To market to market to buy a fat pig. Our market opened well in the green yesterday but proceeded to drift to the bottom right of screens, finishing the day down 0.43%. Long4Life released another cautionary announcement just before the market closed, with what sounds like a fourth purchase on their radar. Considering that they only listed in April this year, management is getting plenty done in a short period of time. I suppose when you have the reputation of Brian Joffe and Kevin Hedderwick, people and deals come to you instead of having to look very hard for them.

There was also an Aspen trading statement, which looks in line with what the market is expecting from the company, if not slightly better. We will have to wait another two weeks to see what their final full year numbers look like. Of interest will be to see how their fairly recently acquired anesthetics business is doing.

For the US, there were two good beats amoungst the economic numbers released yesterday. US economic growth hits 3% rate in second quarter, economists were expecting growth to be 2.8%. The growth came from increased consumer spending and increased business investment, which is a good sign for future growth numbers. Economists are forecasting another 3% rise for the third quarter. Which if that happens, would be two successive quarters of above 3% growth, which hasn't happened since 2014.

The other data beat was the number of new jobs created in the US over the last month, which was 237 000. Economists were expecting 'only' around 183 000 new jobs. Strong growth from the US is good for global growth numbers. After those better than expected numbers, US markets spent the day in the green. Here is the scorecard, the Dow was up 0.12%, the S&P 500 was up 0.46% and the Nasdaq was up 1.05%.

Linkfest, lap it up

One thing, from Paul

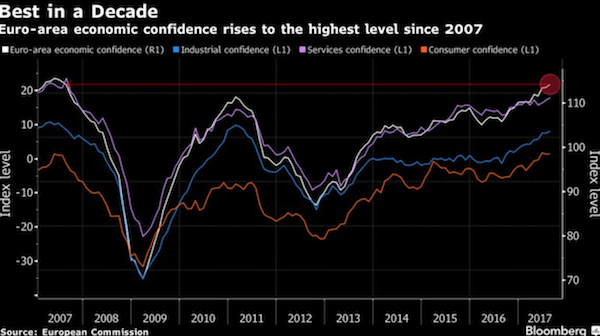

This chart caught my eye yesterday. It shows that the Eurozone economic confidence is gradually rising, and has now reached a level higher than 2007. In other words, above where it was before the all-fall-down crisis of 2008/09.

Remember that the Eurozone is all the countries that actually use the Euro currency, so its mainly Germany, France, Spain, Italy, etc and excludes the UK and some Scandinavian countries. This is good news for companies like Steinhoff, which has many durable goods stores around that region.

Michael's Musings

The Oracle of Omaha turned 87 yesterday, to commemorate his birthday Business Insider has created a list of some of his most famous sayings - 13 brilliant quotes from Warren Buffett, the greatest investor of all time.

Here is a little background to the new Uber CEO, Dara Khosrowshahi (pronounced "Cause-Row-Sha-hee") - The amazing life of Uber's new CEO Dara Khosrowshahi - from refugee to tech superstar

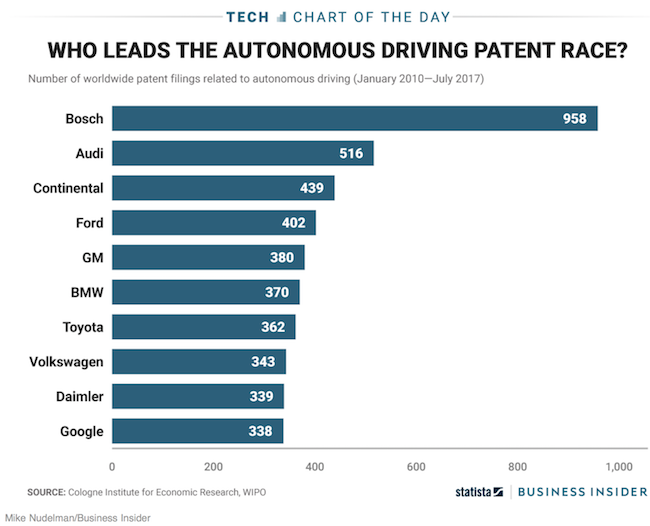

The first company you think of when I say "self-driving cars", is most likely Tesla or Google? Based on the below list Tesla doesn't feature in the Top 10 list of patents related to self-driving cars - Who's in the lead in developing self-driving car technologies? Hint, it's not Google.

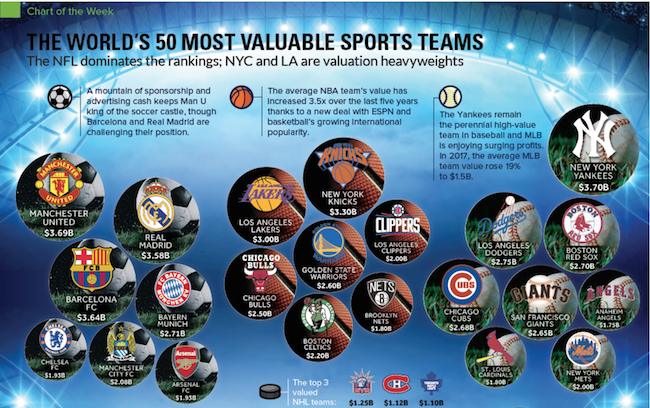

After last weekend's showing, I'm not sure Arsenal will be on this list much longer - The World's 50 Most Valuable Sports Teams

Bright's Banter

Here's an interesting opinion piece basically arguing the fact that Silicon Valley no longer needs to be treated as a special case, since many of these innovative business have grown from being "pirates" to being the navy in the corporate world. Therefore they should face the music and deal with their issues head on and not take the hands off approach. What is with the different classes of shares? Giving themselves more voting rights over other shareholders??? - Silicon Valley Isn't Special

Home again, home again, jiggety-jog. The JSE is off to a positive start, taking its lead from the US. Steinhoff released 9m trading numbers this morning that look positive, the stock is currently up over 1%, more on them tomorrow. Later today, we will get South African trade numbers which may impact the Rand and then there are CPI and employment numbers from the EU.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment