To market to market to buy a fat pig Another good day for the local market, finishing up 0.59% at 55 207, lead by resources. The graph from yesterday tells me that our high of the day was 55 355 which means we set a new all time high, surpassing the old level of 55 188 set in April 2015. Our market has been flat for just over 2 years then, well flat if you draw a straight line between April 2015 and yesterday. Since 2015 the market has been volatile reaching the 46 000 level in January 2016 thanks to the very brief global bear market, the worse start for the S&P 500 on record. I think the reason people were selling was because of growth concerns out of China? Can you remember what the news headlines were back then? We find that our reader numbers jump during times of 'fear'.

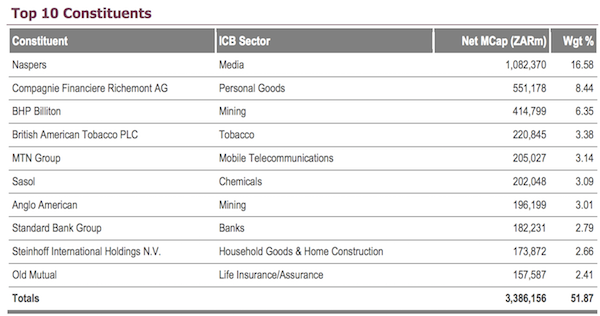

As another market commentator pointed out last week, the market is not the economy particularly in the case of South Africa. What he means is that the market is forward looking, when you buy a share you are paying for what you think the companies profits will be next year, the year after next and so on. In part is the market saying that it thinks things in RSA will improve? Better growth rates, lower unemployment and more investment? Here is a breakdown of the current Top 10 stocks in the all share by weighting.

As you can see, around a third of the market movements comes from 4 companies, none of which derive any significant profits from South Africa. A big part of the positive market moves is thanks to Naspers at all time highs, mostly because Tencent is also at all time highs. That is thanks to the strong growth coming from China. Fortunately our financial markets are some of the best in the world. We have the opportunity to invest in global players, so it is no surprise that our markets are setting all time highs, along with US markets which are also at all time highs.

Last point on markets setting all time highs. When a market hits a high it doesn't mean a drop is coming. As global wealth increases so does company profits which means share prices go higher. A main driver of global wealth creation is the planet moving from having 7 odd billion people on it to around 10 - 12 billion people, depending on what assumptions you make. At the same time, the number of people moving out of poverty into the middle class is growing. Some estimations have the number of people living in absolute poverty at the lowest in the globes history. It then makes perfect sense that markets trade at all time highs.

A note from Paul

I'm wondering what the new iPhone8 is going to cost? If its got a different form factor (looks different to the iPhone 7), it will sell out in a flash, no matter what the price! Horace Dediu of Asymco reckons that it may be $1,100: How much will the new iPhone cost

Byron's Beats

Last week Thursday we received third quarter results from Starbucks. Revenues increased 8% to a third quarter record of $5.7bn. This was on the back of comparable store sales increasing 5% in the US, 7% in China and 4% globally. The rest of the increase would have come from new stores which are flying in at 1.6 a day. 1 a day of those are in China alone.

The rewards programs are doing incredibly well. Rewards membership was up 8% to 13.3 million active members. Starbucks rewards represented a whopping 36% of US sales. They have absolutely crushed it with the mobile app, 30% of US transactions were done through it.

There were two big announcements in this report.

The company will assume full ownership of the Mainland China stores. They are buying the remaining 50% from their JV partners after 18 years of working together. 1300 stores in 25 cities are now 100% owned by the parent with many more to come. This $1.3bn deal is the biggest in their history and we believe is a fantastic strategic investment. China is a massive growth area for the business and now they have even more exposure.

Closing Teavana. Teavana was their tea focused retail stores. 379 stores will be closed which means the product was not well received. I must say this was quite disappointing as I thought this was an exciting product.

The results were not well received, the closing of Teavana overshadowed the purchase of the Chinese stores. The stock fell 9% on the day. To put that into perspective, it is up 127% in 5 years even after that drop.

We see this as a good buying opportunity into what is a very exciting brand. We have seen at McDonalds how a few menu innovations can make such a huge difference in customer adoption. Well Starbucks are the kings of innovative menus. As well as their amazing rewards programs. Expect a broad range of healthy and fresh lunch options to start filtering into the numbers. The developing market story remains a massive growth opportunity. We continue to buy at these levels.

Linkfest, lap it up

One of the reasons that the Amazon share price has flown over the last 2 years is due to investors realising the importance of AWS. The cloud division has been a big provider of profits used to expand the e-tail division - Cloud Business Drives Amazon's Profits.

You will find more statistics at Statista

You will find more statistics at Statista

Apple have numbers out tonight, with the key driver of profits still the iPhone. In time I expect the iPhone profit numbers to follow a similar path to the iPod numbers, the trick will be finding the next product to take over as the profit driver - The Slow Goodbye of Apple's Former Cashcow.

You will find more statistics at Statista

You will find more statistics at Statista

Home again, home again, jiggety-jog. Asian and European stocks are green this morning after another record finish in the US. We have manufacturing and vehicle sales out later today for both RSA and the USA, which will give an indication of how the respective economies are fairing. The dollar index slipped to a 2 and a half year low but the Rand still weakened against the Dollar, currently sitting at $/R13.16.

Sent to you by Michael, Byron and Paul on behalf of team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment