"It is simple, the recent weakness, 9 months or so, in all emerging market currencies is due to a strengthening Dollar, the anticipation of a rate rising cycle in the US, relative to lower rates for longer in Europe and intervention in China. We all just have to deal with this, period. Companies with greater exposure and externalised earnings will be "winning" in the short to medium term, that is why companies like Aspen have a premium to Adcock. Bidvest and Remgro relative to Barloworld. Investing mantra, repeat over and over, keep clam, stay the course, invest in quality businesses, ignore the fog."

To market to market to buy a fat pig. Well, sometimes there is stuff beyond your control that has an impact on your portfolio in a way that you didn't expect. The Chinese deciding to weaken their currency to the US Dollar, it is a managed everything, managed economy, managed currency, managed state planning, managed politically with one governing party, you get the point. Yet interesting I read the other day on Quora that someone said that they lived in both the US and China and never felt that their rights were being violated in China.

The Chinese devalued their currency by the most in two decades yesterday, and some more today, an equal move. The upshot of it all? It means that the Chinese would in theory have less money in their pocket to buy Dollar based products, and the stocks that impact on us are Richemont and Apple. It does not take too long to think about why. Although the Rand is significantly weaker to the US Dollar, that does not make people want the latest Apple products less, does it?

Obviously US based manufacturing would be less competitive, if you are paying the workers the same in China in the local currency and the end product is around 4 percent (after a couple of days trading weaker) cheaper to manufacture in Dollar terms, that is good for your exports. Every major global currency has weakened to the Dollar, I saw on the box that the Malaysian Ringgit was plumbing new multi decade lows to the US dollar, at a level last seen in 1998. That was when there was the Asian crisis. 17 years is a long time in all markets.

The relative strength of the US Dollar, the US economy having come back stronger and faster than all their global counterparts leads me to believe two things, and I may be WAY out of line here. One, their systems of extreme bloodletting in all quarters led to a rebalancing of their economy. And two, their stabilisation of the banking systems through unconventional methods (not always popular from either the left or right) adopted have led to a faster recovery.

I recall that a major debate was happening around 3-4 years ago, the stimulus versus austerity debate, at the time our line was that both would work for their respective regions. The Chines, The Europeans and the US, collectively the three biggest economies in the world have all adopted unusual and unconventional methods to stabilise their respective regions from the external shocks created by the financial crisis. We are still dealing with those problems today, as Greece strikes a third bailout deal, their problems can also be attributed to borrowing too easily and not having the mechanisms to evolve and meet their obligations. Structural reforms, labour reforms, those will all come. I do not think that this is can kicking, it is dealing with the problem slower in order to minimise the pain.

The US could have let it all go, they could have let the financial system collapse and be all purist about it. That actually helps nobody. This whole nonsense of life support and unnatural, I can't say that I am a fan of having peoples life savings wiped out by insolvent and inadequately capitalised banks with no depositors backstops. I can't say that I am a fan of one in four people in the workforce being unemployed anywhere in the world, I cannot say that I am a fan of the soup kitchen queues seen during the Great Depression, the heartache and suffering would have been a global event. I for one am grateful for all the efforts and methodology used to stabilise the financial systems, create the necessary trust needed at the time. The cause is one thing, how you deal with it is another.

That aside, the upshot of a stronger US economy has meant that their Dollar has been much stronger relative to a basket of currencies around the world. The strongest part has been felt in the last 9 odd months. A quick look at the Dollar Index which is a basket of currencies reveals that not too much has changed since the Dollar strengthened significantly over a six month period from August 2014 to February 2015.

Take a five year graph of the same index and you can see that all of the "moving" has taken place in an era where expectations of a rate hike have been heightened at any other time over the last half a decade. September are the expectations. Even the Oracle of Omaha, Warren Buffett suggested that the Fed should not hike. Although I have heard him suggest in an interview at the Berkshire AGM that the Fed could hike 50-75 basis points "next week" (at the time) and his view would unchanged on the outlook for the US economy. So here goes, same graph, same wonderful source from MarketWatch U.S. Dollar Index (DXY):

So what can you and I do about it? Well, the real answer is very little, there is rebalancing going on here. The Dollar is getting stronger both as a result of the US economy having outpaced their global counterparts AND in part of anticipation of rates increasing in the US. We have come from a very stable environment by currency standards to a very tumultuous one. And that impacts on global trade. Weaker commodity prices have not been enjoyed by the majority of the population around the world, since their local currencies have not remained stable whilst this happened at the same time. And by this, I mean the graph below that is a commodity price basket, this one courtesy of the folks at Bloomberg, Bloomberg Commodities Index (BCOM), chart still courtesy of MarketWatch, a five year graph:

The constituents and weighting are 31.2 percent energy, 23 percent grains, 16.6 percent industrial metals, 16.2 percent precious metals, 7.7 percent soft commodities (sugar, coffee, cotton) and 5.2 percent livestock. Livestock = hogs and cattle, or pigs and cows! Of course commodities are priced in Dollars, until that changes and it becomes Renminbi (Yuan) or something else, it is not. That tells you the Dollar is still king, you can easily tell me offhand what the Dollar price of oil or gold is, yet you cannot easily tell me off the top of your head what the Euro or Yen price is of the same commodity. There is this correlation between commodities and currencies, there has always been.

It is simple, the recent weakness, 9 months or so, in all emerging market currencies is due to a strengthening Dollar, the anticipation of a rate rising cycle in the US, relative to lower rates for longer in Europe and intervention in China. We all just have to deal with this, period. Companies with greater exposure and externalised earnings will be "winning" in the short to medium term, that is why companies like Aspen have a premium to Adcock. Bidvest and Remgro relative to Barloworld. Investing mantra, repeat over and over, keep clam, stay the course, invest in quality businesses, ignore the fog.

Linkfest, lap it up

Why is Google doing a shuffle? Here is a quick look at what could be some of the main reasons - What Google has to gain by adopting the Alphabet. I have heard rumours that the new structure also makes the company more tax efficient. The hope for me is that this frees them up to do a nice big purchase with all the cash they are sitting on, something or someone in particular being Twitter!

Josh Brown chats about how the market teaches us through the reward of prices continually going up. What happens though when prices stop going up? - The Positive Feedback Loop is Broken

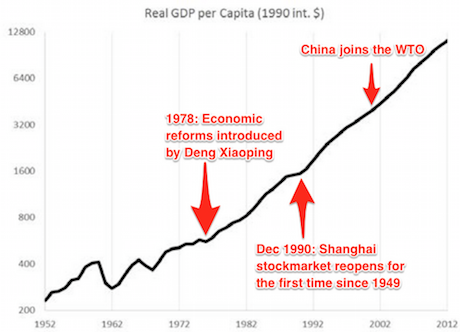

This is a very brief overview on the history of the huge growth seen in China over the last 60 years - A brief history of China's economic growth. Below is a graph of the Real GDP Capita, which would be how the average person in China is experiencing the growth. Note that the Y-axis is in log scale and not a linear scale. If it was in a linear scale the growth line gets very steep very quickly!

The dip starting in 1958 is from the Great Leap Forward, where there was a push to introduce more socialist measures. It resulted in the Great Chinese Famine and in the death of over 18 million people!

Home again, home again, jiggety-jog. It is official, as Paul said this morning, the Chinese currency and policy intervention is now more important than the anxieties related to Greece. There are signs that the Greeks are close, they have wasted 8 months and have seen terrible uncertainty derail their economy. Well done socialists of the world! OK, maybe that is harsh, their lived reality is not mine. Markets have started predictably lower with all the new area of anxiety. Ignore, invest more, buy the same quality, keep saving sports-lovers.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment