"Mr. Market liked this. They liked the fact that introspection has taken place. They like the fact that the management team has basically been overhauled dramatically, the retirement of the chief and the CFO, the entire board. And then the appointment of some key individuals in key brands. If you have been a long holder of this stock, continue to do so. They have turned the corner through the worst and have been through the mill. Global tourism will improve and Chinese buying will take hold in mainland China. The brands are really timeless."

To market to market to buy a fat pig It was jobs Friday. That day of the month when all market participants drop everything to hear a government department tell you the state of the labour market. Labour without the u, the Americans have their own English, like the Brazilians have their own Portuguese. Like the Australians and South Africans, Indians, Pakistanis and New Zealanders have their own English. And Canada too. Except in Canada, they speak English from the UK. Enough of the lack of vowels, the headline number fell short of expectations, there were however revisions in the prior months to a higher level -> Employment Situation Summary.

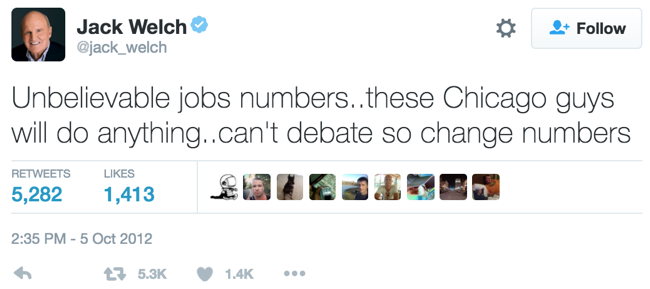

I think that this number being given so much importance is a dumb old thing, the revisions are so volatile, why take the headline number at face value then? There were a few sniggers and lightening bolts in the direction of Jack Welch, remember his comments this time four years ago about the Chicago Guys - this one, remember.

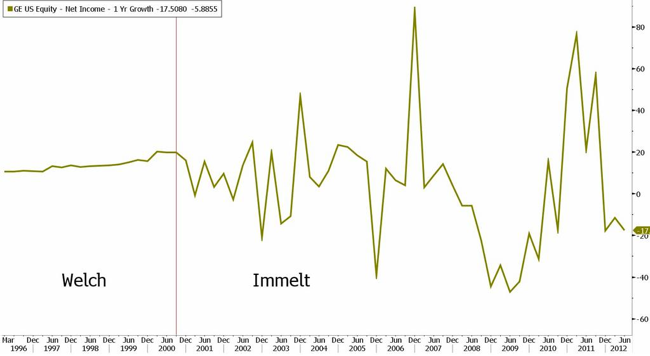

Ha ha. I noticed he has said very little this time around, perhaps some embarrassment about the candidate for his party. Remember this post from Barry Ritholtz shortly after that Tweet - GE's Jack Welch Knows About Cooking the Books. Here is when Jack was at GE and how close his EPS number is to the street. Coincidence? Phew.

OK, forget all that stuff, the broader market S&P 500 was lower for the 9th day in a row. That is for the first time since 1980. Heck, I was just about to go to school then. I didn't have a care in the world. Mind you, this "sell off" and nine day decline has hardly been one for the record books, in day terms yes, in percentage terms, definitely not. It has been all of 3.07 percent lower in nine sessions. Election uncertainty is front and centre of the anxiety. Session end the Dow Jones sank 42 points to 17888, the nerds of NASDAQ lost one-quarter of a percent to 5046, whilst the broader market S&P 500 gave up 0.17 percent to 2085. Reminder, the 52 week high is 108 points higher than currently.

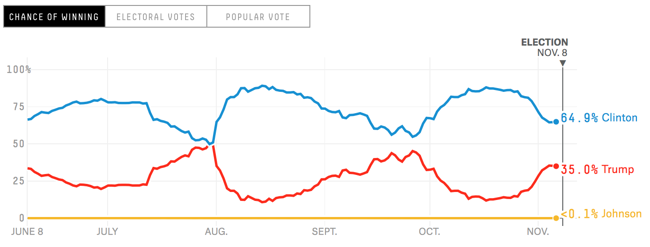

Elections? What does the trusty tracker say? According to FiveThirtyEight - > Who will win the presidency?

Well. 64.9 percent chance for Clinton, and whilst Trump has closed the gap, this suggests that Clinton will win. It depends what media you watch, what polls you listen to. At the end of the day, what matters is the results and their final print. We will learn more in the middle of the week.

Locally the market slipped to the lowest levels since February this year. The market is up 9.25 percent for the last three years. Yes, you read that right. The Jozi all share has fallen below 50 thousand points again. Basically the market has been flat since June 2014. And as Michael points out, as long as you have bought in the dips, you have been fine. If you haven't, the market has not been a great place to be. As they say in the classics (well, Benjamin Graham said it), in the short term the market is a voting machine, in the long term it is a weighing machine. Meaning that sentiment rules in the short term, and in the long term the sheer weight of earnings will bend the market in that direction. i.e. if earnings do not materialise, stocks will trend lower, the opposite is also true. See the graph that Michael has linked to for long (really long) market return.

Company corner

Richemont stock soared 8 percent on Friday, the last three years however has seen the stock slip nearly 9 percent, notwithstanding the excellent day Friday. There were six month results and at face value they hardly looked like anything to get excited about. Perhaps they were less bad, perhaps we can put it down to the announcment that there are likely to be significant changes to the management structure of the business. Even at a global level there are no real peers in the luxury goods industry to compare Richemont to. LVMH has booze and handbags aplenty, Kering owns Puma and Volcom, so it is hardly comparable. Prada. Nope. Tiffany & Co., maybe it is close enough. The quality of the brands of Richemont are at a "higher" level. Some of their Maisons (houses) are timeless themselves. See a recent deep dive - Richemont review - balance sheet and brands for the future.

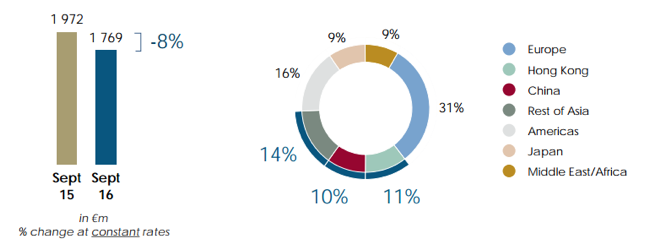

The results themselves, let us have a quick look at the six month numbers. First half sales in Euros were 17 percent lower than the corresponding sales last year. Understandably, watches are starting to take some heat, clearly from wearables in part, a crackdown in gifting too. Mainland China continues to grow at the expense of the other territories. China represents 21 percent of the total sales of the group, with Hong Kong being 11 percent and then mainland China the rest. Europe is 31 percent of sales. Here is a *nice* graph from the presentation to break it down:

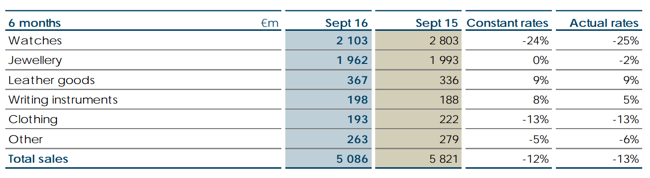

There is about an even spread between watches and jewellery, in terms of sales, what is noticeable is that leather goods have made quite a big comeback. Lancel was a business that Richemont were looking to sell, it seems that there is growth there. And LVMH showed that too. Herewith the breakdown.

What is also apparent in these results is that the buybacks impacted the profits significantly. i.e. instead of discounting their goods, as normal retailers, the company never dilutes the brand, they buy the products back from the wholesalers. That is key to the longevity and appeal of the products. If you cannot afford them at the list price, then you cannot afford the product. The group would rather suffer a slump in sales until the global consumer is on an even keel. When owning this stock you must know that you are in the same mindset as the business. You are going to be owning it through global growth cycles. And as I often say, as each and every year passes and the workmanship improves on the products, they become more valuable as investments.

And then on the management changes, all of which you can read here - Changes to board of directors and senior management, Johann Rupert says the following:

"We are presenting today a series of changes to the way in which the Group operates which will take effect over the coming year. This reflects the retirement of some of our senior colleagues, as anticipated, which we have used as an opportunity to re-think the way in which the senior management group is structured. The changes we have proposed today will strengthen the Group's ability to respond to the dynamic markets in which we operate, especially in the developing field of digital marketing and e-commerce."

Mr. Market liked this. They liked the fact that introspection has taken place. They like the fact that the management team has basically been overhauled dramatically, the retirement of the chief and the CFO, the entire board. And then the appointment of some key individuals in key brands. If you have been a long holder of this stock, continue to do so. They have turned the corner through the worst and have been through the mill. Global tourism will improve and Chinese buying will take hold in mainland China. The brands are really timeless.

Linkfest, lap it up

As research mounts on the negative impact of smoking, I think governments will increasingly clap down on it. Government budgets are increasingly under pressure, particularly on healthcare spend, targeting products that have negative health impacts is the low hanging fruit - We now know exactly how many DNA mutations smoking causes.

The more user friendly and more useful an app is, the more people will use the service. With Uber updating their app, they are making it more user friendly and adding some useful features - Uber is totally revamping its app and laying the groundwork for what could become a new revenue stream

How many people read the contracts that you click, "I agree" on. If you have read all of these contracts you probably have read the equivalent to 1 or 2 of the Lord of the Rings books - Apple fans have click-signed more than 100,000 words of legal contracts.

Sasha found this graph of historical share prices going back to 1250 - A history of share prices. The significance of the graph is it show major negative events during that time period, from the Tulip bubble bursting to the war of 1812.

Home again, home again, jiggety-jog. Stocks across Asia are higher. The sad news is that daylight savings in the US kick into effect today, meaning that the impact of their markets are diluted a little. Ah well ... Berkshire results over the weekend, one has to read that! And then of course we owe you a few more company reports.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment