To market to market to buy a fat pig. Last week was the 57th birthday of OPEC, who were created at a conference in Baghdad in 1960. Here is a brief history of the organisation.

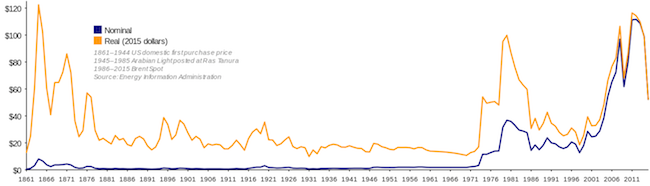

It is interesting to note that in its first 13 years, oil prices (WTI) were mostly flat at $3 a barrel. Then at the end of 1973, OPEC implemented an oil embargo against the nations they felt assisted Israel during the Yom Kippur War, prices almost quadrupled overnight.

Found at 1973 oil crisis

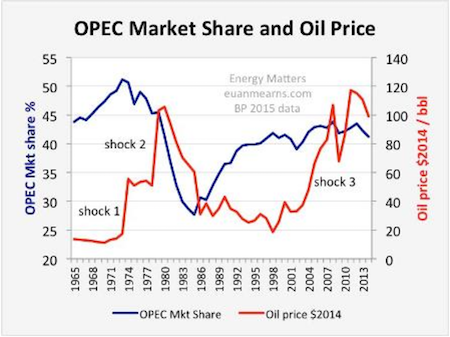

I have never been a fan of the cartel nature of the organisation, who would rather be labelled as a market and price stabiliser. I didn't know though, at forming there was another dominant force in the oil market, called the Seven Sisters controlling 85% of the oil reserves at the time. At the end of last year, OPEC said they controlled 81% of the globes oil reserves, the tables have turned. Even though fracking has taken off, OPEC still produces around 40% of annual production, see below how that number has changed over time. What will OPEC look like in the next few decades given how central oil is to certain countries and how quickly developed nations are going green?

Found at OPEC's $900 Billion Mistake

Yesterday there were fresh records for the Dow and S&P 500. How many more days of records do we need until people start to feel that records are boring and just part of what the market does? Locally, we crossed 56 000 points and are heading for 57 000 for the first time. Here is the scorecard, the Dow was up 0.28%, the S&P 500 was up 0.15%, the Nasdaq was up 0.1% and the All-share was up 0.73%. Interestingly, the list of JSE shares currently at 12-month lows is longer than the list of 12-month highs. Stocks on the wrong list include Life Healthcare, Netcare and Taste Holdings. Speaking of Taste, they are busy building a Starbucks next to our offices, when it opens I suspect people will be queueing into the street. At an all-time high is Richemont, up 34% since January.

Linkfest, lap it up

One thing, from Paul

Byron's Beats

As investors in the apparel sector I sometimes ask myself how much more innovation can be done in this sector. Well Nike have just answered my question. The latest NBA shirts have a chip inside the label which you can scan with your phone. Once you scan the chip you have access to stats, cheap tickets, discounted Nike shoes, Spotify playlists of certain players and more interactive features. Take a look at more details as well as a cool youtube clip in the article below titled How The NBA, Nike Partnership Leads To Smart, Connected Uniforms.

Michael's Musings

Ben Carlson talks about why he loves writing but more relevant to us is the reasons he loves the market - Why I Love Writing About theMarkets. One of the things he points out is how big global equity markets are; "On an average day, over 80 million shares trade hands in equity markets around the globe totalling more than $350 billion."

Millennials have been the talking point generation as of late, Gen Z are about to enter their 20's meaning their significance to companies is growing - Meet Generation Z, the 'millennials on steroids' who could lead the charge for change in the US.

Home again, home again, jiggety-jog. Asian markets are mixed this morning, Japanese stocks are up over 1% as they play catch up after being closed yesterday. The most important Asian stock, Tencent is up another 0.5% this morning so expect a green Naspers on our open.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment