To market to market to buy a fat pig. Sigh! Monday morning and we are greeted with red markets in the East thanks to North Korea doing another nuclear test on the weekend. The Supreme leader feels that the best interest of the nation is in developing nuclear bombs instead of feeding the people. According to the UN, 41% of North Korean's are under nourished, a number that has been growing not declining! There are problems and then there are problems. Not having enough food and a leader who is trying to pull the 'ball hair's of sleeping lions', is a big problem. The Korean KOSPI is only down 0.9% on the news, which points toward investors thinking the risk of full blown war is slim but the risk has increased slightly.

Jobs day on Friday. Unfortunately, the data missed estimates. Here are the headlines numbers, the US Economy added 156 000 jobs in August, the June and July numbers were revised lower and unemployment rose to 4.4%. The forecast was for 188 000 new jobs and the unemployment rate to stay the same. There is not much to complain about in those numbers, even though they missed expectations. It is worth pointing out that a separate data release on Friday showed US manufacturing expanding at its fasted pace in six years, which coupled with a strong consumer confidence number points to forward momentum in the US.

What a jobs number miss does mean though, is that the Fed has another reason to keep their interest rate hikes to a minimum. After two rate hikes this year and four since the hiking cycle began in December 2015, the market is forecasting a 36% chance for a December rate hike and an even lower chance for their September meeting. Even though I think it is a bad idea having our MPC make interest rate decisions based on what they forecast the US's Fed doing, the current weak Dollar is good for keeping our inflation low, which makes it easier to lower interest rates. Our MPC will be meeting at the same time as the US, with the only difference being the Fed meet for two days and the MPC meet for three days. So the Fed announces on the 20 September and the MPC announce on the 21 September, hopefully a rate cut to help our struggling economy.

Here is a quick scorecard from Friday, the Dow was up 0.18%, the S&P 500 was up 0.2%, the Nasdaq was up 0.1% and the JSE All Share was down 0.02%. Today the US market is closed for Labor Day and across their border, the Canadian market is closed for Labour day.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: Socialist student blows R800k, Microsoft hits new high, Fukushima cleanup costs adding up, and Princess Diana dead for 20 years - Blunders - Episode 71

Michael's Musings

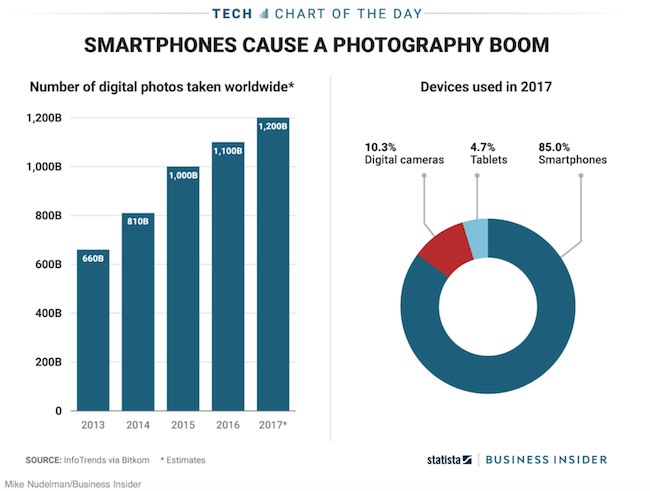

1.2 Trillion is a huge number! The camera industry highlights how technology can change the competition landscape, even though the number of pictures being taking is rising, the number of cameras sold is falling like a stone - People will take 1.2 trillion digital photos this year -thanks to smartphones. Just 15 years ago do you think camera companies were worried about phones eating their lunch?

As Tech companies team up the consumer wins because the product they produce are better, the potential down side is that there is then no competition - Amazon and Microsoft team up to make their AI assistants Alexa and Cortana talk to each other. I think the benefits here out weigh the negatives.

Here is another example of tech companies teaming up - Google and VMware are teaming up with a $2.8 billion startup to get an edge in the cloud wars with Amazon.

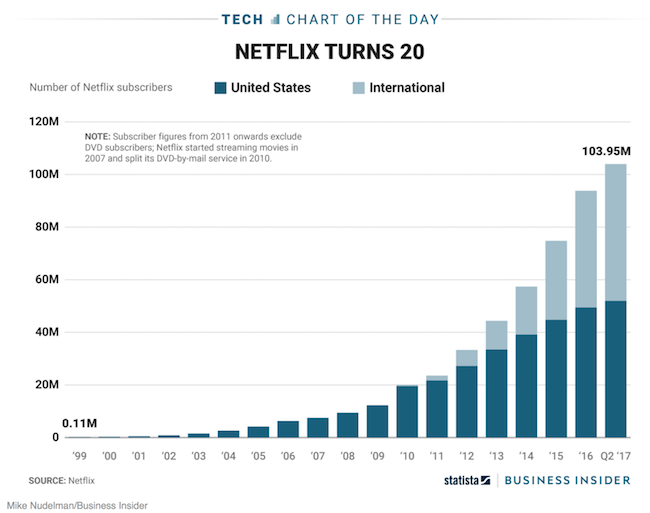

Netflix have done well to time their entry into the streaming space perfectly. There were other companies who tried to push into streaming before but the infrastructure was not in place to support quality, low cost streaming to retail customers - One chart shows Netflix's dramatic 20 year rise. Coupled with Netflix rise, was the early success of shows like House of Cards and Orange is the New Black.

Bright's Banter

Nassim Nicholas Teleb is working on his new book and here's another chapter where he breaks down risk-taking, into simple and easy to follow thought experiments - The Logic Of Risk Taking

Here's an inspiring story by Morgan Housel(he was a guest speaker at the Allan Gray Investment Summit) on how he was inspired by Barry Ritholz's storytelling abilities in public and the challenges he had to overcome in order for him to become a world class public speaker - Overcoming Your Demons

Home again, home again, jiggety-jog. Thanks to the Nuclear tests over the weekend, the Platinum price is over $1 000 an ounce again, currently at $1 012. Gold is also higher this morning, up to $1 334 an ounce and the Rand has held up surprisingly well as money flees to safer assets, currently at $/R 12.94.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment