To market to market to buy a fat pig. As expected the Fed left rates unchanged with the hint that there is a better than even chance of a hike in December. I clearly remember the first rate hike in December 2015; I was in the Frankfurt airport on my way to visit Ted, our broker in New York. Even in a European airport, the only thing the news services could talk about was the first rate increase since the Great Recession and how four more hikes were due for 2016. If there is a rate hike in December, it means that there have been only four hikes over two years, half the speed that people were expecting.

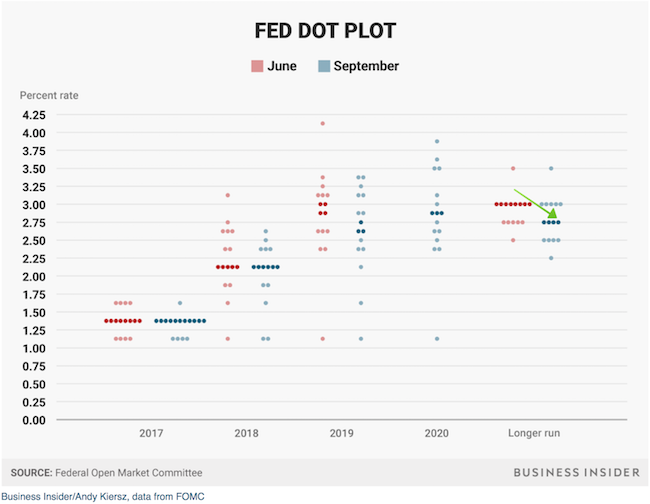

The Fed Dot Plot gives an idea of what officials think the rate trajectory will be. Given that stock prices today reflect the discounted value of future profits, long-term interest rates are an important metric. At the meeting in June, most officials were of the opinion that 3% was where long-term rates would settle, that number is dropping. See below most officials cut their long-term forecast by 25bps.

The plan for shrinking their $4.5 trillion balance sheet is to let $10 billion in bonds runoff each month, working the number up to $50 billion over the next 12-months. $10 billion may sound like a big number, but it is only 0.22% of their current balance sheet, it is going to take them years before things are back to normal. The hope is for things to normalise before the next financial crises hits. Imagine if a crisis hit now? Interest rates are only 1.25%, and the balance sheet is enormous, not leaving much to work with if the economy needs propping up.

US markets yesterday were very flat until the announcement, where they initially fell on the news but then ticked up to finish a little better than flat. That means US markets are on a three-day streak of record closes. Here is the scorecard, the Dow was up 0.19%, the S&P 500 was up 0.06%, the Nasdaq was down 0.08% and the All-share was down 0.26%.

Byron's Beats

On Monday we had results for Discovery. We will still get those numbers to you shortly. There were a few changes announced to Vitality which should interest you if you are a member. This Moneyweb article titled Five Changes to Discovery Vitality will tell you all you need to know about the changes. What was very interesting to see from Discovery's data is that life expectancy for Vitality members is 81 years compared to 67 years for those who are insured but are not in the Vitality program. Now that is some good marketing!

Michael's Musings

The private equity model is to usually buy a company using a ton of debt, improve its profits by making the business more efficient and then sell it, making huge profits because the initial investment was meagre. It doesn't always work out though, as seen by Edgars locally and now Toys R Us globally - The Toys R Us bankruptcy is clobbering 3 giant asset managers. In bankruptcy, the business generally continues to operate but current shareholders get wiped out, and bondholders take a haircut.

For a market to work, you need a buyer and a seller. Two people with different views on the same asset, here is a perfect example - Nvidia hits a record high as Wall Street begins to understand its dominance of AI and Nvidia: Now Irrationally Priced.

Tencent's 'other' division is still a small part of their business but in time it will be a significant contributor to both the top and bottom line - Tencent, Guangzhou Auto agree to collaborate on internet-connected cars

Home again, home again, jiggety-jog. Asian markets are mostly flat this morning. The Dollar was stronger after the Fed's statements last night, meaning the Rand is currently at $/R 13.38. Our market hasn't opened yet due to a computer glitch, expect trading to start from 10:45. Then the big news of the day, "will you pay less for your home loan"? Probably. We will find out at around 15:20.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment