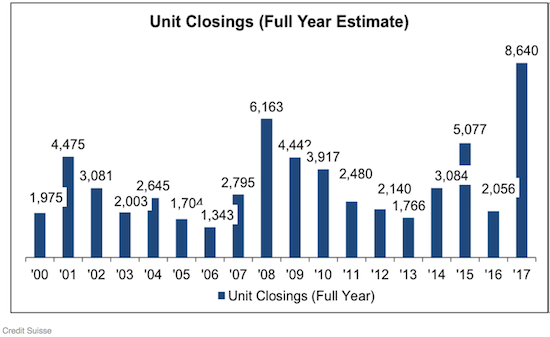

To market to market to buy a fat pig. The US market was up down yesterday, the Dow was up 0.02% but the Nasdaq and S&P 500 were both slightly down, 0.11% and 0.05% respectively. I would say such small moves can be classified as a flat market? Amazon has claimed another scalp, Dicks Sporting Goods was down 23% yesterday after reporting lower than expected second quarter numbers due to customers shifting more and more to online shopping. As it stands, just over half way through 2017, the only year recently with higher US retail store closures is 2008. By the end of 2017, the number of retail store closures is estimated to be higher than that in 2008 and 4 times what it was last year (The tsunami of store closures is doubling in size).

The increasing shift to online retail is the reason that Nike has teamed up with Amazon (Nike-Amazon deal may hurt sporting goods retailers). Sure Nike has their own online presence but they are a shoe company first, not a distributor. Buying directly from Nike online normally involves a shipping charge and a couple day waiting period. Buy shoes online as an Amazon Prime member means that in some cities you could have your running shoes in time for this evenings run. Amazon has worked very hard to be the first site consumers go to if they want to buy anything online, so you want your brand sitting on their platform.

The US Census Bureau estimates that only 8.5% of all retail sales are online, US E-Commerce Sales as Percent of Retail Sales. I have seen other estimates with a slightly higher percentage, in the low teens. The exact number is not the issue though, how will the retail space look when e-tail accounts for 50% of sales? How many traditional retailers will still be standing and how many property companies will be hard hit?

On the local front, e-tail is still a very small segment but they are busy weathering the recession storm. (I wonder if being in a recession means that politicians shrink their cavalcade's?) Talking to business owners across the retail spectrum, it is ugly out there. Store closures are imminent, increasing unemployment which puts further strain on retail sales and the cycle to some degree keeps repeating. South Africa is in desperate need of confidence and economic growth.

Locally the All Share was down 0.87%, with very few green spots on my heat map. Looking at the list of stocks at 12-month highs, there are none today. The market wasn't too impressed with 22% increase in HEPS for Curro, the stock was down 5% at closing.

Linkfest, lap it up

One thing, from Paul

Don't even think about becoming a full time day trader. You will (in all likelihood) lose everything. Read this guy's sad story - The Career Risk Traders Are Unaware Of

There is a lot of hype about possible job losses due to artificial intelligence and robots. In my view, that's all very premature. Have you seen how incompetent most robots are at doing anything other than routine and predictable tasks? Maybe people have been watching too many movies? Anyway, here is a short, funny clip, showing a robot with some state of the art skills. Don't give up your day job people!

Meet the JobTaker. pic.twitter.com/XmMdB2RXiI

— Roscoe (@dataduce) August 14, 2017

Byron's Beats

Clients often ask us what is going on at Amgen. These biotech stocks can be very complicated and sometimes difficult to understand. We chose Amgen because they have a big, exciting pipeline and are not overly reliant on one product. This article titled Where Amgen Stands after 2Q17 has an depth look at Amgen's impressive pipeline. It is long and complicated. Many of you won't read it. If you don't, be sure that we have.

Michael's Musings

In a capitalistic system it is good to see businesses talking with their spending. At the end of the day money talks louder than anything else - FNB CEO says he will not fly with SAA.

Probably more impressive was the move from Sygnia - Sygnia fires KPMG, as its CEO takes a stand against private sector involvement in corruption. How long until other South African businesses start taking a stand?

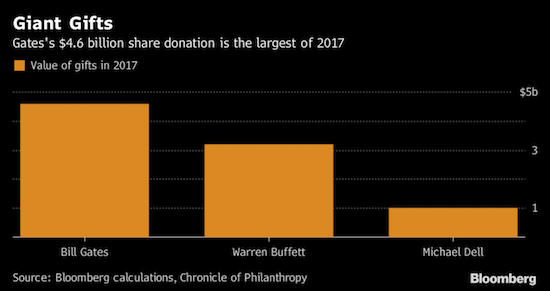

It is great to see these titans of industry using their wealth to better the planet - Gates Makes Largest Donation Since 2000 With $4.6 Billion Pledge

It is amazing to see the behaviour/psychological traps that we fall into when making decisions especially when money is involved - Your Brain on $.

"The brain activity of a person making $ on their investments is indistinguishable from a person high on cocaine. Financial losses are processed in the same area of the brain that responds to mortal danger"

Bright's Banter

How much trust do you have on your "Made in China" tags on your favourite item of clothing? Spoiler alert, your clothes might have been made in North Korea! - Are Your Clothes Really Made in China?

Those are cool socks you got there buddy. We only mention it because the latest fad on social media is dishing out anonymous messages of kindness. The Sarahah app, which means "honesty" in Arabic has over 20 million users within a few weeks of launching and is now the top free app on Apple's app store. Give it a go and give us some feedback please - Honesty App, A Self-Esteem Machine

What was Netflix's reply to Disney after Disney announced they will have their own streaming services by 2019? Poach their best superstar TV producer Shonda Rhimes. Rhimes in her 15 year career at ABC Studios (a subsidiary of Disney) has produced hits like Grey's Anatomy, Scandal (known as "The Fixer" here in RSA), and How to Get Away With Murder of which generated over $2 billion in Revenues - Shonda Rhimes Likes To Netflix And Chill

Home again, home again, jiggety-jog. Tencent numbers out later today, there are high expectations so expect to see share price movement in Naspers and Tencent. Then there are US crude inventory stats this evening which will set the tone for oil prices over the next week. Famous Brands are down 8% this morning on a disappointing trading update, their newly acquired UK operations are taking strain.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment