To market to market to buy a fat pig. Another green day for both our market and the US market, the S&P 500 was up 0.24% to just short of an all time high. Thanks to the strong surge in the Apple share price after hours, the S&P 500 is set to open at a record high today. Good times.

An interesting rule change from the S&P on which companies will be allowed into the index in the future (The S&P 500 is making a new rule). The rule will exclude new companies being included that have multiple share classes, with the first casualty being Snap Inc. Does this mean going forward that the S&P will start removing companies already in the index who have multiple share classes? Big hitting companies who have multiple share classes includes Alphabet (Google), Berkshire and Under Armour. Imagine saying that you want to buy the US market but the EFT you buy doesn't include the first 2 companies?

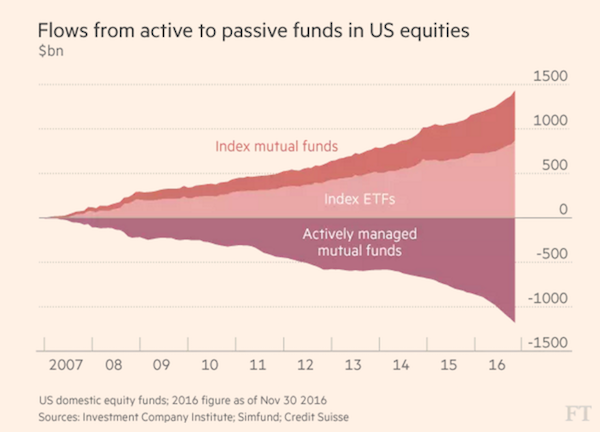

With the big move towards index trackers, the rules determining the index start to hold more significance (ETFs are eating the US stock market).

Companies that don't make the cut will most likely trade on lower multiples as their shares are left dry from the flood of index tracking ETFs. Distortions like this creates opportunities for more active investors, which is good news for you and I. The growing passive space should result in more room to move for active investors because a passive investor buys a company due to it being in an index and for no other reason. So an over-bought stock could be bought up more, creating the opportunity for active investors to short the stock. Or as we have spoken about, some companies may be left out in the cold even though they are cheap and a great buying opportunity.

Company corner

Byron's Beats

The third quarter is usually the most boring in Apple's cycle. That is because it is the quarter before new product releases are announced which also coincides with the festive season. Not much was expected of last night's results. I must say, I was expecting a disappointment because I personally know a few people who are holding out on renewing their contracts until the new Apple phone is released, hopefully in September.

But that was not the case and the results smashed expectations, pushing the share up 6% pre market. Quarterly revenue came in at $45bn compared to $42.4bn this time last year. The company's cash balance now sits at a whopping $261.5bn. Just Wow!

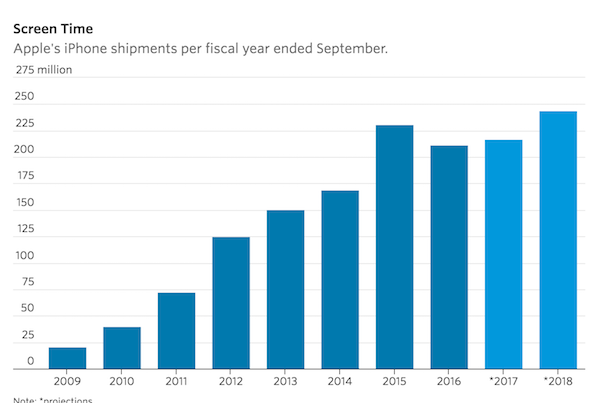

Profits for this quarter came in at $8.72bn, up 12%. Guidance for the next quarter indicated some exciting product launches. See the image below from Wall Street Journal which shows the magnificent rise of the greatest product of all time. More records are expected in 2018.

Pleasant surprises included a rise in the iPad business for the first time in 4 quarters. Mac sales rose 6.7%, the third quarter of gains in a declining notebook market. Services grew 22% to $7.27bn as it becomes more and more significant. Lets hope for more exciting content coming to iTunes subscribers.

Apple continues to be one of our favoured stocks in New York. For a company of this quality, trading at 17.5 times earnings, we think it is a no brainer. Expect more news from these guys soon when those product releases come out.

Michael's Musings

Last week Cerner released their 2Q numbers which were largely inline with what the market was expecting. Revenues were up 6% to $1.29 bn, with the more important numbers of Bookings, up 16% to an all time high of $1.64 bn. Revenue Backlog was up 11% to $16.65bn. On the profit side of things, Adjusted Net Income was up 3% to $206 million, which translated into EPS of $0.61, 5% higher (thank you share repurchase program).

Two noteworthy new customers signed up during the last quarter were, LifePoint Health and the Department of Veterans. LifePoint Health operate 72 hospitals, the rollout is only in a handful of their hospitals for now but in time you would imagine all the hospitals will be running on Cerner systems. For the Department of Veterans, they were elected as lead in "next-generation electronic health record system". Things are still in the planning phase and contracts are still being signed. Of significance though is Cerner beating out the competition to be chosen by a large government department.

Going forward the company gave guidance that their Full Year(FY) Revenue should be around 8% higher and that FY EPS should be around 6% - 11% higher, meaning that the current P/E ratio of 32 isn't cheap. The market gives Cerner this premium due to the long term steady growth potential from the company, where they have a very healthy operating margin of 19.3%. Also, only 10% of their revenues comes from outside of the US, once they are done conquering the US the rest of the globe will be ready for the taking.

Linkfest, lap it up

A note from Paul

Bitcoin is splitting in two? What does this even mean? Too complicated. I'm out! (Bitcoin splits in 2)

Tesla batteries to be used by power utilities? This could be big! (Tesla Batteries May Back Up Wind Farm Off Massachusetts Coast)

Bright's Banter

Failed In Loans Trying High Yield (FILTHY) - A perfect example of pro-risk behaviour by Pension Fund Investors in Europe where FOMO and the low interest rate environment forces these investors to over reach for returns without any risk consideration (European loan fund boom sparks concerns over risk taking)

Home again, home again, jiggety-jog. Numbers to be on the look out for later today are, the ADP Nonfarm Employment change and then probably more significant to us in South Africa, the Crude Oil Inventory number from the US. The change in inventory will give an indication of what the demand picture looks like in the US, having a knock on effect on the oil price which has found a new home above the $50 a barrel mark.

Sent to you by Michael, Byron and Paul on behalf of team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment