To market to market to buy a fat pig. How does 'Naspers R3 000' sound? Well depending on if you own them or not, it will either be sweet, sweet music or the sound of a cat 'singing' in the night. Yesterday afternoon Naspers was briefly above R3 000 a share and then settled at R2 993 at the close, meaning that it is now up 48% year to date and up 500% over 5 years. You have heard us talk frequently about how much more Naspers has in the tank, so we won't go down that road again. Bravo Naspers, bravo. Next stop R 4 000 a share.

To go with the new record highs from Naspers, the All Share finished up 0.23% at 56 130 points, a whisker away from its own all time highs. In the movers and shakers column for yesterday is Long4Life, who have just locked down their third purchase since listing in April - Share Purchase Agreement to acquire Inhle Beverages. From the outside, it looks like the synergies they are going for are that the current management will stay in place doing what they do best, managing the operations. Long4Life will bring a big balance sheet to help the business expand as well as the skills of Brian Joffe and Kevin Hedderwick, to further streamline operations.

In New York, New York things were less rosy, the Dow closed down 0.4%, the S&P 500 was down 0.35% and the Nasdaq was down 0.3%. The market pundits are attributing the lower markets to White House uncertainty and lower new home sale's numbers. Good news for US consumers is that the Amazon's purchase of Whole Foods is one step closer, Amazon deal for Whole Foods wins U.S. regulatory and shareholder approvals. As an Amazon shareholder, I am interested to see what they have in store for this business.

Company corner

Michael's Musings

A company that we haven't spoken about before is Activision Blizzard, who own brands like Call of Duty, Star Craft, World of Warcraft and Candy Crush. Depending on your age and how you spend your evenings, those are all very big names. The significance of this company though is that Tencent owns 12% of it.

A quick history of the company, Activision was founded in 1979 to produce games for Atari. Blizzard Entertainment was founded in 1991 by three friends fresh out of university. Fast-forward to 2007, Activision merged with Vivendi Games who already owned Blizzard Entertainment and renamed the merged entity, Activision Blizzard. Then in 2013, due to Vivendi having a huge debt burden, they (Vivendi) sold the bulk of their shares to a consortium, which included the founders of Activision and Tencent. Then the last major division of the company is King Digital Entertainment, the maker of Candy Crush, who Activision Blizzard bought for $5.9 billion at the end of 2015.

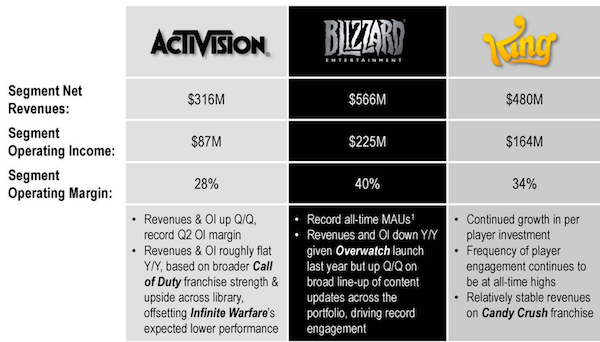

Here is a look at the company breakdown:

The first thing to note is those very healthy operating margins, company wide they average out to 35%. To put things into perspective, in the last quarter they had revenues of $1.6 billion (around R21 billion) and operating income of $576 million, not bad for a company that sells games. Currently, all the money is made from owning some of the biggest gaming brands ever, where they continuously launch new versions of those brands. Given that being in the entertainment industry is all about being relevant to the tastes of the consumer at that moment, it is important to have many different games on the market at the same time to try buffer the ebbs and flows of the consumer's feet.

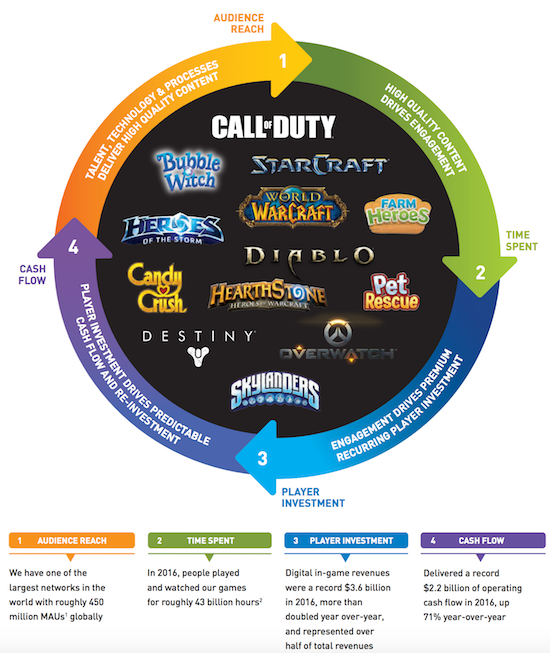

Continuously coming up with new content can be challenging and results in lumpy profits, a hit game this quarter and none the next. I think the future of the company is in the e-sport sector, where creating leagues, having teams and a solid fan base means more stable profits. For comparison, the NFL has 240 million fans watching 7 billion hours of content creating $12 billion in revenues. The NBA has 176 million fans watching 2.1 billion hours generating $5.2 billion in revenues. In last financial year Activision Blizzard had 450 million monthly active users, playing 40 billion hours and watching a further 3 billion hours to generate $3.6 billion in revenues. E-sport still has huge potential as a form of entertainment that fans will pay to watch, remember that it is being considered for the 2022 Olympics.

Until e-sport becomes a significant part of their revenues and earnings, here is how the company plans to stay relevant. Their "moat" so to speak.

Like any good tech firm the market has high expectations, currently giving them a market cap of slightly more than $48 billion and a P/E ratio of 43. What is impressive is that even with such a high multiple, they are still able to have a dividend yield of 1.2%. Back to the P/E, which looks rather high considering that in the last quarter two of their three divisions had shrinking revenues and the last one was flat, so no growth currently and management aren't forecasting any either.

For Tencent, I think it is a great investment, not only because Tencent has about tripled their investment value over four years but because of their ability to team up on projects. Tencent and Activision Blizzard have already collaborated to make Call of Duty for the Chinese market and I wouldn't be surprised to see more collaborations in the future. An investment for your personal portfolio? I am less convinced. Personally, I own a few mostly because of my personal nostalgia attached to their brand portfolio but also because I think e-sport is going to be huge in the future, when I can't be sure though.

Linkfest, lap it up

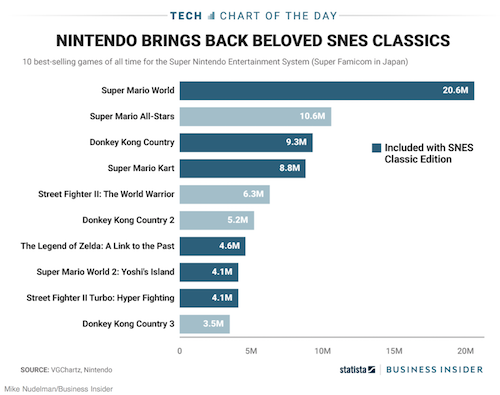

The reason that monopoly is still around today, even though it is the cause of families not talking to each for weeks is because of the nostalgia factor. Monopoly is associated with our childhoods where we have fond memories so then buy it to introduce it to the next generation. The same is happening with remakes of old movies and with video games - Nintendo's SNES Classic Edition will come with three of the four most popular games made for the original version

Google and Walmart are teaming up to make ordering online even easier - Google and Walmart are joining forces to take on Amazon. This is a step in the right direction but their offering still seems miles behind that of Amazon.

Here is a good take on the current debate of what Naspers executives should earn - Allan Gray is dead wrong - Naspers CEO earns his salary, and then some

One thing, from Paul

There are rumours swirling around that the cash-strapped SA government is thinking of selling its remaining stake in Telkom to fund a further bailout of SAA. In investment terminology, that would be what we call "pruning your roses and watering your weeds". Ridiculous! - SAA R10bn rescue from sale of stake in Telkom

Mind you, perhaps this kind of muddled thinking and operational uselessness is just a function of large, government controlled bureaucracies with soft budget constraints? The US Navy has a budget of $117 billion, and they keep crashing their ships? - Spate of mishaps, deadly accidents prompts Navy to examine training, leadership

Byron's Beats

This morning I had a client asking about the Steinhoff/Shoprite/STAR deal that will take place next month. This article titled Steinhoff to list Star unit on JSE as Shoprite deal is back on explains the logistics of the deal.

Here is what I had to say about it.

"There has always been complicated deal making activity when it comes to Steinhoff.

They probably feel the company trades at a discount in Europe because of their big Africa exposure. The listing of STAR will be the beginning of the offloading process.

Because STAR will own a controlling stake in Shoprite, there will certainly be lots of collaboration between STAR brands and Shoprite. Shoprite have a well established infrastructure network in many big African countries. STAR will certainly leverage off of that.

They are all well managed retail businesses targeting all sorts of geographies and demographics. In general, all growing.

I still think the best way to benefit from all of this is to own Steinhoff who will own most of STAR which in turn will own 23% of Shoprite (but has over 50% control). That is where the bulk of Christo Wiese's assets sit. Generally these deals are spearheaded by him and suit Steinhoff's long term strategy."

Bright's Banter

Most breakthroughs in science and business come when an insane idea makes its way to the commercial world. On that note, here's a story about a microbiologist who is collecting athlete poop for his research - Scientists Are Collecting Poop From Elite Athletes To Try Put Their Endurance Into A Pill

If you want motivation to reach your personal goals, a healthy dose of public shaming and FOMO can help - That Annoying Runner On Your Social Media Feed Is Deeply Influential

Home again, home again, jiggety-jog. There were FY numbers from both Woolworths and Bidcorp this morning. The Woolies numbers were underwhelming, the stock is down 5% off the bat. The Bidcorp numbers are inline with market expectations, so the stock is trading slightly higher. Steinhoff are being investigated again for irregular tax practices, they dropped 9%. We will follow that closely. Good news for consumers and retailers is that the CPI read came in lower than expected, at 4.6% meaning that an interest rate cut at the next MPC meeting is firmly on the table.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment