To market to market to buy a fat pig. Following the big sell off in the US on Thursday, Asian markets and then our markets were down on Friday. The All Share finished down 0.98%, with the biggest loser being the big and heavy Naspers, down 3% to R2 757 a share. Two or three strong days in the share price will see it breaking the R 3 000 a share mark for the first time, Tencent is currently up 2.8% in Hong Kong so today could be one of those strong days.

The US markets seemed to forget all about any tensions brewing on the Korean peninsula and were back to their merry way. As you were! The Dow was up 0.07%, the Nasdaq was up 0.64% and the S&P 500 was up 0.13%, meaning that 16 out of the last 17 trading days, the market hasn't moved more than 0.3% in a single trading day, just that little hiccup on Thursday.

The price of a Bitcoin crossed the $4 000 mark for the first time over the weekend. The currency/commodity is up 280% this year and up 524% over the last 12 months! I think there is no doubt that blockchain (the backbone of crypto currencies) and digital currencies will play an increasing role in our lives as we go forward. The foreign exchange system is ripe for a shake up. SWIFT is an ancient system and banks fleece customers in fees and poor exchange rates when doing a forex transaction.

The question to ask though is, "what is the intrinsic value of a Bitcoin or any other crypto currency"? The most common argument that I have heard is that there is a finite supply of it which gives value to what has already been produced. Like gold but unlike modern currencies. My reply is that not everything that is rare is worth something and there is a good reason we moved away from gold as our currency. If you don't know what something is worth how do you deal with extreme price movements?

The underlying demand for Bitcoin seems to be from people that are trying to skirt regulations. In China one of the ways people are getting cash out of the country is through Bitcoin. There have also been recent hacks where the hackers have asked to be paid in Bitcoin as ransom. Also don't forget the criminal organisations that were using it to launder money. I'm sure that increased regulation is on the horizon, what will happen to the value of the currency/commodity then?

I agree with the opening line in this article, The case for $5,000 Bitcoin. "Bitcoin is either an enormous bubble or has a lot further to run.". So what to do? As the saying goes, the surest way to get rich during a gold rush is to sell shovels. In the case of cryptocurrencies, the shovel is a GPU and the companies selling them are Nvidia and AMD (Nvidia and AMD have very different views on cryptocurrencies (NVDA, AMD)). See below, Byron has written on Nvidia's most recent set of results where Bitcoin mining gets a mention.

I personally think we are in bubble territory. Every time I go online I see an ad for buying Bitcoin and we have been getting increasing calls from clients, who might still be running Windows 98, wanting to buy Bitcoin. I am mindful that the extreme exuberance in the late 90's, had internet stocks in bubble territory for around 2 years before the bubble finally popped. So we might be a few years away from 'peak Bitcoin' or we are just getting started with an asset that the next generation will use. Either way I am much happier owning Nvidia.

Company corner

Byron's Beats

Last week we had second quarter results from high flying Nvidia. As is often the case with stocks that have done incredibly well over a short period of time, expectations were high. The results also coincided with a sizeable tech sell off last week. The share price is off over ten percent since the results were released, trading at the same levels they were at 1 month ago. That should give you some perspective.

Revenues were up 56% from last year to $2.23bn. Earnings per share were up a whopping 91% to $1.01 for the quarter. Expectations are for the company to make $3.71 next year and $5.47 in 2019. That is a possible 48% growth in earnings off what is already a fast increasing base. At 42 times next years earnings, the market has high expectations but you can see why.

A quick refresher, Nvidia manufactures Graphic Processing Units (GPUs). These are specialised electronic circuits used for image processing on a display device. They are more efficient than CPUs at processing more complex algorithms due to being able to do multiple processes at the same came. Nvidia actually termed the phrase GPU after creating the first of it's kind in 1999 used for gaming.

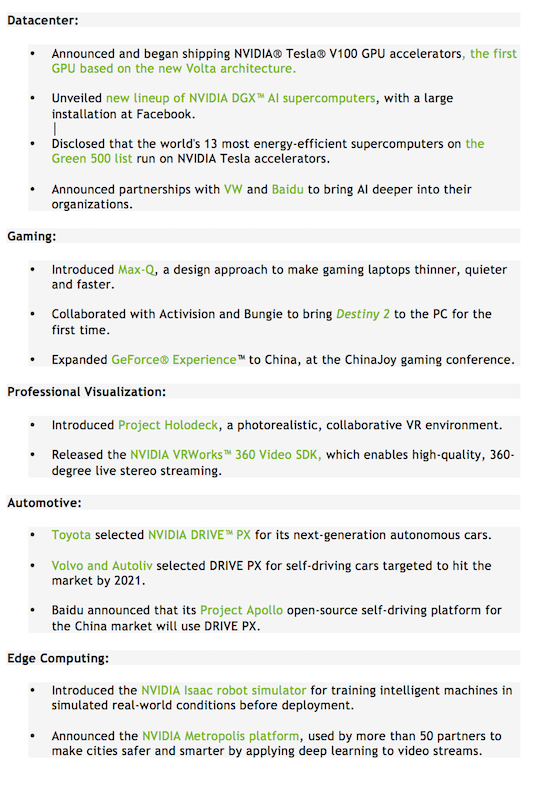

The demand for GPUs has exploded into all sorts of industries. In the Nvidia results they breakdown demand into 5 sectors. The image below lists these 5 sectors as well as recent developments within those sectors. You will notice collaborations with many well known business giants.

The biggest division is still gaming which contributes about 53% of revenues. Datacenter is the next biggest, contributing 19%. Pro visualisation contributes 10% and automotive contributes 6.4%. It is unclear which division mining cryptocurrencies falls within but Goldman Sachs estimate that these revenues exploded in the quarter and represent nearly 10%.

Cryptocurrencies, self driving cars, Internet of Things (IOT), robots, cloud storage, gaming, video, website hosting, Artificial Intelligence (AI) and Virtual Reality (VR). Nvidia chips are key to the success of all these exciting industries. Although the stock is expensive, we feel that the company will continue to grow like gangbusters. The ride will be bumpy, this is buy rated for clients with tolerance for volatility.

Linkfest, lap it up

One thing, from Paul

This week: Trump vs Jong-un is all bull****, Sentula Mining reborn as a Unicorn, hit Chinese movie filmed right here, and a "driverless" car spotted in DC - Blunders - Episode 68.

Michael's Musings

Here is a look at how the US market has fared this year - The Best and Worst Performing Sectors in 2017.

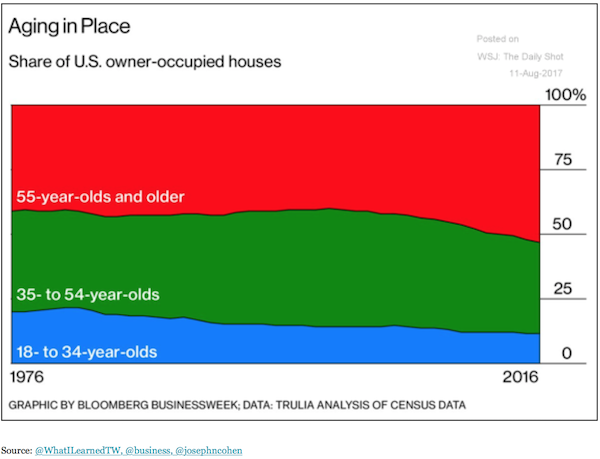

One of the biggest wealth transfers in history is still in its early stages but will start to pick up momentum as the 'silent' generation and 'baby boomers' pass their wealth onto Millennial's. The graph below is a good breakdown of where wealth currently sits.

I was surprised to see typewriting was still a course offered. I was more surprised when Google told me that there are still companies producing them - End of an era as typewriting tests phased out in India.

Home again, home again, jiggety-jog. Asian markets are green this morning, following on from where the US markets finished off on Friday evening. There was economic data out of China this morning that was worse than expected but still very healthy growth numbers. Earnings season starts in South Africa this week, noticeable companies reporting this week are BHP Billiton, Standard Bank, Curro and Anchor. The Rand seems to have settled in a new range around the $/R13.40's.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment