To market, to market to buy a fat pig. Markets on Wall Street climbed off the worst of the day and managed to finish marginally higher. Locally the weakening Rand has been a bit of a problem for the inflationary outlook. So whilst the oil price has been trending lower and the petrol price locally is set to fall by 28 cents midnight tomorrow I think, the weaker currency means that perhaps this is short lived. Frack baby frack to paraphrase Sarah Palin. Palin could have been a single heartbeat away from the presidency. That could have happened. But I guess Bushisms and Palinisms went hand in hand, it could have been more of the same. Back to local, where we managed to add around one quarter of a percent on the local markets, a closing high for the year.

In Rand terms, the currency which we spend and invest each and every day, the market is up 21 and one quarter of a percent over the last 12 months. The Rand has weakened by nearly 14 percent to the USD over the last year, so in greenbacks we are not as rich as we could be. And let us face it, when there is Kleptocracy, the funds are squirrelled away in Dollars/Euros/Swiss Francs and not Indonesian Rupiah's, Philippine Pesos or Congolese Francs. Suharto, Marcos and Sese Seko are used as examples here. I wonder where all those stolen public funds are? Paul told me when I asked that the Libyans are desperately trying to get the money back that Gaddafi stole. That is another piece entirely, and the only upside to corruption locally is that it is all spent within the borders of South Africa, not externalised into a foreign national bank account. I think it is sickening to spend money that belongs to the people on unnecessary luxuries, but again, that is another argument for another day, stay clear of politics young man!!

L'Oreal released their results last week. Interesting business, essentially in the control of the daughter of the founder, and because we live much longer nowadays than before, she basically was there with her dad at the beginning. Liliane Bettencourt, the only child of the founder of L'Oreal, Eugene Schueller, has just celebrated her 91st birthday. According to her Wikipedia entry she started working for her dad when she was 15. The business only went public in 1963 after her father had died (1957) and had passed on the family fortune. So how long did she work for? Well, effectively until the day before Valentines day last year, that is when she officially resigned as a director of the business. 74 years long at the business founded as Aureale (a hair dye product) and then in 1919 he (Eugene Schueller) registered Société Française de Teintures Inoffensives pour Cheveux (Safe Hair Dye Company of France). Phew, L'Oreal does roll off the tongue a little easier than that longer name.

Like most companies, there is a fair amount of controversy surrounding the founder, Eugene Schueller. He provided funding for a fascist French movement that then collaborated with the Nazis during World War Two in Vichy France. Anti communist he was too, that sounds more like an entrepreneur. Ironically Schueller's granddaughter (Bettencourt's only daughter, Françoise Bettencourt Meyers) married Jean-Pierre Meyers, who's grandfather, a rabbi by the name of Robert Meyers was murdered at Auschwitz by the Nazis. Astonishing history.

Now if you think the family you live in is pulling in different directions, the granddaughter, Françoise has sued François-Marie Banier in 2008 (whilst her mom was still a board member) for taking money from here mum and wanted to declare her mum mentally unstable. Wow. She is currently under the care of her family. The son in law, Jean-Pierre Meyers is the vice chairman and if you wondered who was next in line (and naturally from the family's point of view the best person for the job), the founders great grandson, Jean-Victor Meyers is also on the board!!! But, fear not, they are not operational, rather non executive members of the board to keep an eye on the family wealth. Three of them? Well, yes. Nestle have the same number of board members, more on that in a second.

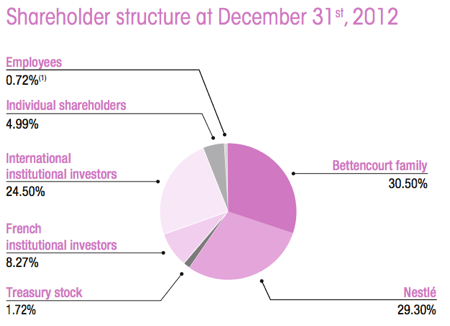

Why does the family matter at all? Because Liliane Bettencourt (the family) are the major shareholder here, as per this graphic from their annual report last year.

And Nestle? Well, for now the agreement between the two exists whereby they vote and agree together. And as such control the company. So how did Nestle get that big stake? And how did L'Oreal get a 9 odd percent stake in Sanofi-Aventis? A very valuable stake at that, around 9 billion Euros, around 12 and a half billion Dollars. Nestle and Bettencourt signed an agreement nearly 40 years ago in which they gave each other the option to buy their respective stakes as at a date, and that date is 29 April 2014. Nestle cannot increase their stake in L'Oreal for six months after Bettencourt dies, I am guessing that when the document was signed all those years ago that everyone thought they would not be around to see this. But from 29 April 2014, Nestle is able to sell this stake to whomever they want.

And if the signals from Nestle are anything to go by, they are sellers of their stake and not buyers of the Bettencourt stake. And L'Oreal the company have signalled that they would use internal reserves to buy this back, including the Sanofi-Aventis sale. The Sanofi stake according to the CEO, Jean-Paul Agon is "financial" and not strategic. So therefore it is for sale. Plus the company has around 1.6 billion Euros of cash. But they would definitely have to borrow a whole lot in order to do this. Perhaps Nestle could unbundle the stake to their shareholders? Likely? No, they would prefer to use the funds I am guessing for other projects.

Nestle got their stake in L'Oreal when Bettencourt was worried that the socialist French government would nationalise her business and as such swapped half of the families fortune for a Nestle stake. Wow. so there is the history of THAT. And why this is important to minority shareholders is that there is a big event coming next year, in order for the company to buy the Nestle stake, at last evenings price they would have to pay at least 22.26 billion Euros. A lot of money. So stay tuned for this very important event.

What the company has on their side are some powerful brands, Lancôme, Vichy, Garnier and The Body Shop augment their L'Oreal brand beautifully. I just had to throw that part in. The CEO reckons that they could double their potential customer base in the next half a decade. Cosmetics are soft luxuries, not as expensive as jewellery but just as necessary for emerging middle income people to announce that they have arrived. The cosmetics business is a very fast growing in emerging markets, and according to this paper, GLOBAL BEAUTY INDUSTRY TRENDS IN THE 21st CENTURY: In 2011 all those countries generated 81% of the global cosmetics sales growth, according to Euromonitor International's data, more than half of which (54%) was attributed to BRIC. Further emerging markets, among others Mexico, Argentina, Indonesia, Thailand and Turkey, have shown incremental growth of about 8 billion dollars

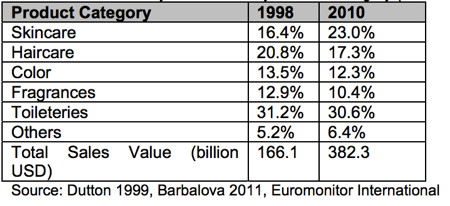

Inside of the beauty products global sales have grown strongly in the skincare category. A little table snapshot from the same paper shows you how the trends have changed pretty quickly over the last 15 years:

It makes sense that rapid industrialisation leads to wealthier middle income families that have disposable income in order to fund their lifestyle choices, beauty products included. Skincare will continue to grow faster than the other segments, meshing together science and smart marketing. In China for instance, according to research paper above: it is believed that a pale and youthful-looking skin determines the social and economic position of a person. Richer people look younger because they spend more time out of the sun, and less time doing physical labour!!!

Results, well they were a little disappointing, well at least the market was disappointed. The US specifically from a sales point of view fell short of expectations, inventories were wound down by some of their distributors as well as a slowdown in the market. Japan was strong, South Korea was NOT, China, India and South East Asia continued to make major progress, the area as a whole posted an 8 percent increase in like-for-like sales. Latin America, Eastern Europe and Africa/Middle East all grew at stronger rates than that. Western Europe, which is still their core market, 5.68 billion Euros of the 16.099 billion Euros in cosmetics sales (for the 9 months to end September), grew at an encouraging 2 percent for the year. Not great, but still going forward. We continue to accumulate what is a fast growing segment of the consumer market in developing markets, and continues to be a robust and fairly recession proof business in what are recovering developed markets. Buy.

The Steven Cohen (SAC Capital Advisors) settlement with the SEC leaves a bad taste in my mouth, many s's there! I could not care a hoot if the guy was brilliant at what he did, nor if he is worth 9 billion Dollars (7.2 after the settlement) and now this is a massive blow for his reputation. He likes winning, we all do, even Charlie Sheen when he is full of Tiger blood. SAC, the firm which Steven Cohen has presided over for twenty years, has pleaded guilty to securities fraud and will pay a whopping 1.8 billion Dollar fine. But they will stop managing money. So Steven Cohen has effectively ended his career here, that is what I think, he can still trade as himself I think. Confidential information was obtained by employees of SAC in order to trade profitably for the firm, enriching themselves and Cohen along the way. History (for now) will show that Cohen's outlandish returns (after some outlandish fees - 3 percent of assets and as much as 50 percent of the upside) were tainted with insider trades and knowledge that the market did not have.

According to a Bloomberg article (Cohen's Dream of Soros Status Dies as SAC Pleads Guilty), 87 people have been charged in the network and 75 convicted. But not Cohen. It feels weird, the guy has little or no ego to speak of, but he wanted to crush everyone. He does not wear the fancies and keeps to himself. So it is about winning, you just need to be inside of the borders of the rules.

Home again, home again, jiggety-jog. Markets are bring driven here locally by a strong PMI number out of China, following some decent ones from Europe yesterday. Blackberry is semi kaput, but you knew that already, i think.

Sasha Naryshkine

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment