall network). This is undoubtedly where the growth is going to come from. According to the BusinessInsider and some research that they put out last year, the US now has 55 percent smartphone penetration, up from 30 percent towards the end of 2010. Expect more people to want better handsets that can do more. That will invariably lead to higher data consumption. I suspect that we are a long way away from that point however, in the commentary there is still reference to rolling out 2G networks. Yes, really. Whilst you and I might be gearing up for 4G LTE and embracing that, the poor fellows in Nigeria might be used to much slower speeds. But of course, it is coming.

The bad is an uncertain bad. "Foreign exchange losses (Iran, Syria and Sudan) negatively impacted HEPS by 178,5cps" Most of that was Syria and Iran. Strangely in local currencies Iranian revenues grew 28.8 percent, Syria only 2.9 percent and Sudan 28.2 percent. All their respective currencies. But sanctions and civil war and general unrest have hit these countries and their respective currencies. These are significant risks that always will impact the company and their rating. But I suspect that investors know this well.

The company is expected to add 21 million subscribers over the year, that is the projections, which would take them comfortably through the 200 million mark. That will mean that MTN will have a similar sized subscriber base as VimpelCom, around 7th place on the global list. You are buying this company on the basis that Sub Saharan growth rates are going to be around 5 percent per annum. Meaning that the local populations should have more earnings power to continue to consume both airtime and increasingly data. We continue to buy the stock.

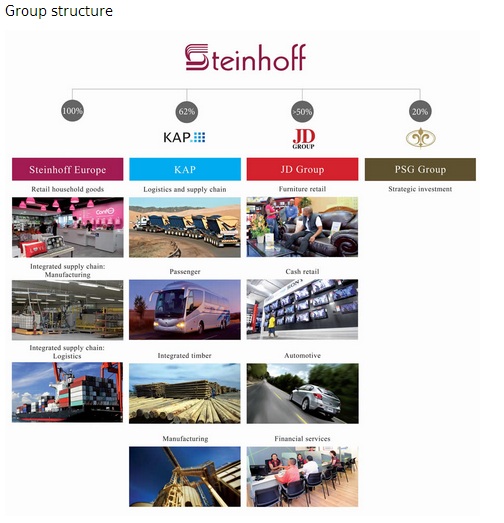

- Byron beats the streets. Yesterday we had 6 month results for the period ending December 2012 from Steinhoff International. Wow there are a lot of moving parts here. This picture which I hacked from their website sums up the group much better than I could ever attempt.

Sasha does a great explanation here of how the group came to such a structure so I won't waste my time explaining it again. Steinhoff looking to take control of JD Group.

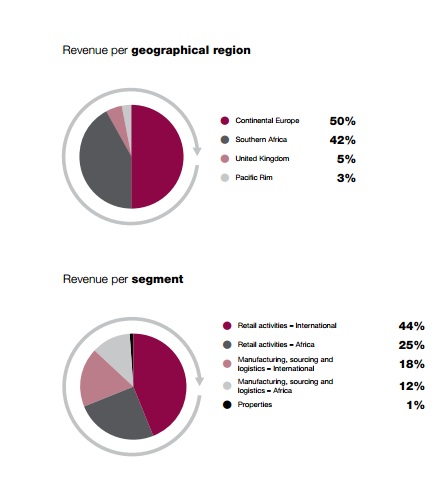

So what do the numbers look like? Paul commented yesterday when we were discussing them that every year the group is different so there actually aren't any comparable numbers. Regardless of that let's see what they say. Revenues increased 52% to R57.3 billion. Operating profits came in at R5bn. After all costs and finance charges this equated to earnings per share of 174c which is up 5%. Earnings for the full year are expected to come in around 340c yet the stock trades at R26.70. That is a forward multiple of 7.8. We will discuss later why this stock is so cheap, first I want to see the significance of each business to the group, these pie graphs should do the trick.

And this is why the stock is so cheap. Retail in Europe sounds like the last place you want to be. They own Conforama which is the second biggest furniture retailer in Europe. The South African retail division is mostly JD Group which trades at an even lower forward multiple of 6.85. All the furniture retailers are cheap plus they have a massive unsecured lending book and we all know how everyone hates that sector at the moment.

You also must not forget that the company has taken up massive debt in order to buy Conforama and the likes. They have long term loans to the value of R38bn and short term facilities worth over R9bn. All this for a company with a market cap of R48bn. The cash flows are positive but again they are pushing their cash into investment activities. They are sitting on around R8.3bn worth of cash and cash equivalents.

So I guess that is exactly why the stock is so cheap. Not only are you playing on a contrarian view of the general market but management is flying full steam ahead on your behalf. It is certainly way too risky for your average retail investor but I still like it if you are willing to take on some extra risk. Marcus Jooste is a wheeler and a dealer and you need to put a lot of trust in his abilities here. Not for the faint hearted. I will leave you with management's outlook.

"The fragmented European household goods retail market continues to present many opportunities to our retail operations focused on the mass-market value-conscious consumer. In many of the markets where the Conforama group operates, our strategy to change our product mix and overhead structure to focus on furniture and home decoration sales (in contrast with electronic goods) should prove decisive in growing margins.

In Africa, the industrial businesses of KAP expect to benefit from infrastructural development both in southern Africa and selected other African countries. JD Group remains confident that its consumer finance division will continue to generate acceptable returns on capital employed. In addition, the previous investments in technology and infrastructure should result in efficiencies to support sustainable margins of the retail business.

The global markets and future consumer spending patterns remain uncertain. However, the group is satisfied that the diversity inherent in its earnings will continue to protect the group against any prolonged downturn in any one market where we operate."

Crow's nest. Stocks are up again. Everyone is getting excited about the Dow being at an all time high. Manchester United lost last night to a team that has the biggest revenues of any global team. But according to Forbes is less valuable than the Red devils. You could argue that man for man the Real Madrid team is better. So, like traders who always think that they are right on a specific position that goes against them, football fans can be the same. And the bears too, waiting for a big old pullback. I hear that all the time. Over and over.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment