"Anyhows, the emerging market sell off left us a little battered and bruised, and again worse for wear. Stocks sank by over 1000 points on the All Share from the best to the worst position, which was unfortunately for the bulls, at the end of the day. It was a broad based sell off from industrials, through financials to banks and retailers, gold miners and telecommunications."

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

To market to market to buy a fat pig It has been nearly a week since the world was shocked by the man with big hair, the man who is brash, the man who got a small loan from his dad way back, the man that is not afraid of leverage, the man that has basically skirted with bankruptcy multiple times, the man that made some pretty crazy promises in his campaign. No ways, people would not want a wall built, right? Whilst Clinton still won the popular vote, that is not the way that the presidential elections work. For the record, she got 800 thousand more votes than Trump, perhaps that is why the pollsters were wrong? 53 percent turnout is relatively low. Still, over 120 million people voted, and that is the way that democracy works. The upshot of it all has been a strong Dollar, a sell off in tech businesses and those businesses that earn a lot of money offshore, and a surge in financials.

The biggest shock has been a global sell off in fixed income markets, treasuries, bonds and all things debt have been sold. The Daily Shot (available for free for just a few more days) produced a series of charts to show the selling pressures. The US 30 year bond yields over 3 percent now. That is from around 2.6 percent this time last week. The five year treasury yield has also moved sharply higher in a week, from around 1.3 percent to nearly 1.7 percent. All global bonds have done the same. The whole idea is that there is going to be a lot of borrowing to build infrastructure, that is going to stoke inflation (and raise risks) and as such, investors need to be compensated for the risk and higher inflation environment. Hack, as the Daily Shot points out, the newly issued Italian 50 year bond holders (if they were to sell now) have lost 16 percent since the issue date in October.

The Dollar Index is back above 100 again, the highest level in a year, since last October. Goldman Sachs have suggested that growth in the US will remain at 2 percent and below until 2022, the unemployment rate will trend lower to around four and a half percent (and bottom out in mid 2018) and then start rising again. The expectations are for the Fed funds rate to tick higher and reach nearly 3 percent by 2022. By that time, believe it or not, Trump would have finished his first term in office. Depending how "things" are going for him, he may well stay on, it is quite hard to unsettle the incumbent. Emerging markets have been hard hit with outflows, it makes sense, going back to the Dollar and things you know, sell all the stuff that you do not know.

And that includes Rands Rupees and Rupiahs. And of course our bonds, so regardless of whether a downgrade is pending or not, the market is telling us to pay more for our debt. Our longer dated "ten year" proxy, the R186, is currently yielding 9.17 percent, a week ago that was 8.65 percent. In the dark days of last December when we had three finance ministers in a week, the yield spiked to over 10 percent. The lowest yield we have seen in the last five years is 6.68 percent back at the end of April 2013. So we are at the top end of the range and it means that new debt gets more expensive to issue.

So read the lips of all and sundry at treasury, "no can afford nuclear". Not now and perhaps not ever. The irony of that all is that Telkom (State Owned by around 40 percent) said this in their interim numbers this morning: "Telkom continues to invest in renewable and sustainable forms of natural resources management. Of particular note in this period has been a 3MW solar farm going live at Telkom's Head Office, the largest privately owned installation of its kind in Africa. The solar farm is capable of producing the entirety of Telkom's Head Office power requirements for its staff during daylight hours." When one "State owned" enterprise no longer needs the other, at their head office too. I had a little chuckle.

Anyhows, the emerging market sell off left us a little battered and bruised, and again worse for wear. Stocks sank by over 1000 points on the All Share from the best to the worst position, which was unfortunately for the bulls, at the end of the day. It was a broad based sell off from industrials, through financials to banks and retailers, gold miners and telecommunications. Even platinum stocks were thumped, notwithstanding the fact that Lonmin added nearly five percent on a favourable production report. You may or may not be surprised to know that Lonmin has a market cap of 10.11 billion Rand. It was trading updates and results galore, unfortunately all of that was caught in a broad based EM selloff.

Over the seas and far away, it was more of the same post Trump, with a repeal of Dodd-Frank (Trump has called that a disaster, I guess he uses colourful language for almost everything) that could potentially see banks and financials benefit. Mind you, many analysts hold their views of about neutral on banks and financials, the recent 11 odd percent rally amongst the majors must have caught many off guard. Wells Fargo of the majors trades at the richest price to book ratio. Citi and Bank of America at the lowest. This is actually a *nice* review of what we are talking about, when reviewing the Trump win and what it means, Bloomberg have a superb piece (and it may be a lot repeated of what we have echoed above): Bond Vigilantes to Trump: Be Careful, It Could Get Painful.

At the end of the US session, the Dow Jones closed at another record high (it just needed to be up), a fraction better, just over one-tenth of a percent. Both the broader market S&P 500 (down one-quarter of a percent) and the nerds of NASDAQ (down just over one-third) closed in the red. It was a real mixed bag however, some of the heavy tech stocks that make a lot of money offshore in other jurisdictions were sold heavily. Apple down two and a half, Alphabet (Google) down 2.38, Facebook down 3.31 percent and Amazon down 2.7 percent. Pretty heavy selling in that space. On the flip side you saw Bank of America up over five and a half percent, JP Morgan up nearly 3.7 percent, Wells Fargo up 2.88 percent. Citi up three and a half percent. Berkshire Hathaway traded at an all time high in the session.

Talking of Berkshire, the name synonymous with the company is of course Warren Buffett. Two F's, two T's. He gave a great interview to CNN over the last few days - Buffett after Trump win: '100%' optimistic about America. There it is. Buffett does seem to always be cheerful, he does however suggest that they must move on and is almost always positive about America. I agree with him (of course). Buffett said this was an election that he has never seen before, calling it a negative voting election. i.e. Trump supporters didn't like Clinton and Clinton supporters didn't like Trump. Buffett may not like Trump, it does not mean he does not support him. Watch it. It may be long, it will make you come away and feel better. Weapons of mass destruction scares Buffett the most.

Linkfest, lap it up

When markets are turbulent and when they are not going up, here is how you should be thinking about the market - My Portfolio. Not knowing what the market is going to do in the short term is par for the course. In the Buffett interview over the weekend with CNN Money, Buffett said that he has no idea what will happen in the coming months or even next year, he does have a general idea what will happen over the long term. Focusing on the long term helps you keep your head down.

Once you have mastered knowing that you can't predict tomorrow, the next thing to master is doing nothing when the markets get choppy - Understanding the Art of Doing Nothing. Making a concerted decision to do nothing is still doing something. One thing that helps you do nothing is to not look at your portfolio often. If this is a long term portfolio, looking more than once or twice a month is excessive?

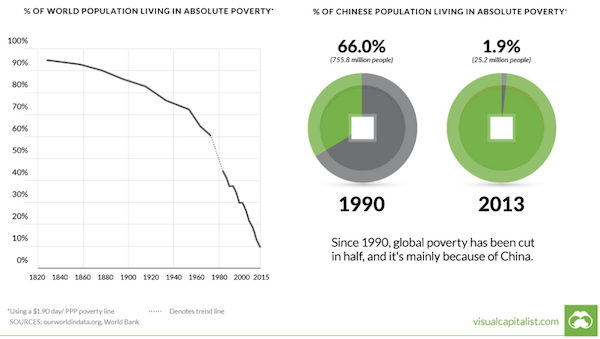

The progress in lifting people out of poverty is great to see. Having less people not living in extreme poverty is not only good for humanitarian reasons, as people move up the economic ladder they consume more leading to more growth in global GDP which lifts more people out of poverty - The End of World Poverty is in Sight.

Apple is rumored to be working on some more wearables, this time some glasses. According to Bloomberg - Apple Considers Wearables Expansion With Digital Glasses.

Home again, home again, jiggety-jog. US futures are up a little. Asian markets are mixed to higher. The Rand is a smidgen firmer, there may be some early buying after some EM bloodletting today. We shall see! For now, hang tight.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment