To market to market to buy a fat pig. Today marks 40-years since Steve Biko's death. He is one of the early struggle icons, martyr against apartheid and one of the fathers of the black conscious movement. If you don't know how he died, here is a detailed article, The Death of Stephen Biko, which includes testimony from the Truth and Reconciliation Comity (TRC).

As a rule, I try not talk about politics publicly. It is a very emotive topic with way too many angles to cover in brief statements. So I will just share some of the things he said:

"The most potent weapon in the hands of the oppressor is the mind of the oppressed."

"We believe that in our country there shall be no minority, there shall be no majority, there shall just be people"

When ever we celebrate struggle icons who didn't see the end of apartheid, I wonder what they would say about South Africa today. The country is much better off today than where we were in the 70's and 80's but probably nowhere near where we pictured ourselves 23-years on, after the first free and fair elections took place.

Yesterday was another record breaking day for the S&P 500, finishing at a record high. The Dow and the Nasdaq are only slightly below their record high levels. Here is the scorecard for yesterday, the Dow was up 1.19%, the S&P 500 was up 1.08%, the Nasdaq was up 1.13% and the All-share was up 0,51%. The explosion of green is thanks to the pent up worry from last week not coming to fruition. North Korea didn't fire a missile over the weekend during celebrations of the nations 69th birthday and Hurricane Irma dissipated quicker than expected.

When people hear the words, 'record high' the immediate reaction is to think of Newton's third law, "What Goes Up Must Come Down." That is not always the case though; stock markets reflect the increased wealth being created daily by private enterprise. Just by the fact that the global population number is growing daily, more products and services need to be created, which translates into higher profits and a higher share price of the providing companies.

Goldman Sachs has two big reasons the stock market is safe from a correction. Lack of investor euphoria and persistent US economic expansion, both very valid reasons. Lack of euphoria means there are fewer cases of 'I must own that asset regardless of the price', we all know how that ends. The second reason is probably more important though, continued economic expansion at the current low-interest rates, explains why stocks are currently trading at higher than average P/E ratios. For as long as global economic growth continues and interest rates tick up slowly, stock prices should remain at these levels or continue to grow.

Linkfest, lap it up

One thing, from Paul

Quite a few South African property companies have been charging into Eastern Europe, especially countries like Romania, Slovakia and Poland. For example, the largest listed property fund on our market is now NEPI Rockcastle (after their recent merger), and it is almost exclusively focused in this region. It has a market capitalization of over R100 billion. Hats off to the Resilient group of companies for this achievement!

One thing that worries me slightly though is that some these Central European countries have quite contentious politics. For example, Poland. A right-wing populist political party called Law and Justice (abbreviation PiS) won the 2015 parliamentary election with an outright majority; something no Polish party had done since the fall of Communism. Once installed in government their leadership proceeded to try to fire all their senior judges and overturn press freedoms.

As you know, Poland is a fully-fledged member of the European Union, but for the last two years they have been in a direct confrontation with EU leadership, given that judicial independence and press freedom are central to the EU's principles - EU heads toward tougher action on Poland after Merkel joins fray

Byron's Beats

Yesterday it was announced that China have begun a study to determine when they will ban the production and sale of cars which use fossil fuels. China has a bad reputation for destroying the environment but they have certainly turned a new (green) leaf when it comes to renewable energy. I guess when your cities are covered in smoke, the incentive to breath clean air increases! China is planning to set a deadline to ban sales of traditional fuel cars.

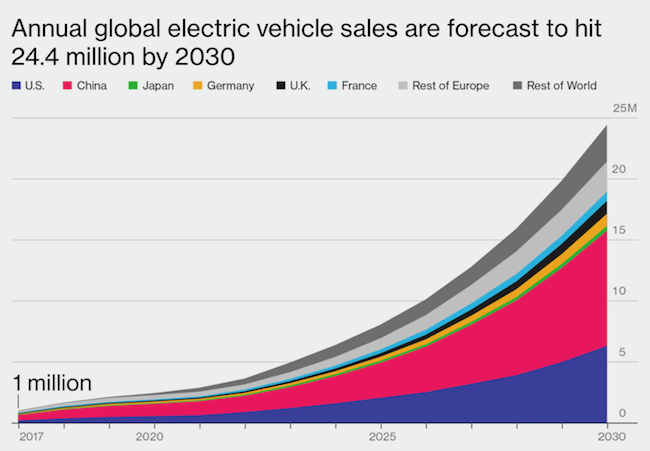

On a similar note, one of our favourite market bloggers Josh Brown thinks lithium is the best way to benefit from an electric car boom. In this piece titled The Lithium Story is Catching On, he adds a nice image of projected electric vehicle demand by country.

Michael's Musings

Tesla was able to improve the performance of their cars just through a software upgrade - Elon Musk auto-magically extended the battery life of Teslas in Florida to help drivers evacuate. The upgrade gave drivers extra range, all done over the internet and no need for a human in the process.

Developed countries who have low immigration numbers, will probably start to have these same issues. Having labour shortages, ultimately means that consumers pay more for their goods and services - Japan's convenience stores and fast-food restaurants are competing to hire"hardworking housewives"

Bright's Banter

Ray Dalio's hedge fund, Bridgewater, is one of the biggest and longest standing funds in history. Bridgewater is famed with making their shareholders more money, in aggregate than any other hedge fund. However, Bridgewater is a weird place to work, thanks to its founder Ray Dalio and his principles on radical transparency. Dalio wants to share his theories with you, make sure you get his book and read it again and again! - Bridgewater Ray Dalio Spreads His Gospel Of Radical Transparency

Home again, home again, jiggety-jog. As would be expected with a record close in the US, Asian markets are all in the green this morning. On the economic calendar today, are CPI numbers and house prices out of the UK. I missed the coincidence that Boeing is 7.47% of the Dow and their most famous aircraft is the 747, thanks to our reader Cotty for pointing it out. Then tonight is the big Apple launch, excitement levels in the office are high.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment