To market to market to buy a fat pig. Or if you celebrated heritage day with a braai, you may have bought some boerie, lamb chops or a big chunk of steak. The price of meat has been increasing at a very fast rate in SA. In last month's inflation data we saw a 15% increase in the meat price, a lot higher than the rest of the basket. Having said that, meat here is still relatively cheap compared to many developed markets.

On Friday stocks were down across the board. North Korean tensions again rearing its big fat ugly head with rim glasses and a terrible crew cut. Trumps recent comments seem to be fuelling the fire. As investors, these are the kind of tensions and speed bumps we need to absorb. If you stayed out of the market because of political tensions, you would never be invested. Markets do not like uncertainties. If everything was certain, investing would actually be a lot harder because there would be no opportunities.

US stocks also took a hit yesterday for the same reasons. Tech stocks were hit the hardest, as they often are when uncertainties arise. Facebook declined 4.5% because Mark Zuckerberg ditched plans to create a new class of shares which would allow him to keep control of the company whilst selling shares to fund his charities. Because the shares had done so well, he no longer needs to restructure the company's share scheme. He plans to sell 35-75 million shares over the next 18 months. At the current price, 75 million shares equates to $12.4bn. Good on the Zuck, a great example of business and capitalism making the world a better place.

The oil price has hit 2 year highs. In the past, higher prices has pushed US frackers to bring operations back on line and ramp up production. In turn, this has forced OPEC members to break alliances and ramp up their own production. So far OPEC has managed to keep to their latest agreements. I am sure at current prices the temptation to ramp up production is tantalising. The good old prisoners dilemma. In my opinion OPEC will eventually be a thing of the past because of increased competition. I cannot stand collusions, OPEC is the second biggest collusion in history and I cannot wait for increased competition and alternate energies to end them.

You may ask then, what is the biggest collusion of all time? Remember this is all my opinion, this is not based on fact (Byron here, you are more than welcome to challenge me on this). The answer is taxi drivers. The fact that most taxi drivers around the world use a set price is crazy. They should be competing against each other for better prices and better service levels. Poor consumers have been ripped off for decades until Uber came around. That is why I love Uber so much, another great example of business making services better and more transparent. I am very disappointed that London has banned Uber from their city. See Bloomberg article titled Uber Losing Battle in London After Regulator Revokes License.

Sounds like a successful lobbying campaign to me. London is supposed to be a forward thinking city which encourages innovative disruptors. Another step backwards for a city plagued by the likes of Brexit. Uber do have the right to appeal. Lets keep an eye on it.

Linkfest, lap it up

Two Things from Paul

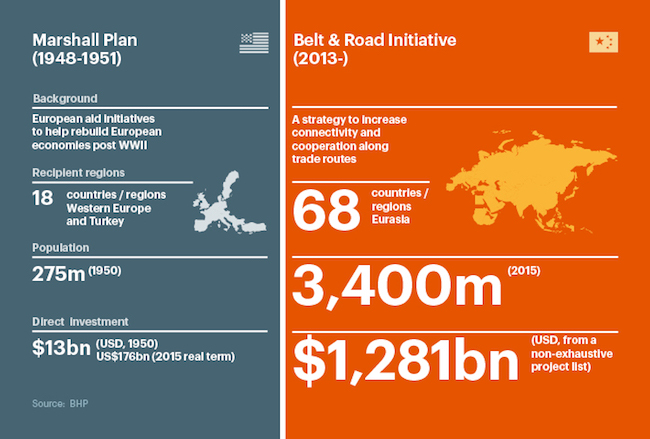

In case you thought that China had stopped investing in infrastructure, they have not. Look at the details of their Belt and Road initiative. It is seven times larger that the Marshall Plan after World War 2. China's Belt and Road Initiative.

Is Mexico ethically challenged? At the recent Mexico City Marathon, the organisers deployed a timing chip and mat system for the first time, only to discover that 5800 athletes (20% of the field) cheated. What the Hell Happened at the Mexico City Marathon?

Brights Banter

Remgro is swapping its Unilever's South Africa stake for Unilever's Spreads Business. We don't know for sure what prompted this move, but knowing the Remgro management, it was probably a deal that made lots of sense for shareholders otherwise why would they go ahead with it right? - Remgro Sells Minority Interest In Unilever SA

Mastering excel is a very important skill if you're planning on having a successful corporate career. John Dumoulin is only 17 years and he's already the champion of Excel, this opens so many doors in corporate as every big corporate has an eye on him. Not all heroes wear capes! Be like John and become the best Excel guy at your firm - Microsoft Excel Champion

The Zuck is planning on selling 35 million to 75 million shares of Facebook stock over a period of around 18 months from 22 September 2017 in order to fund his philanthropic endeavours. In the words of Bobby Axelrod from the TV series "billions" - Make the money and give it all away! - Mark Zuckerberg Selling Up To 75 Million Facebook Shares

Home again, home again, jiggety-jog. We have opened up horribly in the red, playing catch up to two days of market uncertainty. Naspers is down 3% in sympathy with the tech stocks.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment