To market to market to buy a fat pig. Yesterday stocks were all over the place. Locally the All Share sat in the red for most of the day and then around two o'clock started to tick up. The move up the page was supported by a weaker than expected jobs number in the US, which meant money flowed out of the Dollar and into other markets. US markets opened in the green, then fell in earning trading, recovered, fell again and finally finished mixed. Here is the scorecard, the Dow was down 0.1%, the S&P 500 was down 0.02% (flat?), the Nasdaq was up 0.07% and the All-Share was up 0.72%.

We talk about the above indexes daily but how many people know how they are compiled? Did you know that the S&P 500, is composed of 505 companies at last count and not 500? The Dow Jones Industrial Average, or just 'the Dow' consists of only 30 stocks. Something I didn't know until this morning, the JSE All-Share index has 165 shares, which covers 99% of the full market cap of all the stocks listed on the main board of the JSE.

A bigger difference between the Dow and the S&P 500 is how the index is compiled. In the S&P 500, as with the All-Share, the size of the company determines the weighting/influence a company's share price has on the index. The Dow, on the other hand, is weighted based on the share price of the company. So the higher the company's share price, the more influence it has on the index. For example, Apple is the biggest company listed, so it has the biggest impact on the S&P 500, a weighting around 3.2%, which is significant bearing in mind 505 companies are influencing the index. In the Dow though, the biggest influence comes from Boeing with a 7.47% weighting, Apple is 5th on the list with a weighting of 5.1%. A monster like Walmart has a weighting of 2.5% and GE, the first company that comes to my mind when people say 'blue chip', only has a weighting of 0.76%.

The low company count and price weighting system is thanks to the age of the index. It was first created in 1896, compared to the S&P 500 which was created in 1957, way before the days of computers which could do complicated computations to come up with an accurate index. For the first three decades of its existence, the Dow only had 12 stocks, and in 1928 it was increased to 30 stocks. Having only 12 or 30 stocks in the index, made it easy to update the index as prices were fed through by the ticker. Not having to worry about market caps for weightings allowed for simpler computation.

Through legacy, the one index most people have probably heard about is the Dow. Even though the Dow is very focused and has a weird weighting system, its performance, surprisingly is almost the same as the S&P 500. Over 10-years the Dow is up 66% and the S&P 500 is up 69%.

Linkfest, lap it up

One thing, from Paul

According to this Bloomberg article, Apple's corporate bonds are acting more and more like government debt. I'm not surprised. - Apple's Bonds Are Acting More andMore Like Government Debt

Which issuer do you feel is more reliable? A long-term bond issued by a global technology giant selling the world's most popular product at a premium price, and run by a whip-smart humanist (Tim Cook). Or sovereign paper issued by an over-indebted government becoming more unpopular by the day, and run by a weapons-grade narcissist (Donald Trump)? I'm not a bond investor, but I think that I'd take the former, thanks.

Why are we still holding Wells Fargo, didn't they have a have major PR and governance disaster?

We started buying Wells Fargo for New York clients in 2012 because we believed (as we do now) that US banks would improve margins as they went digital, and as they adjusted to tighter compliance levels. Wells Fargo was the best retail and corporate bank, in our view, as it had fallen least during the 2008/09 crisis. They don't really do any proprietary trading, derivative structuring or fancy investment banking deals.

We were certainly taken by surprise by the customer account ghosting debacle! Although few clients suffered any losses, and all have been repaid, there has been some loss of confidence. The CEO, head of retail banking and chair of the board have all been fired. Big executive bonuses were clawed back. Any staff member guilty of gaming the internal incentive programme has been fired. The cross-selling scheme has been dropped.

Our view now is that the worst is past them, and the upside from here is even more substantial. In time this unhappy chapter will be forgotten.

Michael's Musings

It was Buffett's birthday a few weeks ago, with birthdays comes some reflection and generally a longer term outlook - An amazing lesson from Buffett on his cake day. Josh Brown has a look at how Buffett's long term thinking has saved him from panicking when markets drop 30% - 40%.

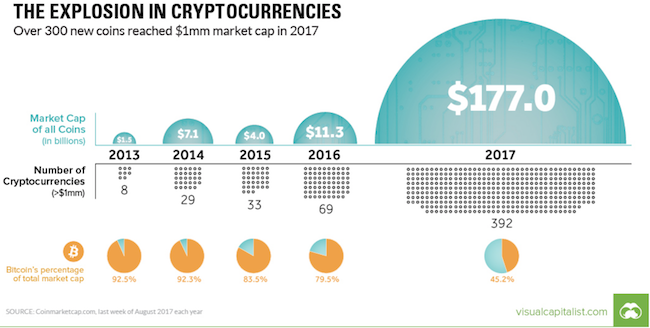

Thanks to the explosion in the price of bitcoin, everywhere you look people are talking about crypto currencies. I drove past a 'bakkie' the other day that had a sticker on it saying, "Ask me about Bitcoin" and gave a link to his new web page - The Unparalleled Explosion in Cryptocurrencies. I think there is only one certainty with crypto currencies at the moment, they are either wildly under-valued or wildly over-valued but not fairly valued.

If Elon Musk was not busy enough running two companies. He now has another project on the cards, underground tunnels - Elon Musk has ambitious plans for his tunneling company - here's what we know

Home again, home again, jiggety-jog. Our market is in the red again this morning but the good news is that Dollar weakness has pushed our currency to now trade around the $/R 12.70 to $/R12.80 range. It is rather quiet on economic news today, the most important thing to watch though, is Kevin Anderson's semi-final at 22:00. He is the underdog according to the bookies but he is only one step away from a Grand-slam final.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment