"What would you get for that return? If I had to say to you, at a yield of 1.8 percent per annum, reinvest that in a 100 thousand Dollar portfolio for 25 years and what sort of return are you like to have? The number is 2.341 million Dollars. Without doing "too much" really. Just staying patient and making sure you avoid selling when the going gets tough, or harvesting and selling as a result of feeling the market is "too high". Much of investing is doing very little most of the time."

To market to market to buy a fat pig It is a record. Another day and another set of records. Strategists and their market predictions ...... you're fired. The big haired man has certainly ignited markets in the US, not so much emerging markets. He has stoked the inflation outlook. He has single handedly in very few public appearances created this whole idea that huge infrastructure spend is going to take place. Ideally low rates would help fuel an infrastructure spending plan. Would there be all on board with the spend plan? I suspect that is definitely something that would appeal to all segments of the political aisle. And so much for prudent spend. Yields have also spiked, in part as a recognition that higher borrowing means the issuers of debt (The US Treasury) is a little more risky, also rates are likely to go up in an environment like this.

All I can say is that before jumping the gun, think clearly about your investment strategy and what you are trying to achieve in the long run. All too often you see individuals that are reactionary and that ends up being "bad" for them in the long run. Bad ..... as in chasing their tails in and out of the market, being reactionary to a situation and wondering whether or not to sell stock or sector x as a result of y happening. 3 to 5 years is a very long period of time, think if you still want to own that stock in that time, and then do nothing.

Regardless of politics, as that changes day to day, the situation is always "fluid". See this article, government workers may be in for a rude awakening - Trump has a plan for government workers. They're not going to like it. Everyone wants the same thing with government spend. Accountability.

At the end of the record breaking session last evening in New York, New York yesterday the Dow Industrials printed a closing high of 18956 points (adding nearly half a percent on the day), the all time high. C'mon 19000, come to me! The broader market S&P 500 also printed an all time high, up three-quarters of percent to end the session at 2198. The nerds of NASDAQ closed nearly nine-tenths of a percent better, the new all time high closing level is 5368 points. This is the first time that all three indices have closed at record highs since the middle of August.

Does a level of an index matter when owning individual stocks? Not in my world, perhaps for many others it is a consideration. Facebook led the charge, surely a 6 billion Dollar buyback is not the only reason? The board approved this Friday, the stock rallied over 4 percent. It may only be two percent of the market capitalisation, it represents that at a board level, they think that the stock is cheap enough to utilise precious resource in this manner. Remember that not all buybacks are equal.

Facebook has, before this share purchase (they may have bought a lot of stock already), around 29 billion Dollars of cash to deploy. We were having a chuckle about the "failed" and "disastrous" IPO back in May of 2012, it seems that the company got through that just fine, not so? CNBC used to interview Trump back then, they had a segment called Trump Tuesday and he bemoaned the fact that he didn't get any shares, citing that he was "too rich". Anyhows as he says, his only intention was to flip the stock.

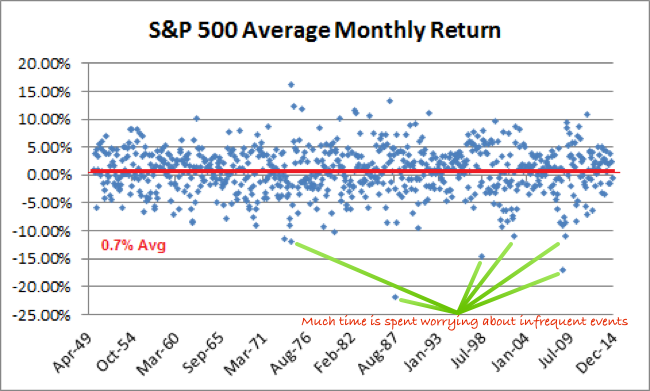

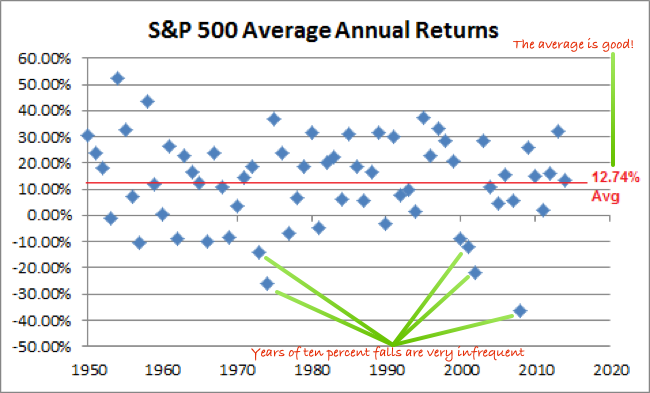

There was something that grabbed my attention in that link in yesterday's piece, the link titled A Lesson from the Market's Overreaction to Trump's Win. I think that it deserves some more attention. The average daily return for the equities market post World War Two is 0.03 percent. That is it. A fraction, each and every day. Investing is like Gridiron Football, inches won day in and day out. The monthly return is equally uninspiring at face value, the average return for each month since the second world war is 0.7 percent per month. And then per annum, the average return for the US markets is 12.74 percent. Obviously one has to account for returns relative to the risk free rate, US treasuries.

What would you get for that return? If I had to say to you, at a yield of 1.8 percent per annum, reinvest that in a 100 thousand Dollar portfolio for 25 years and what sort of return are you like to have? The number is 2.341 million Dollars. Without doing "too much" really. Just staying patient and making sure you avoid selling when the going gets tough, or harvesting and selling as a result of feeling the market is "too high". Much of investing is doing very little most of the time.

The thing that really grabbed my attention however was how the returns tend to be very lumpy. Some great years, some horror years, some months that look like you are a teenager stuck on Elm Street with a dude named Freddy. The point is that everyone spends a great deal of time obsessing about the next market slump that they miss the whole idea of steady investing, adding when stocks look weak and making sure that you avoid the pitfalls of selling at the bottom. I have yet to meet anyone who gets truly excited about stocks going down. Those with cash to deploy get truly excited and have conviction, of those people there are few. This graph, taken and shaken from Cullen's blog (thanks in advance). Actually there are very few events when the equities market drops ten percent plus. It hardly ever happens.

Yet ..... people talk about it all of the time as if their hard earned money is going to evaporate. Our advice often to private individuals is to always hang tight when the going gets tough and equally not to be tempted to fiddle when stocks look like they get "too high". Be more Mosquito Coast and less Money Never Sleeps. Pay attention still, don't go completely off the grid and get all weird with us, I am just saying that you shouldn't get anxious, as this graph below clearly shows, most of the time the returns are actually boring. This is also grabbed from the same piece (thanks Cullen), this is the annual returns, again, the returns are lumpy.

Much time is spent obsessing about infrequent events. Much time is spent worrying about the market making new highs. Less worrying and more paying attention.

Back home where local is lekker, stocks were not feeling the love. In parts there was definitely some strong action, the resource stocks had a good day, up a percent and a half. Industrials sank around three-quarters of a percent, the overall index closed up shop around 30 points lower, which is 0.06 percent, hardly a move of any substance. There were results and announcements aplenty, Curro announcing that they were buying just over half of a Botswana based university that specialises in teaching. Nice. Good work Curro. I suspect that this is part of a broader expansion plan into Sub Saharan Africa. If you can control the quality of the teachers and offer them gainful employment in your schools, it seems like a win for everyone.

Something struck me yesterday about the size and scale of industrial South Africa. In so much that we know our food businesses well, and there were results from Pioneer Foods, Astral Foods and the Rhodes Food Group, if you add their annual revenues together (Rhodes around 8 billion Rand annualised from these interims, Pioneer at 20.6 billion Rand for this full year, Astral at 11.9 billion Rand) you get to nearly 40 billion Rand. These are brands you know well, you have many in your pantry, you are a great consumer of their products. Barloworld also reported numbers yesterday morning, their annual revenues were marginally higher than last year, clocking 66.5 billion Rand. In fact, if you add RCL annual revenues of 25 billion Rand to these other food producers, you have the same annual sales as Barloworld.

All the Farmer Brown Chickens, all the Epol food, all the Rainbow Chickens (and other brands too, including eggs), all the Bokomo cereals (including Weetbix and Pronutro), all the Ceres juices, all the various pies that Rhodes sell, all the prepared meals that these groups sell, all the maize and rice they sell is the same as one company, Barloworld. Four well known company brands collectively sell as much as the industrial titan that is Barloworld. Yet .... when we think of industrial giants in a South African context, sometimes this company is too often compared to their glorious past and the days of Punch Barlow. Perhaps that is unfair.

On balance, Mr. Market acted positively to all of these numbers, Astral was fractionally higher, I passed a solemn looking Chris Schutte at the JSE in the CNBC studios, he didn't seem his cheerful self, perhaps he is taking the Springboks loss to Italy badly. Rhodes traded up 1.8 percent, the market happy for the time being with the numbers being delivered, the broader consensus is that they will have to continue to do some heavy lifting in order to justify their lofty valuation. Pioneer fell a little, down three-quarters of a percent on the day. Barloworld was the big winner, up nearly seven percent on the day. Clive Thomson hanging in there in what is definitely a tough environment out there!

Linkfest, lap it up

For you and me we buy shoes to be worn as shoes, for some it is more an art and is collected - A look inside Sneaker Con, the "Greatest Sneaker Show on Earth". The more that sneakers are seen as cool, the better it is for the likes of Nike where wearing their shoes outside of a sport context is sociably acceptable.

Barry Ritholtz takes a look at physiological biases/errors we make. It is human nature to find and see things that correlate with the way we see the world, the example used in the blog is how voters viewed economic data leading up to the US election - Dangers of a Fact-Free America

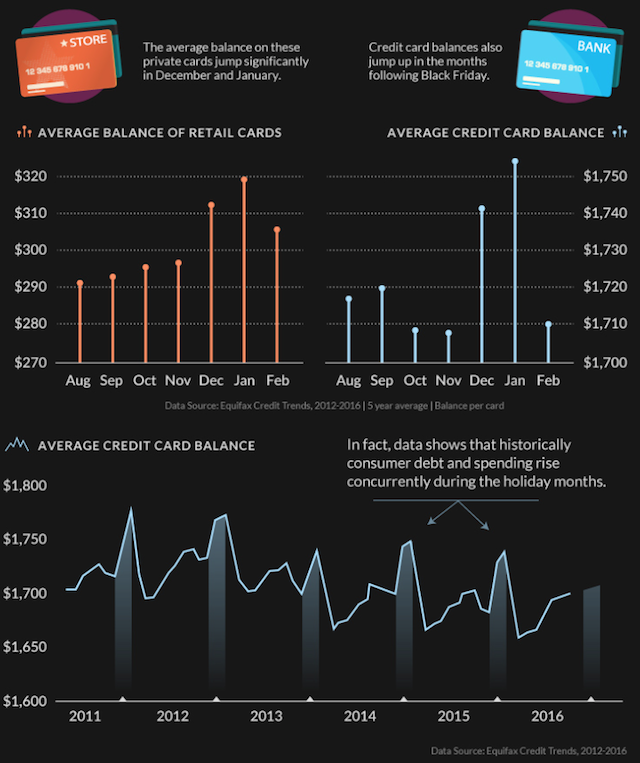

As the December shopping season approaches credit cards are itching to get out of pockets - Black Friday: The Holiday Surge in U.S. Consumer Debt and Spending. The graph below highlights why this period is so important to retailers, the increased revenue now needs to compensate the spending drop off that occurs in the New Year.

Home again, home again, jiggety-jog. Stocks across Asia are higher, Japan, China (and Hong Kong) all benefitting from a stronger Wall Street overnight. Some follow through here today no doubt! Hey, when are those ratings agencies in town and will we be able to stave off any downgrade of any sort. Yes? No? And if so, is it baked in the cake already?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment