To market to market to buy a fat pig. Yesterday was a wild ride on the market, keeping things interesting for market participants. We started the day off with weaker than expected numbers out of Woolies resulting in their stock price being down over 5% and okay numbers from Bidcorp, with their shares being slightly up. As we were getting to the bottom of all that was said from Woolies and Bidcorp, news broke that Steinhoff was being investigated further for tax evasion, German media reports of 'balance sheet forgery'. Shares promptly dropped around 8% and then slid further to be down over 14% at one stage.

Even though Steinhoff was getting crushed and Woolies was down, the All Share broke new ground to record highs and the Top 40 index reached 50 000 points for the first time, JSE on record-breaking run as indices reach new highs. By mid-afternoon, Woolies and Bidcorp had switched places, with Bidcorp now down 5% and Woolies ever so slightly in the green. What? Then shortly before the market closed Steinhoff released a SENS addressing the news, Response To Press Statement Published By Manager Magazin, which helped to push the share price higher but they still closed down 9.8% for the day. Woolies closed down 2.5% and Bidcorp closed down 2.2%.

Based on the Steinhoff SENS it seems that most of the allegations are from a disgruntled ex JV partner. I have little doubt that Steinhoff pushes the limits of tax laws (like most large multinational's) but they hire top lawyers and accountants to make sure they stay on the correct side of the law. As we saw from Apple's tax fine, where the line can be very blurry and subjective, you have Apple and the Irish government with one opinion and the EU with another. For Steinhoff, the tax evasion allegations date back to 2015 and since then, Steinhoff hired an outside firm to do their own investigation, which would have cost a pretty penny. The external investigators determined that there was no wrong doing from Steinhoff. I expect the Steinhoff share price to have a significant rebound today, let's see what happens at 9:00.

For the second day in a row, US markets are down when our markets were up. Here is the scorecard, the Dow and Nasdaq were both down 0.11% and the S&P 500 was down 0.21%. The dreaded debt ceiling is creeping back into the minds of traders. Trump says negotiations are a mess and law makers say they are on track to pass a bill increasing the debt ceiling before the end of September deadline. What a time to be alive though, where the presidential mouth piece to the world is Twitter. You get to know what Trump is thinking, when he thinks it.

Company corner

Byron's Beats

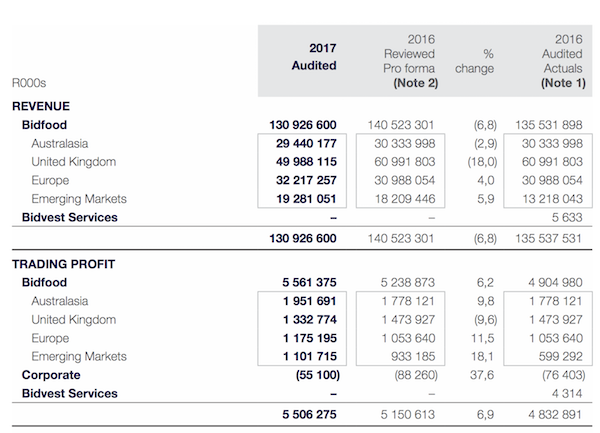

Yesterday we had solid full year results from Bidcorp. These are the first full year numbers since the Bidvest split. This business is well diversified geographically, operating in over 30 countries. Ironically Rand strength had a big negative impact on the numbers. Headline earnings per share grew 9.4% to 1181c. On a constant currency basis, this would have been a 19.1% uptick. That is encouraging considering the developed markets they operate in such as Australia, the UK and big parts of Europe. For a good idea of the segmental analysis you can look at the image below. Remember there are still a few irregularities there from the Bidvest split.

As you can see, the UK is their biggest revenue driver although Australia is more profitable. I guess that is why CEO Bernie Berson is based in Aus. South Africa has been included in the emerging market segment. On the TV yesterday Bernie mentioned that growth in South Africa was a cracking 24%. A very different contrast to the Famous Brands numbers. Maybe it is the more high end, sit down dining that is doing well?

The other day we put a link in the message on the trends millennials were following. One of those was ordering in and eating at home. This trend suits Bidcorp because instead of buying from a grocery store, they are using Uber Eats or Delivery Hero to buy meals from restaurants. Essentially they become Bidcorp clients.

The share trades at 25 times earnings which is by no means cheap. Sysco, a $27bn market cap competitor in the US trades on the same multiple. These guys have shown interest in Bidcorp before, I wouldn't be surprised to see more interest in the future. The company has R1.2bn in debt, next to nothing compared to their R100bn market cap and R5.5bn trading profit. I mention this because there is still huge room for consolidation in the industry. During the year the group concluded small acquisitions in Spain, Australia, Brazil, Belgium, Italy and the UK totalling R1.7bn. Expect a lot more of that this year.

To conclude, we are pleased with these results. Considering the geographic spread, low gearing and room for acquisitions we are happy to carry on adding at these levels. This is a must have in every local portfolio.

Linkfest, lap it up

Michael's Musings

If you were wondering what Whole Foods under Amazon will look like, here is an idea - Whole Foods is about to get cheaper for everyone starting Monday. Also, a number of Whole Foods's products will be available on Amazon. Scary stuff if you are a retail competitor.

Even though Uber is privately owned, there are a number of funds who own them so their numbers become available to the public - Uber's sales more than doubled to $1.75 billion in the second quarter, despite all its drama. Amazing to see the number of trips taken up 150% and probably more mind boggling is their cash burn of $645 million for the quarter.

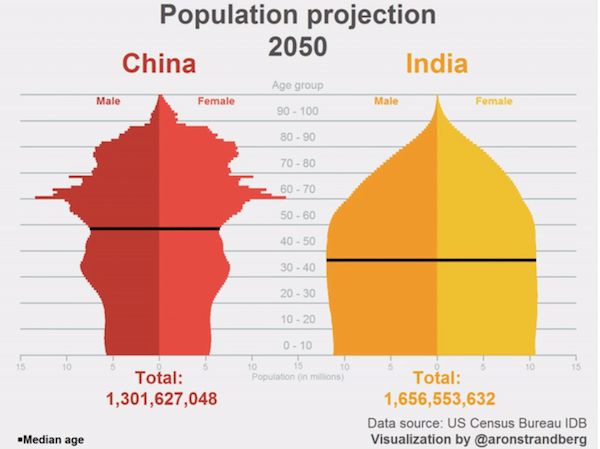

In the next decade India is forecast to overtake China as the most populous country - Animation: Comparing China vs. India Population Pyramids.

Bright's Banter

American foodies finally have an appetite for brains, yes like zombies they're eating animal brains. Famed Italian chef Mario Batali is being credited with launching the organ meat movement (Lies Mzansi did it before him), and its flourished in major food cities from Los Angeles to New York - Americans Are Eating More Brains As Offal Goes Mainstream .

I've been eating chicken brain, pigs head, chicken gizzards, like forever!!!! Welcome to the dark side America, I mean welcome to some of Mzansi's best delicacies.

Home again, home again, jiggety-jog. Asian markets are mostly in the green, locally there are currently more green stocks than red. Woolies down another 2.3% and Steinhoff is flat. The global, market moving news for today is what comes out of Jackson Hole with speeches from Janet Yellen and Mario Draghi.

Sent to you by Team Vestact.

Follow Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment