To market, to market to buy a fat pig. Taper tower trip and topple, Fed member indicates taper on the table from December. That is my nursery rhyme for the day. The tapering comments come from Fed (rock star) president of the St Louis district, James Bullard in an interview with Bloomberg. Bullard is not afraid of a little media time, and he is remarkably good at it. Watch that man, I think that he will in some time take the top job, I guess if he wants it of course. I am sure that he is driven, apparently he enjoys tennis and bicycling. And he would buck the trend, because that would mean that he would be taller than the last Fed governor, have you seen this funny image from the StreetInsider Fed Chairman Shrinks as Balance Sheet Grows:

Volker was huge, Yellen is tiny! OK, but Michael wants to write about QE tomorrow, so we shall not spoil a good piece. Oh, and Janet Yellen looks likely to win the number of senate seats for the nomination, as many as five Republicans have indicated that they would be voting for her, so expect this graphic to be official I guess. And inflation in the US (excluding the drawdown in 2008/2009) is at a fifty year low. So much for all this easy money causing runaway inflation. Gold prices were lower and that reflected in gold companies. Markets over the seas and far away fell after the comments, after having traded higher at the beginning of the session.

Aspen announced that the GSK sale had happened yesterday, I am more interested in who the buyer was. The announcement was pretty brief, the important line being: " .. its beneficial interests in Aspen Holdings now amounts to 12.4% of the total number of shares in issue." There you go, portion sold, they have taken all of their money off the table and now are still a significant shareholder. An old friend of the newsletter (he is not old, the newsletter is getting there) had this contribution:

"It is noteworthy how Big Pharma is selling assets. First Pfizer with Zoetis, Merck looking to unbundle/sell its animal health division and now GlaxoSmithKline selling down one third of its Aspen stake with probably more to follow. One can hypothesize any number of reasons, but GSK is probably the most puzzling. One would have thought that they would rather try & take Aspen out to give them unrivalled access to Aspen's extensive distribution business, rather like Kraft Foods (now Mondelez) buying Cadbury's more for its worldwide distribution facilities rather than its brands. Could Big Pharma be after funds as each strives to discover and deliver a blockbuster cancer drug that they can then sell at $100,000 per treatment course per patient, as is now beginning to happen? With aging demographics and an accelerating incidence of cancer, it might explain these moves."

According to the last annual report, page 102, that was published in October, Glaxo at 12.2 percent (now) will just be a whisker over the holding of Stephen Saad, who has 12.1 percent of the shares in issue. 55 132 421 shares to be exact, multiply that by the closing price last evening, 257.00 ZAR, and you get to 14.169 billion ZAR. 1.39 billion US Dollars. If Stephen Saad's holding in Aspen was a single listed company, it would slot into 81st place on the companies by market capitalisation, in-between Telkom and Omnia. Makes you think.

And the biggest shareholder of Aspen, that changes now to the GEPF, the government employees pension fund, who own 12.7 percent of the business. And in fact, remember that the PIC (who manage assets worth 1.4 trillion Rand) own listed assets of approximately 13 percent of the whole JSE. That is because 45 percent of their (the PIC's) assets are equity assets. Aspen up a touch today after having been thrashed nearly 4 percent yesterday. Not all bad, different shareholders, I am as keen .

OK, then there was Woolies out with a trading update yesterday, for the first 20 weeks of the 2014 financial year. Mr. Market must have liked it, the stock went up 3.8 percent. Wow, that is a serious move higher. Clothing sales locally grew 11 percent, retail space expanded 4.6 percent. Food sales grew a whopping 16.7 percent, general merchandise grew by 5.5 percent. Their financial services book grew by 15.4 percent year over year, whilst the impairment rate increased to 5 percent, from 3 percent this time last year. All folks under a little pressure seemingly.

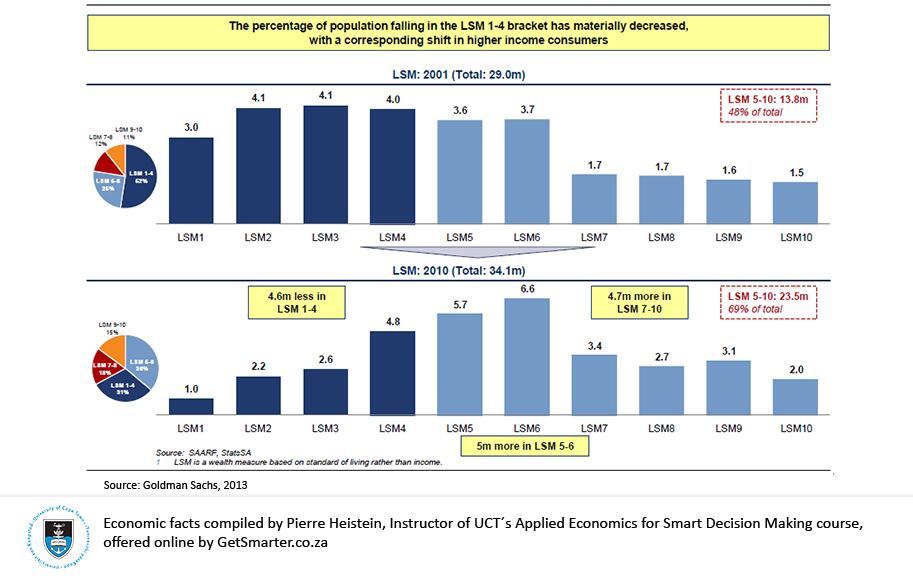

I think that the part that many got excited with was the Australian and New Zealand businesses, good progress there. All in all, a quality company that got their clothing mojo (higher margins in that business) back from their competitors. Selling to LSM groupings that are less prone to an economic downturn, plus also remember that there are more potential customers, the growth in the higher LSM groupings according to some Goldman Sachs research has been pretty eye popping over ten odd years. Paul re-tweeted this image, here it is:

Progress is too slow for everybody else unfortunately, we need more people on the right of this picture and nobody on the left on order to have a much more equal soceity. We are getting there, it is just taking longer, but in the end this shift is going to be very good for retailers as a whole. Woolies half year numbers are anticipated the day before Valentines day next year.

Michael's musings. The Tiger within your Brands.

Tiger Brands released their results yesterday, with the Key financial indicators according to the SENS are:

Key financial indicators

INCLUDING DFM

Group turnover R27,0 bn Up 19,1%

Operating profit# R3,1 bn Down 11,6%

Headline earnings per share 1 624 cents Down 3,8%

EXCLUDING DFM

Group turnover R24,7 bn Up 8,8%

Operating profit# R3,5 bn Flat on previous year

Headline earnings per share 1 781 cents Up 5,4%

#Before abnormal items

DFM stands for Dangote Flour Mills, which is a Nigerian company they purchased towards the end of last year. DFM accounts for 9.3% of Tiger Brands' revenue, and due to its poor performance has distorted the performance of the rest of the Tiger Brands' business, so as an investor relations officer, you want to put the company in the best possible light, hence the "excluding DFM" section.

I am not too worried about the DFM performance because Tiger Brands is in the process of streamlining the company by selling assets they don't need, removing duplications, and up-skilling staff. The SENS announcement says it best:"we expect that it will take two to three years to fully align the DFM operations to Tiger Brands standards and for the business to deliver acceptable returns. However, the group remains optimistic that this investment in one of the fastest growing economies in Sub-Saharan Africa, will meet expectations over the medium term" Once DFM is at Tiger Brands' standards, it will be in a good position to take advantage of the growth in Nigeria. Interesting side fact, Nigeria's GDP could be larger than South Africa's soon due to a change in the way that their GDP is calculated.

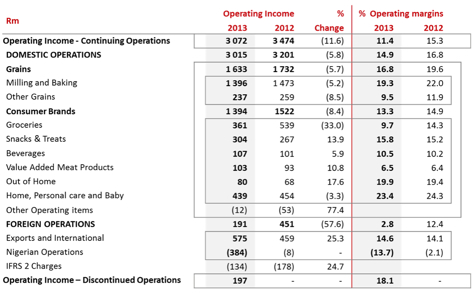

Below is a breakdown of the different divisions, and how they are faring from the previous year.

The stand out items are that Groceries EBIT is down 33%; sales for groceries was only down 1.7%, but margins decreased from 14.3% to 9.7%. The drop in margins is due to increased input costs that they didn't want to push through to the consumer, preferring instead to keep their market share. When the consumer (you and I) have more money to spend, we will see these margins increasing again.

The next standout item is the "Out of Home" division, which is the division that supplies their products to caterers. Sales were up 14.9% to R403 million; so the increase was off a small base.

Foreign operations excluding Nigeria had sales up by 21.7% to just short of R4 Billion, where 12.1% of the gain was attributed to the weaker Rand. The African map shows their operations, where you can add Chile to the list of manufacturing countries and then USA, Canada, Australia, New Zealand, Malaysia, Taiwan, Saudi Arabia, Portugal, Germany, UK and Sweden to the list of countries that they distribute to.

When evaluating a company, I always like to refresh myself on the brands that they own, and for me when I think I Tiger Brands, I always think of Jungle Oats, and Albany bread. Have a look at their brands page http://www.tigerbrands.co.za/brands.php, I'm sure that you will find at least one brand that you didn't know they owned, for me it was Peaceful Sleep and Spray ‘n Cook.

Their brands are well known and many being the brand leader in their respective industry, and the company has established African exposure where significant growth should be seen in the future. So Tiger Brands, ticks all the boxes for us; quality company (strong brands), in an essential sector (everyone needs to eat) and it has good growth potential.

Home again, home again, jiggety-jog. Markets are lower across the globe, that sell off late in the US means that we have to catch up here a little. Or catch down.

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment