To market to market to buy a fat pig. 'The Fat man' and his nuclear toys were on the market's mind at the start of the day yesterday, resulting in US markets being deep in the red from the get go. As the day went on though, stocks had a steady rise to end the day off in the green. Financial bloggers tell me that this was the best intraday comeback for US markets since last year. Here is the scorecard, the Dow was up 0.26%, the S&P500 was up 0.08% and the Nasdaq was up 0.3%. Our broker in New York, Ted had this to say after the market closed:

"Interesting day today. They looked pretty bad over night (Korean Crazies). Open well in the hole and spent the whole day climbing out of the hole. One day reversals used to be important and impressive. Unfortunately not sure anyone pays attention to that stuff anymore. Bottom line. Pretty impressive performance. But, no volume. This weekend is Labor Day (end of summer for us) Monday is a holiday. This week and next always very quiet trading weeks"

Part of the comeback was Apple, which opened down 0.8% but then did an about turn to head higher and reach a new all time high, Apple (AAPL) Stock Touches New All-Time High. In the middle of 2015, the stock was trading at $130, fast forward a year and it was trading below $100 and now in the middle of 2017, the stock is at $162. It is up around 80% from its 2016 lows. During that period of poor performance in the stock price, we got an increasing number of calls from clients saying that they no longer thought Apple was a good investment because Samsung was becoming more dominant. Or because of Apple's problems in China or simply because they had lost faith in the company. Now that the stock has been flying we get the opposite calls, "Why aren't we adding more to Apple?".

Two things to point out. Firstly, the stock price is not the company. A lower stock price doesn't automatically mean the company is a poor investment or conversely a higher stock price doesn't mean the company is a great investment, which is a very difficult thing for us as humans to get our heads around. Secondly, it is during periods like that where your management fees are worth every cent. It was when Apple was below $90 where we got the most calls to sell Apple, keeping clients calm and in the stock has resulted in a return of over 70% in 15 months!

Locally the All Share was down 0.26% and the Top 40 was down 0.35% to finish below the phycological 50 000 points mark. The miners were absolutely flying thanks to a higher gold and platinum price; Anglo Gold was up 7.8%, Sibanye was up 6.9%, Goldfields was up 5.7%, Implats was up 4.8% and Northam was up 4.3%. Talking of Sibanye Gold, they are renaming themselves given all the PGM assets they have bought recently. Sibanye Gold Limited - Introducing Sibanye-stillwater, A Unique And Globally Competitive South African Precious Metals Company

Linkfest, lap it up

One thing, from Paul

When Johannesburg was founded in the 1880s it was a wild mining camp. Its still still a crazy place, where terrible things can happen. I mean, read this story about a shooting in a movie house in Hillbrow! - Hillbrow theatre horror: 'There were screams and then silence'

The perpetrator was caught later in the day because he was injured in a hold up at the Greenstone Mall. The clincher at the end is the quote from the movie house manager Gerard Bester, who said that the shows must go on. Closing the theatre is "not an option". Life goes on.

Byron's Beats

The world of e-gaming is exploding and many businesses are trying to tap the market. MTN are jumping on the bandwagon with MTN Play, they even have a lucrative tournament in the pipeline. R680 000 tournament for MTN's subscription gaming service. There are many eyes on MTN and how they can leverage off their 220 million subscribers. This is certainly a step in the right direction.

Michael's Musings

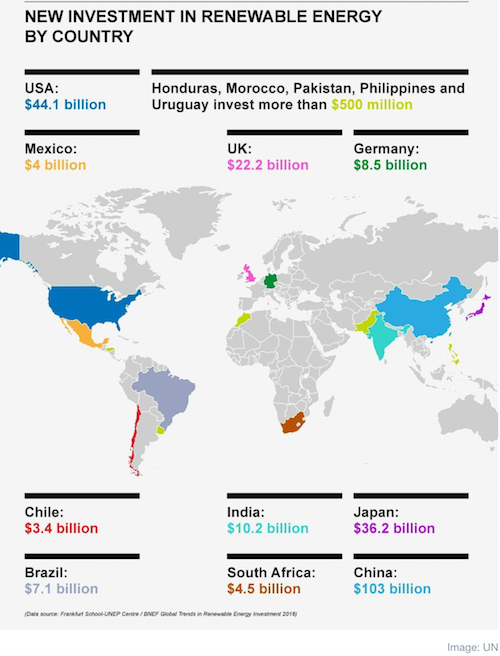

Depending on which industry you work in, the switch to renewable energy is either a good thing or a bad thing. Is South Africa there has been very big pushback from coal truck drivers, which is understandable - One of the biggest criticisms of renewables might have just been debunked.

"the fossil fuels not burnt because of wind and solar energy helped avoid between 3,000 and 12,700 premature deaths in the US between 2007 and 2015."

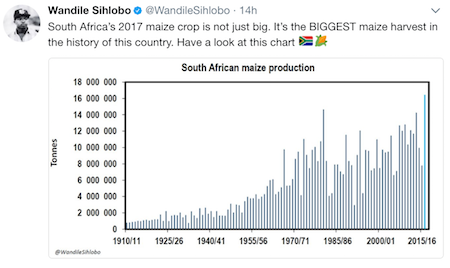

If you are on Twitter and don't follow Wandile, you need to do it now. His tweets have great information about South Africa. A record maize crop means lower prices and good news for consumers, I'm not sure how this effects the farmers though.

It has been three years since Facebook bought WhatsApp for $19 billion (even more if you consider that they paid with Facebook stock) and they have yet to make any money from the company. It looks like things may be about to change - WhatsApp is preparing a separate app for businesses and starting to verify business accounts.

Home again, home again, jiggety-jog. Following on from the US, Asian markets are also higher this morning. Tencent is up 1.9% in Hong Kong, so Naspers should be back on its horse today and heading back above R3 000 a share. There are many big data releases out of the US today; ADP nonfarm employment numbers, 2Q GDP read and then crude inventory numbers. Finally thanks to a very weak Dollar the rand is back below the $/R13.00 level currently trading at $/R 12.95.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment