To market to market to buy a fat pig. Today is Fed day. Later this evening the Fed will probably announce no interest rate increase, but more importantly, they will give details around how they will unwind their $4.5 trillion balance sheet. Rewind a couple of years, the short-term interest rate was already very low at 0.5% but long-term rates were much higher because people were scared. Ben Bernanke's Fed came up with the idea of Quantitative Easing (QE), to bring down longer-dated rates.

Economics 101; higher demand means higher price and conversely a higher supply means a lower price. The Fed stepped into the bond market to create extra demand, pushing up the price of bonds, which results in a lower interest rate attached to those bonds. At QE's peak, the Fed was buying $85 billion worth of new bonds a month, with one of their main focuses on the housing market, where they currently own $1.77 trillion worth of mortgage-backed securities. The Fed slowly reduced the value of bonds they bought a month until November 2014 when they stopped buying new bonds.

Given that bonds have set maturities, the question then becomes, what to do with the money from the mature bond? When QE was first thought up, their exit plan was to buy bonds for a short period, creating confidence and financial support, and then just let them runoff, which would reduce their balance sheet again. QE 1 then expanded into QE 2 into QE 3 and then QE 4, lasting longer and becoming bigger than anyone had originally imagined. There is a fear that the Fed, just stepping out of the bond market will result in a sudden shock to the financial system. As a result, instead of just letting bonds runoff, the Fed has been rolling over bonds that reach maturity.

Today Janet Yellen will give us an idea of how quickly they intend to shrink their balance sheet. Full steam ahead will be them not rolling over any of the bonds and baby steps will be them only letting a small percentage of the bonds runoff. I expect it to be somewhere in the middle. The Fed will always err on the side of caution; they won't do anything unless they are sure the US economy is strong enough to handle it. Basically, whatever the Fed announces today around their balance sheet, will be a non-event to most people, apart from economists and academics.

New York, New York Yes, you guessed it, another day another record. Here is the scorecard, the Dow was up 0.18%, the S&P 500 was up 0.11%, the Nasdaq was up 0.1% and the All-share was up down 0.07%. Unfortunately, the list of stocks at 12-month lows is growing and the list of stocks at 12-month highs is shrinking.

Linkfest, lap it up

One thing, from Paul

What on earth is Kim Jong Un thinking?

Experts disagree with Donald Trump (no surprise there). 'Rocketman' is not suicidal, they say. North Korea's nuclear missile program is best understood as an emulation the Chinese strategy of the 1960-70s. China was a rogue nuclear state and economic backwater, but became a military and economic giant and undid the US-Taiwan alliance. Kim Jong-Un hopes force concessions from the US, win reunification with South Korea and become a global power. This plan will likely fail though, since North Korea is economically decrepit. Here's Max Fisher on the topic, in the New York Times - North Korea's Nuclear Arms Sustain Drive for 'FinalVictory'

Michael's Musings

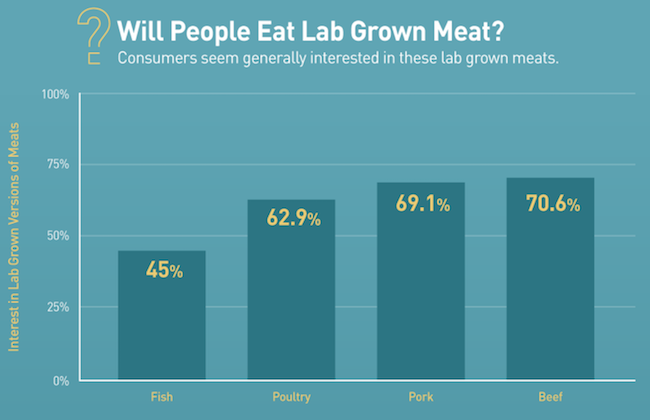

Would you drink milk that was created in a lab? How about eating beef that was created in a lab? Animals have a negative environmental impact due to all the resources needed to sustain them - Infographic: The Future of Food.

Positive and negative responses from cities, over Amazon's new HQ is interesting. The fear is that Amazon will increase the population density, which increases property prices and increases wages. Surely more economic activity is always better than less though? - The $5 billion battle for Amazon's new HQ is getting even more heated

Bright's Banter

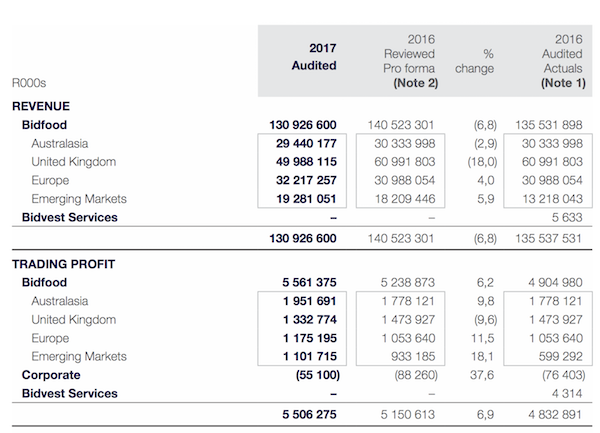

On Monday the 18th of September I had the pleasure of meeting with Bidcorp's CFO David Cleasby at their head office in Sandton. Bidcorp as you may know is our largest holding in the food sector.

The business has presence in over 30 countries and are market leaders in countries like Australia and New Zealand. Bidcorps offshore businesses account for 90% of earnings and RSA is only 10% making them the perfect Rand hedge.

Bidcorp's typical customers are the owners of restaurants, who happen to be chefs most of the time. Bidcorp's growth will come from increasing their 'Routes To Market' (selling more things to the same customer), from entering a new market organically and through small bolt-on acquisitions, where Bidcorp can bring in their 'Know-How' and systems to the table. They focus is on increasing the basket of goods purchased by chefs; since the truck is already heading that way, any additional items purchased is pure margin. In the near future, there is big margin growth to come as a result.

The food industry is very fragmented and this translates to plenty of opportunities for Bidcorp. Their reps have their ears on the ground and they help spot gaps in the market. This kind of attention to detail allows Bidcorp to see exactly what the needs of the customers are and fulfill them. If the customer is happy with the service, they will ask for repeat business, and the income becomes annuity in nature. As long as the eating out trend persists and the middle class emerges, we expect Bidcorp to benefit handsomely and are happy to own this one for our clients for the long term.

Home again, home again, jiggety-jog. Our market opened slightly in the red this morning, being pulled down by Sasol who are down 3.5% on the news that they have had to take a $900 million hit on their BBBEE scheme. STAR who listed this morning, are off to a strong start, opening at the top end of their expected range.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment