To market to market to buy a fat pig. The 15 day streak of the S&P 500 not moving more than 0.3% in a single day came to a spectacular end yesterday, finishing down 1.45%. The tech heavy Nasdaq, was in even worse shape finishing down 2.13%. It seems the tensions between the US and North Korea took a day to settle in before having a significant impact on the market.

Three exciting companies had numbers out last night. Blue Apron, the recently listed food delivery company missed expectations and are down 18% in after hours trade, meaning that they are now down over 50% since listing date. Snap Inc also recently listed and also missed expectations pushing their share price down 17%. Nvidia was down 4% along with the rest of the market and then dropped another 7% in after hours trade due to their results, even though they were a beat! More on Nvidia next week.

Talking of red markets, this week marks the 10 year anniversary of the start of the market meltdown leading to the 'Great Recession'. The official start of the crisis is marked as the 9 August 2007, when BNP Paribas blocked the withdrawl of funds from three hedge funds due to "a complete evaporation of liquidity". The peak of the S&P 500 was 2 months later on the 11 October 2007, topping out at 1 576 points and then a steady drop until the fateful 15 September 2008, when Lehman Brothers didn't open business on Monday morning. It is worth noting that the cause of all the pain was the housing market bubble that had peaked in 2006 already, the delinquency rates started to rise in August 2006. It took one year for the effects to start to show on Wall Street and two years for Lehman to go bust, which then lead to debilitating fear and an absolute shutdown of the cash circulating around the banking sector. No cash moving around meant healthy businesses couldn't access credit for their daily operations. At that point a Wall Street problem became a Main Street problem.

If you bought an S&P 500 ETF 10 years ago at the official start of the crisis you are up, before dividends, by around 70%. Considering that inflation has been near zero for the last 10 years I don't think you can complain about 70% ? To get a 70% return over 10 years the market only needs to grown by, wait for it, 5.45% a year. That is all, reminding us about the power of compound interest. Yes, 70% over 10 years is not an amazing return but it is not bad either and if we continued at the same 5.45%, over 21 years we would have tripled our money. 'Not too shabby hey Nige?'

Locally our market was down 0.5% yesterday even though we started the day off in the green. Just about every sector was in the red except for gold miners, who were up 6% thanks to a weaker Rand (no-confidence vote) and higher gold price (missile comparing contest in the Northern Hemisphere). Unfortunately the only stock sitting on the right side of the 12 month high list is South32, on the wrong side are some former market darlings like Taste, Ascendis Health and Anchor Capital.

Company corner

Michael's Musings

On Tuesday night after the market close, the world's biggest online travel company, Priceline reported their 2Q numbers. They had revenues of $3 billion up 18%, ahead of expectations and net income of $720 million up 24%, also ahead of expectations. As is the case with any company, especially fast growing tech companies with high expectations, the past period is of less importance the then next quarter. Their guidance of earnings growth of between 4% and 10% was a bit lower than the market expected resulting in the stock selling off 8%. It is still up over 30% for the last 12 months, so where you draw the line in the sand matters.

The absolute size of this business amazes me. They have a $90 billion market cap yet most people have never heard of them. Through their sites there were 170 million room nights booked over the last quarter or around 1.9 million rooms booked per night, up 21%. Lastly, their spend on getting customers to come to their sites, they spent around $1.4 billion in the last quarter on advertising and marketing (most of it going to Google) out of a total $2.06 billion in operating expenses.

As more people want to travel and feel more comfortable using the internet to design and book their trips, Priceline will continue to see the cash rolling in. A recent study shows the dominance of their business (Expedia and Priceline now own 95 percent of the Online Travel Agencies market), I don't think the researchers included Airbnb in their numbers though? A company with high growth expectations will always have a bumpy share price, hang in there and book your December holiday on Booking.com.

Linkfest, lap it up

Byron's Beats

MTN has been through a very tough period but with a brand new management team and a recent sponsorship of the resurgent Bokke, things are looking optimistic. Financial Mail did a nice piece on their latest results titled MTN the bright spark once more? A few interesting stats that caught my eye were that out of 232m customers, only 72m have access to data. Still huge room for growth! They also expect their current target population of 700m to grow by 45m in the next 4 years. Sounds like an opportunity to me.

Michael's Musings

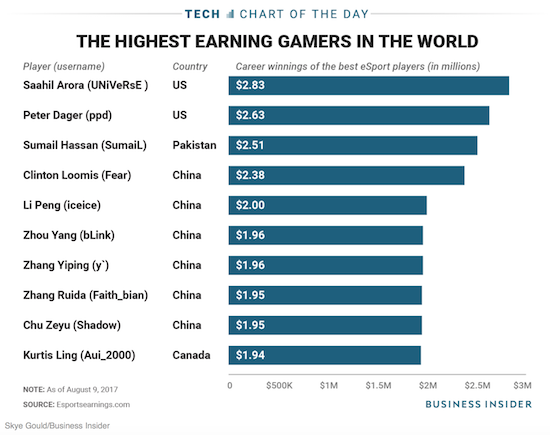

E-sport is a fledgling industry, have a look at lifetime career earnings of the best in the business. It is around the same as what golfers or tennis players make for winning one major tournament - The highest paid eSports player has won almost $3 million in prizes - one chart shows the world's top earners

I wonder how much a ticket for this flight costs? - The shortest scheduled flight in the world only takes 90 seconds

How big do you think the batteries will need to be for long haul trucks? The trucking industry along with the taxi industry seem set to be the first industries to be impacted by self-driving technology - Tesla developing self-driving tech for semi-truck, wants to test in Nevada.

Thanks to faster internet connections and better quality cellphone screens we have seen the growth in video consumption sky rocket. Facebook is now moving more directly into the video space where they will be a type of Netflix/ Youtube hybrid - Facebook is packing its first original video series lineup with annoying reality shows.

Bright's Banter

Here's a quick update from The Visual Capitalist on where the U.S. market is year-to-date on the returns front - Who's Thriving And Who's Diving

If you're thinking about a career in investment banking, make sure you join the right bank. Middle market and boutique firms seem to offer the best work life balance as well as the best pay compared to the Big Banks - These Are The Best Paying Investment Banks

Home again, home again, jiggety-jog. Markets in Asia are also red this morning following on from the US. Tencent is down over 3% so expect Naspers to probably be down more than that. Later today there is a CPI number from the US which is expected to be an increase by 1.7%, below the Fed's target rate of 2%, meaning that there is still no pressure to raise interest rates in the US too quickly.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment