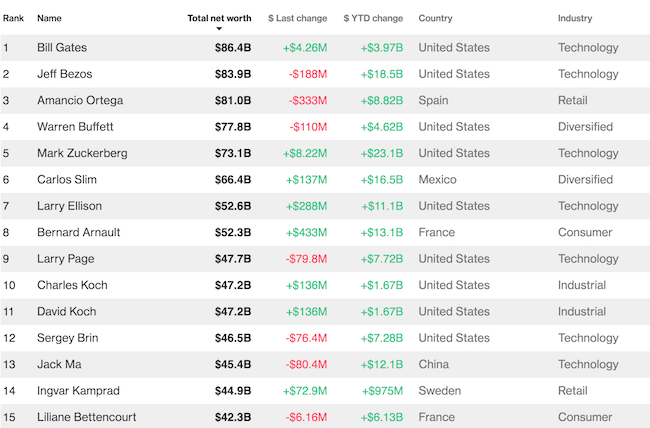

To market to market to buy a fat pig. There has been a tussle at the top of the globe's rich list, the top spot has changed a number of times over the last month. First with Jeff Bezos briefly dethroning Bill Gates and then Amancio Ortega also briefly dethroning Gates.

Having a look at the Bloomberg Billionaires Index this morning, I decided to see who how far down the list you needed to go until you reached the first person who inherited their wealth. In days gone by, you didn't have to go too far down to reach the Walton siblings who inherited the Walmart empire. Today though you need to go all the way down to number 15 in the form of Liliane Bettencourt who inherited the L'Oreal empire.

You could argue that the Koch brothers and Bernard Arnault, inherited a few million so they shouldn't be considered self-made. Turning millions into billions is no small task though. Also, neither of them took the money/ businesses they inherited and did nothing, they set to work expanding operators, making things efficient and most importantly creating value. So I am happy to keep them in the self-made column.

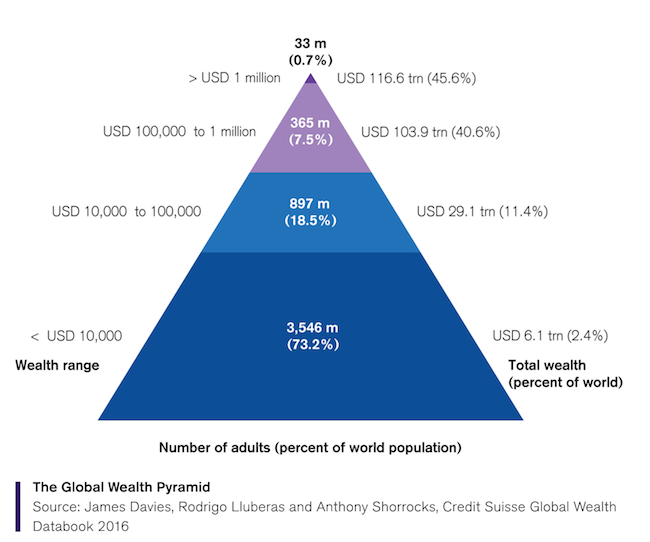

Over the last couple of years, partly due to middle-class stagnation, it is an increasing topic of conversation to bemoan the NAVs of the world's richest people. If you have a look at the below pyramid, you can see why the natural reaction is to be shocked by wealth inequality. If you are reading this, there is a good chance you are in the top 25% globally, do you feel you earn too much and some of your wealth should be distributed to the other 75%? The next question would be, how do you then distribute that wealth to the poor? The how part is a highly emotive subject and in truth society hasn't really found a solution.

How much value has Gates created for society through MS Office and then his efforts to eradicate polio (which is on track to be eradicated by 2020)? How much value has Bezos created by allowing consumers to find products cheaper on Amazon than anywhere else? How much value has Ortega created through Zara's affordable fast fashion? These guys do have a large portion of the globe's wealth but how much poorer would the globe be without their innovations? A paraphrase of Buffett, as a society we know the best way to create wealth but we don't yet know the best way to distribute that wealth.

A quick look at our market yesterday. Thanks to the tensions on the Korean peninsula our market, along with global markets, stayed in the red all day to close down 0.34%. As you can imagine, in the current 'risk-off' environment, gold mining companies have done well. Yesterday the gold mining index was up 4.6% and the platinum mining index was up 1.6%. Having a look at how the gold miners have done over a 12-month period, I was surprised to see how much they are down. AngloGold was up 5.2% yesterday, is down 9.8% since the start of the year and down 43% since last year this time. Looking back a bit further, the stock is down 47% over a 5-year period and over 10-years it is down 51%.

Over the last 10-years, the stock didn't just gradually drift lower to close down 51% for the period, it has been up and down. Let's assume you bought AngloGold shares, 10-years ago today. Looking at the graph, you were up for the start of 2008 and then gold mining stocks crashed with the rest of the market, yes they went down when the 'world was ending', not up. Then after the Fed announced their QE program gold prices shot up and so did the mining shares, so from 2009 till the end of 2012 you were up. Only in the middle of 2016 were your AngloGold shares higher than their September 2007 price again, but since then the share price has gone from R30 and has slumped more than 50% to be around the R14 mark today. Those moves characterize owning commodity companies, they move in cycles, which makes the ride very bumpy and makes your purchase timing very important.

Looking at the graph it may seem easy, with the benefit of hindsight, when to buy and sell. Remember though that when the share price was at its top, the future looked bright for gold and even brighter for the miners. Conversely, when the share price was at its lows, gold miners were going to go out of business and the gold price was going to drop because the Fed was going to raise rates. It is for that reason we avoid commodity companies for clients, too volatile and generally no long term growth.

Linkfest, lap it up

One thing, from Paul

I'm turning 51 in December, so I'm coming to terms with the idea that I won't live forever. Sad!

So I've found myself clicking on more links about keeping ones life in order. This blog post struck me as a good reference. It lists the four estate planning documents you need to get on file, regardless of your age, health, or wealth - Key Estate Planning Documents

Spoiler: the four are a durable power of attorney for when you lose your marbles, a letter setting out your medical directives once you are on your last legs, a will (of course), and a more general letter of instruction.

Bright's Banter

Your favourite song by Luis Fonsi and Daddy Yankee "Despacito" is the most-watched YouTube music video ever (sorry Gangnum Style). The skeptics say it could've made so much money had people listened to it on a different platform. YouTube's rate is $0.0007 cent per play, Fonsi and his team made a pedestrian $3.2million from its 2.7billion YouTube views compared to $38.6million approximately if it were on Spotify alone with a similar hit rate, and thats nothing compared to a potential of $193million in iTunes sales if it were exclusively on iTunes and the track went for $1.29 - Descpacito Could Have Made So Much More Money If It Weren't On YouTube

How can anyone consider cryptocurrencies to be safe haven assets (as an accountant I hate to even use the term asset when describing these alternative currencies) when the price of Bitcoin got pummeled over the last few days? Gold, Yen and other major currencies actually outpaced Bitcoin in the latest bout of global tension - Bitcoin Fails As A Haven Amid Fears Of Nuclear Conflict Between US And North Korea

Home again, home again, jiggety-jog. Despite Asian markets being in the red this morning, our market has opened in the green. As geopolitical tensions subside, gold and platinum prices have also dropped, pulling the precious metal miners down with them. Then later today 2Q GDP number is released by Stas SA, the forecast is for South Africa to be back in growth mode, leaving the short recession behind.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment