To market to market to buy a fat pig. Happy Spring Day! If you google, "when does spring start" though you find that it only starts at the end of September. The 22 September to be exact and it will run until the 21 December. Global seasons are determined by the dates that the equinoxes and solstices occur. Just based on the weather in Jo'burg though, and the blossoms on the tree outside of my window, spring arrived one week ago. Here is an interesting piece written by the South African Weather Service, looking at all the different methods that can be considered when looking at the changing of the seasons: How are the dates of the four seasons worked out? So happy, sort-of Spring.

"A further failing of the earlier astronomically defined seasons is that they simply did not describe the real seasons as actually experienced. As one of the contributors to this article expressed it, summer does not start four days before Christmas. A climatologically definition of the seasons would obviously be more realistic."

New York, New York has been on a roll this year. With a green close to the month of August, the S&P500 has now had 10 green months in a row. More reason to celebrate is that the Nasdaq closed at a record high last night. It is now up 23% over the last year. Here is the scorecard, the Dow was up 0.25%, the S&P 500 was up 0.57% and the Nasdaq was up 0.95%. Locally our All Share was up 0.63%, with just about every sector in the green. Discovery is now back over R150 a share, it was there in 2015 but fell to R110 shortly after. Stocks go in and out of favour, which is normal for the equity market, the key is to sit tight through the cycles.

Company corner

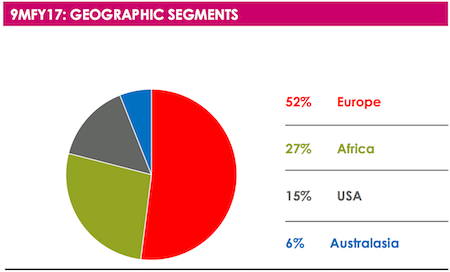

Thanks to their positive nine-month sales update, Steinhoff stock closed 2.6% higher. The company has been very busy in terms of purchases in the UK, US and Australia and many new store openings in all their regions. They have seen a 48% increase in sales to EUR 14.9 billion for the nine months, with 8% organic growth. Here is a breakdown of how that EUR 15 billion in sales is split:

Now that Steinhoff is listed in Germany, they have to report their numbers in Euros. It is not often that you hear the words, "the strong Rand had a significant positive impact on the numbers but the weaker Pound had a negative impact". The Africa division saw sales increase 10% in constant currency terms but a solid 26% increase when measured at current exchange rates.

Probably the division most people were looking at, was how is their recent purchase of Mattress Firm in the US going. They took over Mattress Firm in September last year and immediately set to work overhauling things. You will remember that they booted Tempur Sealy out as a supplier and signed more favourable terms with Serta Simmons. Other major changes are the overhauling stores and the rebranding many of them, currently around 40% of their stores have gone through the makeover. All this change has meant a 10% drop is sale values but a lower 6% drop in actual transaction numbers. Now that the initial shock of all the change has happened, management is reporting a tick up in sales and better margins, things bode well for the future.

Steinhoff looks well positioned for future growth. As Paul shared yesterday, consumer confidence is strong in Europe. Their Eastern European arm of the business had like for like sales growth of 20% over this reporting period. The Africa division is about to get a boost from the listing of STAR and then the effective purchase of Shoprite. Lastly, the US business is on track with its 'Steinhoff overhaul'. Hopefully, their issues with the German tax authorities can be resolved soon, so that they can focus on what they do best, making supply chains efficient so that they can bring the lowest price possible to the consumer.

Linkfest, lap it up

One thing, from Paul

Our friend Deon Gouws (CIO at London-based Credo) investigated what the CEOs of large South African corporates are paid, using data from Bloomberg. As you can imagine, the numbers vary considerably, with those at firms with large offshore operations dragging up the average. The final number: $3.2 million per annum. Nice work, if you can get it! - How well paid are South African CEOs really?

Michael's Musings

Ever wondered what information you are sharing with the web pages that you visit? You can now see - What every Browser knows about you. Sharing what my battery level is, seemed a bit random to me but seeing what printer was connected to our network was a bit more eye opening in terms of how much information we share without realizing it.

With world population on the rise and the urbanization trend continuing, architects and city planners have needed to get creative to keep cities functioning - 11 billion-dollar mega-projects that will transform the world's greatest cities by 2035.

For as long as there has been money, people have been lending it out. Farmers have needed debt to buy seed for this season's plant and emperors have need debt to conquer their neighbors, here is a specific look at the evolution of consumer credit - 1The History of Consumer Credit in One Giant Infographic.

Home again, home again, jiggety-jog. Big data out today are US job numbers and their unemployment rate, which will hit our screens at 14:30. Mr Price had a four month trading statement this morning that showed good growth, the stock is currently up 3%.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment