To market to market to buy a fat pig. Dow 22 000! It was only in January that Dow 20 000 was the talking point for financial journalists, it is just a number but marking these milestones creates excitement around the market and hopefully results in more "average Joe's" investigating using equities to create long term wealth. Any idea how far the Dow fell in 2008, 2009? The index fell from around 14 000 points to the mid 6 000's Ouch! A reminder that markets don't only go up. Since those lows though, the market is up 3 fold, meaning that if you continued to regularly contribute to your investments and your pension, those lower prices have been a huge win for you now.

On to the scorecard, the Dow was up 0.23%, the S&P 500 was up 0.03% and the Nasdaq was 'down' 0.00% or down less than a point. Locally the all share is holding its ground above the 55 000 mark, finishing at 55 200 yesterday down 0.34%. Companies sitting at 12 month highs include Dischem and Clicks. If you had to guess, would you have picked 2 RSA focused retailers to be sitting top of the pile? Dischem has been on a tear since listing, up 40% and more if you were lucky enough to get some pre-listing. Another company having a good time sitting at 12 month highs is Discovery, breaking into the 140's again. The talk on the street is that a potential rights issue from them is looking less likely which is good news for existing share holders.

Having a look for the US oil inventory number from yesterday I stumbled across this article, Venezuela Expects Refinery Output Capacity To Drop To 44%. Ouch! Poor policy has lead to poor economic outcomes, which then leads to more poor policy and the cycle continues. Currently the antigovernment death toll is sitting above 120, the country has a chronic shortage of essentials and there are reports of some citizens having to eat their pets (no food to be found for the pets or the owners). Remember that Venezuela is the country with the largest oil reserves in the world, they have 12% more reserves than Saudi Arabia, proving that even if you have an abundance of natural resources, the people can still suffer due to poor policies. Back to the oil inventory number, inventories in the US dropped but by less than the market was expecting meaning demand for oil isn't as high as expected. Good news for the consumer not good news for producers.

Company corner

Byron's Beats

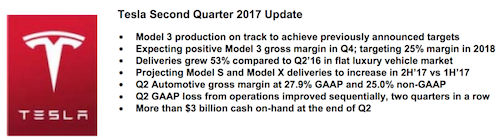

Last night we had Tesla results. This is always exciting for market participants even if you don't invest in the stock. People love to hear what Elon Musk has to say. Here is a quick highlights reel of what happened this quarter. Never a dull quarter for these guys!

The market liked what it saw and the stock surged 10% from it's intra day low. The loss was less than expected and demand for their luxury vehicle's, the Model S and Model X, were higher than expected.

What was absolutely incredible to see was that they are averaging 1 800 Model 3 orders a day. Remember, you need to make a $1 000 deposit to get your order in. That's $1.8m coming in per day. Not bad for a capital hungry business like this. If you want one here in SA, you better get your order in now because that queue is not slowing down. The ability to grow supply will be exponential as they adjust to the scale. They aim to produce 10 000 a week at some point in 2018.

The hype for this product and the long virtual queues smells a lot like apples.

The energy generation and storage business. They have installed the solar tiles onto various Tesla employee's houses. This will help them find defects along the way. Those will go mainstream soon.

Energy storage is a huge theme. Whether you use wind, solar or hydro, storage is crucial. They have just landed the biggest lithium-ion battery storage project in world in South Australia. It will provide 30 000 homes with stored electricity. This division brought in $286m in revenue, growing 34% from last quarter.

This is not just a car company. It is a software business with self driving car capabilities. It is a utility business with it's energy producing capabilities. It also a battery business. Anyone who needs to store energy (who doesn't) could be a Tesla client, especially since they are the first movers in mass produced lithium batteries for both homes and commercial.

The ride will be wild with many ludicrous modes involved. But we think, with every quarter, Tesla are slowly winning the battle against all odds.

Michael's Musings

MTN released their first set of numbers under new management this morning, I'm pleased to see that the market reacted favourably to them. In constant currency the numbers looked okay, when converting everything back to Rands it looks rather horrible. In constant currency Revenues are up 6.7% (down 18.5% on actual currency) with Nigerian revenues up 11% and South Africa up 1.6%. The future of the business, data had a strong showing with a revenue increase of 31.9% or 9.6% in actual currency, with Nigeria growing by 70%, South Africa by 14% and Iran by 68%.

New management means a new vision for the company and a new culture to some degree, which is what shareholders were looking for. Below is what the new growth plan and focus will be for the company. My corporate speak is a bit rusty but if they can execute on what they plan to do, it looks good for the long term health of the business. I'm interested to see what the "digital" focus will entail, there has been talk that MTN might buy Multichoice's Rest of Africa operations.

"During the past six months the management team undertook a thorough review of the Group strategy and developed a clear growth plan for MTN that will be arranged under six strategic pillars comprising: Best customer experience; Returns and efficiency focus; IGNITE commercial performance; Growth through data and digital; Hearts and minds; and Technology excellence. We refer to this as the "BRIGHT" strategy."

One of my favourite stats from the telecom companies is what they have to do to achieve their growth, for the last 6 months they installed 4 404 3G towers and then a further 3 478 4G towers. They estimate that for the full financial year they will spend around R30 billion on CAPEX, around 13% of their market cap. The biggest chunk is allocated to South Africa with planned CAPEX expenditure coming in at R11.5 billion! With an improving political situation in Iran they are doubling their CAPEX spend to R3.9 billion.

As a long suffering MTN shareholder you will be in line for a R2.50 dividend at the end of August and then a projected R4.50 dividend in March next year, still a far cry from the R13.10 full year dividend paid two years ago. If you have ridden the share price over the last few years, it would make sense to keep ridding this one for a while longer to see how much of an impact the new management will have.

Linkfest, lap it up

One thing, from Paul

I'm old enough to remember Apartheid South Africa, so this article made me feel sick in the pit of my stomach. A list of prominent SA businessmen who actively supported PW Botha's National Party. With copies of their donation letters. (Declassified: Apartheid profits - Who funded the National Party?)

Bright's Banter

We all know the famous saying An apple a day keeps the doctor away. Well it seems that we may have been sold dreams because the Queen has FOUR DRINKS A DAY and that formula seemed to have worked for her and your majesty is only 91 years young. (The Queen Has Four Cocktails a Day)

So Game of Thrones lovers, yes you AKA the Throners…SPOILER ALERT!! STOP READING FROM HERE! I AM WARNING YOU FAM, YOU REALLY DON'T WANNA SEE THIS. HBO is freaking out about the hack that leaked an upcoming "Game of Thrones" episode. Now the FBI is involved. I wonder what this means for Time Warner Inc and its shareholders. (HBO Hack: Insiders Fear Leaked Emails as FBI Joins Investigation)

Home again, home again, jiggety-jog. After being up 4% this morning, MTN are now down 1%. Maybe something was said in the results presentation this morning that the market didn't like? Our market is higher again this morning and the $/R is sitting steady at around 13.25. Note worthy data out today is a rate decision from the BOE and then initial jobless claims from the US.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment