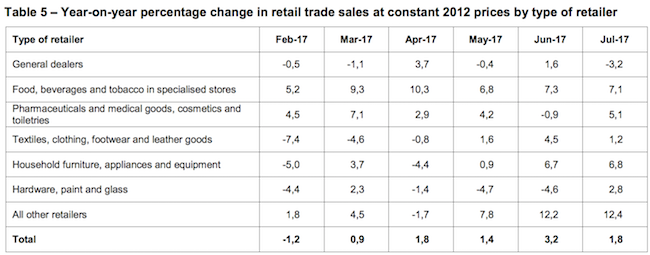

To market to market to buy a fat pig. Data out from our beloved country yesterday was under whelming. The retail sales number released by Stats SA showed a year on year increase of 1.8% (economists were forecasting a 2.8% increase) and a month on month decline of 0.6%. See below which areas of retail are doing well and which are not.

It is interesting to see that household furniture and appliances had a strong year but the hardware sector had a poor one. Does that mean, due to contained budgets, households are using furniture and appliances to improve their homes instead of going the more expensive route of construction based home improvement? 'All other retailers', which is flying, is mostly compiled of more specialist retailers such are jewellers, sports shops, second-hand stores and repair services. Yesterday's data is just one read of what is a volatile data set but is it pointing toward what is to come? Would the consumer rather go to specialised outlets instead of going to more general stores?

New York, New York saw very modest gains yesterday, for the S&P 500 to record its third record close in a row. Here is the scorecard, the Dow was up 0.18%, the S&P 500 was up 0.08%, the Nasdaq was up 0.09% and the All-share was down 0.38%. Aspen released numbers this morning that had more bright spots than negative; the share price has opened higher. Byron is at their presentation as I write, he will give us a detailed breakdown in the coming days.

Company corner

Byron's Beats

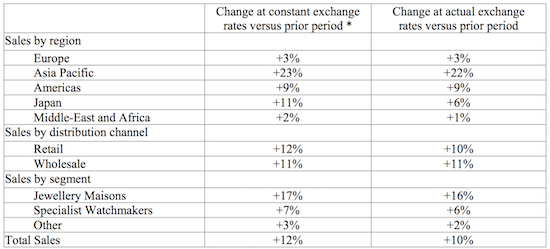

Yesterday we received a 5-month sales update from Richemont which looked impressive. Constant currency sales increased by 10% across the board. For a company of that size, operating in what has been a pretty tough environment, that is a good showing.

The below table looks at the numbers throughout the regions.

Europe was slow on the back of a strong Euro. In those numbers however, the UK increased by double digits due to a weaker pound. Asia Pacific was very solid although this does come off a low base because of inventory buy-backs in the comparative period last year. Jewellery Maisons and Specialist Watches continue to be the shining light of the business.

Luxury goods sales have gone through a tough few years, and this looks like a good sign of a recovery. We will have a closer look when the full numbers come out in November.

Linkfest, lap it up

One thing, from Paul

Business confidence in SA remains woefully low. Our biggest issue at present is politics. Stories of high level corruption, theft and bungling in government departments and at state owned enterprises fill the news every day.

There is a connection between business confidence levels and stock market valuations. Both are a measure of expected return on investments. The higher the anticipated profits the higher share prices go (relative to current earnings). Conversely, if trading conditions are expected to deteriorate, why pay up?

This of course, only applies to companies with large South African operations. For example, Richemont's sales numbers yesterday weren't impacted in the slightest by the current South African environment.

I do not expect much improvement in confidence levels before 2019, to be honest. Once the next national election has taken place, we will know where we stand and what kind of leadership we can expect in the years ahead. Until then, we will have to keep our heads down and our sense of humour high!

This RMB/BER survey taps the views of more than 1 600 senior executives in the building, manufacturing, retail, wholesale and motor trade sectors - 70% of SA execs unhappy with business conditions

Michael's Musings

Elon Musk is a very busy man! In the midst of ramping up his factories to produce 10 000 Model 3's a week, he is now focusing on building trucks too. Yesterday he tweeted an unveiling date of next month for a Tesla truck - Tesla's 'long-haul' electric truck aims for 200 to 300 miles on a charge. As the article points out, having batteries big enough to power trucks, will be very expensive.

The Bill and Malinda Gates Foundation has chosen three statistics to show how the world has developed since the 90's, where things have been getting better for the poorest of the poor. This is thanks in part due to global funding to combat poverty and its resulting consequences - These numbers tell us real progress is at stake in the fight against global poverty and disease, say Bill and Melinda Gates

The topic of CEO and executive pay, is hot at the moment. It forms part of the wider debate around global inequality. Here are some more views on the topic - When CEOs StartWarning CEO Pay Is Too High, You Got A Real Problem

Bright's Banter

The Mnuch showed up at the CNBC Institutional investor conference, Delivering Alpha, yesterday all guns blazing, saying that tax reform which was bounced off a couple months ago will be back and this time with a sweetener (closing the hedge fund loophole) - Hedge Funds Will Lose Tax Benefits

Home again, home again, jiggety-jog. Asian markets are mostly lower this morning due to Chinese growth numbers coming in slower than expected. Still massive growth, just less massive than people were expecting. Later today is data on our current account, which should have an influence on the Rand. Then on an international front, the BOE is expected to leave UK interest rates the same and there are inflation numbers from the US. Just in time for the Feds interest rate meeting next week.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment