To market to market to buy a fat pig. Markets were mixed on Friday, with both our local market and the US markets sitting in positive territory at some point in the trading day. Come closing time/beer o'clock (I think in Jozi on a Friday the beers start much earlier in the day) our market was down 0.2%, with the gold miners being the only major green spot, up 3.9% for the day.

US markets started the day in the red, then moved positive with more staff changes in the White House (Stocks see brief bump after Bannon ouster) but then closed with the Dow down 0.35%, the S&P 500 down 0.18% and the Nasdaq down 0.09%. Steve Bannon was Trump's chief strategist and a big proponent of the current anti-free trade agenda. Restricting free-trade would be a bad outcome for most of the companies listed in the US, who already have significant customers and operations outside of the US.

Then on Friday after the market closed, Bidvest announced that the Joffe chapter in their history has come to an end. Brain Joffe resigning as a non-executive director with effect from last Friday. Since the Bidcorp unbundling last year, Joffe has not had an executive role at the company and has been regularly selling his shares. Currently, the combined market caps of Bidcorp and Bidvest is around R160 billion, incredible value considering that he founded the group in 1988. As South African's we need to celebrate entrepreneurs who create jobs and economic growth through their ideas and vision. Here is a great interview with Joffe, The Bidvest story with Brian Joffe, in the interview he talks about his mindset going into the new South Africa. The end of his Bidvest chapter and just the start of his Long4Life chapter.

Company corner

Michael's Musings

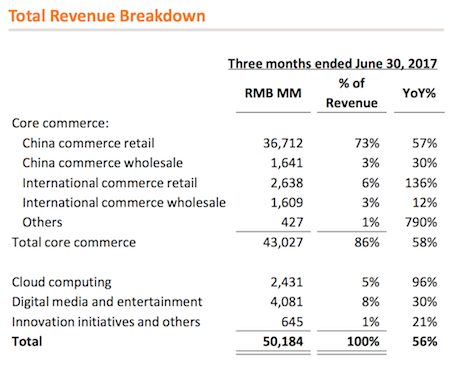

On Thursday we had another expectation smashing, set of numbers from a Chinese internet company, this time it was from Alibaba. They had revenues of RMB 50.1 billion ($7.4 billion) for the first quarter, an increase of 56%. Analysts had estimated it to come in at RMB 47.7 billion. Earnings per share were up even more, growing by 62%, showing that even with their monster top line growth they are not sacrificing margins. Here is a look at how the different divisions stack up.

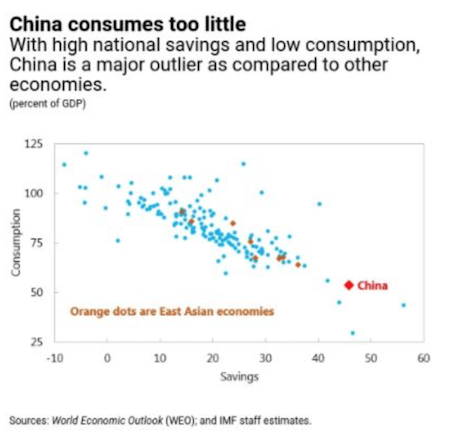

As you can see, the bulk of the business is Chinese retail, which is not a bad thing considering how fast their middle class is growing. Even though the country's growth is slowing to 6.9%, retail growth is still above 10%. Based on the following graphic, the Chinese consumer still has plenty in their 'consumption tank'.

The first thing that stood out to me though was how many opportunities there are for their international division. Currently, if you are a business and want to buy a container of anything from China, you would strike up a relationship with an agent in China who will source the product for you. The agent will pick the factory who can produce what you want, in the correct time frame and at the correct quality. The agent then charges you for their services but as a business, it is worth it because you know that what you ordered will arrive. Imagine if you can now use Alibaba to find what you are looking for and Alibaba will guarantee quality and delivery time? Given the size of the company, they would have no problem refunding you if your order goes wrong. I think that there is huge potential for the 3% 'International Wholesale' figure to become more significant.

On the 'International Retail' front, there has been a strong push into South-East Asia. Part of the push includes free shipping on selected items in Singapore. Added to that Alibaba have also teamed up with Netflix and Uber. Cross-marketing where ordering something from Alibaba gives you free services from Netflix and Uber. Their approach seems to be working shown by the 136% growth for 'International Retail'. How long until they are in South Africa in a big way and we have access to their HUGE singles day (11/11) promotions?

Much has been made of their cloud division in the media since their results came out and you can see why. Revenues were up 96% and the number of customers increased from 577 000 to just over 1 million. One of their significant customers is Air-Asia, having a well know brand run their systems and app through the Alibaba Cloud infrastructure is a vote of confidence that I am sure the sales team is using to lure other customers. The division is still loss-making though which is not a concern for now, as long as they keep growing at this rapid pace. The beauty of the cloud business is that once a company chooses to run their IT systems on a particular cloud infrastructure it is very difficult to move to a competing cloud company.

In this space, our preferred company is Amazon due to their primary market being the US and having a much larger cloud division. That seems to be the market consensus at the moment because, at current valuation metrics, Alibaba is cheaper than Amazon.

Linkfest, lap it up

One thing, from Paul

This week on Blunders: CEO of the Year (allows girlfriend to expense $5.8m on his company credit card), chili pepper eating contest in Hunan, long company names banned by Beijing, and a sad story from Venezuela - Blunders - Episode 69

Byron's Beats

I am currently reading the book about Jeff Bezos called The Everything Store. Although it was published in 2013 and much has happened since then, it is still a fascinating read about an incredible man. This article from Quartz titled What is Amazon, really? goes through each of Amazon's divisions and gives a nice description of the current business models.

Michael's Musings

I had to read the headline twice but after thinking about it, why not include esport in the olympics? - Esports in consideration for 2024 Olympics. If it does go through, it would be a big win for the likes of Tencent and Naspers.

Even though most of these inventions were very impractical at the time of their inventing, they show the pioneering human spirit - 13 things that were invented much earlier than you probably thought. My favourite is probably the first attempt at a car radio, where they were driving around with what looked like the washing line from your back yard.

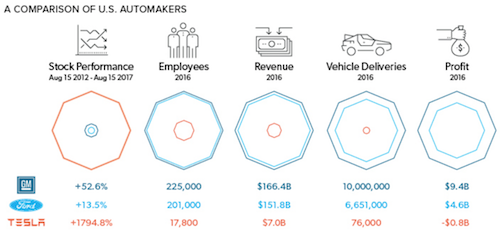

The guys at visual capitalist have come up with a nice infographic showing how Tesla compares to other car makers globally and in the US - The World's Largest Automakers, By Market Value. It is worth remembering though that Tesla is much more than just a car maker.

Home again, home again, jiggety-jog. Asian markets are mixed this morning and the All Share is higher 0.4%. AdvTech released their half-year numbers this morning that looked positive, resulting in the stock up around 2%. We will have a full breakdown of the numbers for you tomorrow. More important this week will be full-year numbers from Woolworths on Thursday.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment