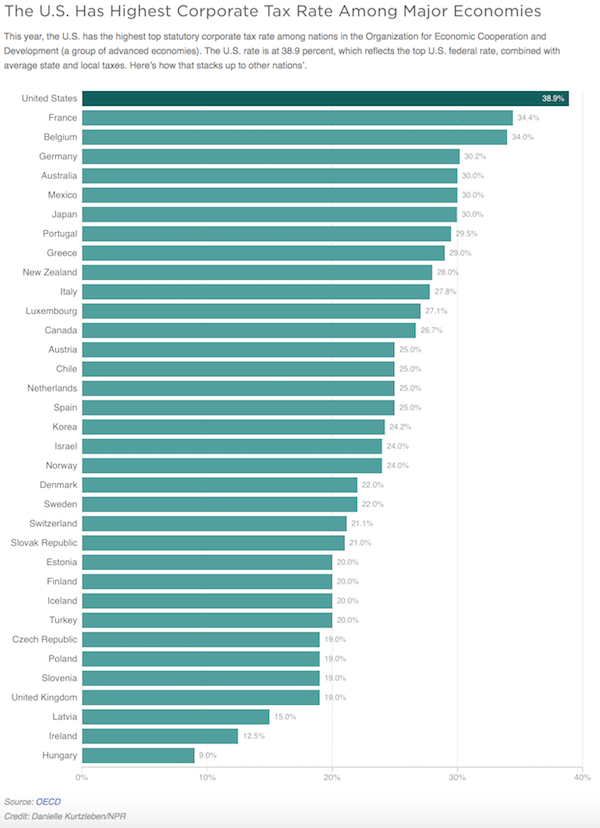

To market to market to buy a fat pig. The much-awaited US tax revamp finally arrived, well a vague breakdown at least. As investors in US companies, the drop in the corporate tax rate from 35% to 20% is significant. One of the Trump campaign promises was a corporate tax rate of 15%, so he has already made a compromise. House Speaker, Paul Ryan has said the final rate would probably be between 20% - 25%, time will tell where it finally settles. The below graph highlights why a US tax rate drop is significant and probably called for.

A quick google search for, "Average effective US Corporation tax rate" says, after deductions, US corporations pay around 18.6%. Even though that is much lower than the above 35%, when compared to global effective tax rates, only the UK and Japan have higher rates. What deductions are allowed is as important as the headline number. To get this bill through Congress, some of the current deductions may get dropped meaning the effective tax rate won't shift much.

As expected, there will be a one-time reprieve for companies to bring back offshore assets at a low tax rate. At last count, Apple alone had more than a quarter trillion dollars offshore! It is estimated that the one-time, low tax rate will be around the 10% mark. In 2015, when Obama was proposing a similar tax-break, it was estimated offshore cash amounted to at least $2 trillion. That number has no doubt swelled over the last two years. Good news particularly for US tech companies and good news for the US budget.

Time will tell how much of this proposed tax bill gets through Congress. Political 'experts' are forecasting it to be implemented during the first half of next year.

New York, New York. Markets were red hot yesterday! All three major indexes finished at record highs. Here is the scorecard, the Dow was up 0.25%, the S&P 500 was up 0.41%, the Nasdaq was up 1.15% and the All-share was up 0.26%.

Naspers announced this morning that, "Naspers Increases Stake in Delivery Hero", their stake now sits at 23.6%. The current share price of Delivery Hero is EUR 34.10, Naspers received a 13.5% discount to buy them at EUR 29.50. The current market cap of Delivery Hero is EUR 5.85 billion; Naspers stake translates to around EUR 1.38 billion or R22.1 billion. On Naspers R1.3 trillion market cap, their stake in Delivery Hero is a rounding error but for perspective, R22 billion is the equivalent of two Famous Brands.

Linkfest, lap it up

One thing, from Paul

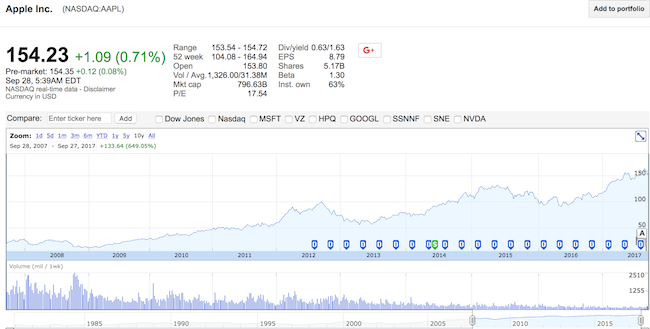

Apple's share price has softened in recent days. Its all time high was $164.94 which it reached on September 1st. It closed last night on Wall Street at $154.23.

The price came off after its product launch event, despite lots of buzz generated at the event. For one thing, there have reportedly been problems with the cellular connectivity of the new Apple Watch Series 3. The company is working to resolve those.

More importantly, festive season sales might lag expectations slightly because the much anticipated iPhone X will only be available in November, and will probably sell out when it does come in. Early indications are that pre-order demand for the iPhone 8 and 8s is a little muted. In my view this is because more people (myself included) will go straight for the top of the range iPhoneX. That model starts at $999, so expect a big revenue and profit boost in 2018.

This view matches that of a US analyst who made the news yesterday - Apple shares bounce back afterRaymond James sees 'surprising' demand for iPhoneX.

Byron's Beats

Clients have asked about selling Nike because it's recent performance has been poor. Here is my reply:

I would strongly advise against selling a share just because it has gone down. That is not a good long term strategy.

I will give you 3 examples of stocks we own which would have been a terrible call to sell just because the company hit a speed bump.

Cerner had a horrible year in 2016 as the market was unsure they could sign on big clients. They went from $66 a share in Oct 2015 to $48 in January this year. Many of our clients were down on the stock and thought it was not a "good" company. But behind the scenes Cerner was working hard and managed to sign a few large US government clients. So far this year Cerner is up 50%! It would have been a horrible mistake to sell.

From December 2013 to July 2015 Google traded around $550 a share. It did nothing for 18 months. Then they hired a new CFO who was more transparent about the business and it flew to $960 in 2 years. Again, the patience paid off.

Apple reached $95 a share in 2012. It then dived down to $60 a share in 2013. By March 2016 it was back at $93. It had gone backwards over 4 years! There were big concerns over competition from Samsung (just like Nike now with Adidas). But then sales continued to do well and the stock rerated to $154. It is up 33% so far this year.

Yes Nike is facing more competition. The whole industry is also shifting to online and more direct sales (Nike are adapting to this). From the examples above, when a company is quality like Nike is, these are the times to be buying aggressively, not selling. It may take a year or two but it is much better to be patient.

Michael's Musings

Thanks to social media, researches have been able to collect mass data on our mood - The data that proves bad weather alters your mood. If you have any big life decisions to make, wait until it is a sunny day.

There is no doubt that Twitter needs to shake up their business model. I don't think doubling the character limit is the way to do it though - Twitter is doubling the number of characters allowed in tweets; Twitter users are not happy. Short is sweet.

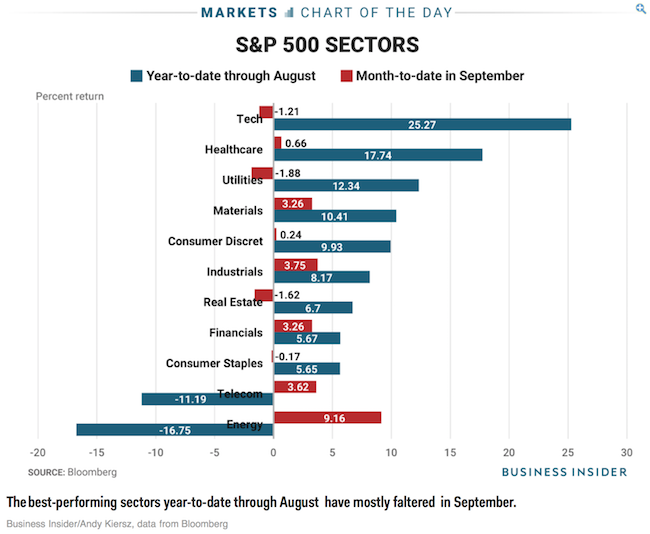

With the S&P 500 at record highs, here is a breakdown of how the different sectors have faired this year - The stock market has been flipped completely upside down.

Home again, home again, jiggety-jog. Asian markets are mixed this morning and the All-Share is in the red for the first hour of trading. The Rand has continued to weaken against the Dollar, it is almost at $/R 13.60. Not good news for consumers, inflation has just been tamed. The big data read for today is US GDP and US initial jobless claims.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment