To market, to market to buy a fat pig. It was a little like an exercise video, up and down with the cheesy music in the background. At least there was no wearing of the pink luminous tights or weird vests and bad shoes/sneakers. That is out, and do not even mention the huge fizzy hair or the mullet hairstyle, that is bad news and is best left in the late eighties and the early nineties. It is a lesson, have a timeless hairstyle, ok? Markets over the seas and far away on Wall Street reached new highs, the Dow crested 16 thousand points for the first time, the S&P managed to break 1800 for the very first time, whilst the nerds of NASDAQ could not quite get to that 4000 level. Anyhow, other than having a *nice* ring to it, what is in a level? The level is set by the collective company prices that investors afford, by way of valuing the businesses relative to their outlook.

An index is not a magic number but rather the collective market value of companies and what investors are willing to pay for it, that is what sets the levels. A level of the index should not determine whether you buy or sell stocks, but rather the quality and prospects of the underlying company should determine whether or not you buy. The company, not the index. Nor should the state of the economy determine whether or not you buy stocks, this was one of the single biggest mistakes made over the last half a decade, I think!

I suppose if you live in the Western world and "things" have become "tough" or much harder than before, then I suspect your life and circumstance view translates through to markets. You think? This was quite cool, I saw a graph published by Barry Ritholtz on Bloomberg (he has arrived!) from this article: Economy Is Not Quite Bubblicious Yet: Ritholtz Chart. It is actually a Blackrock graph from this article, Are We In Global Bubble Territory? Not Yet.

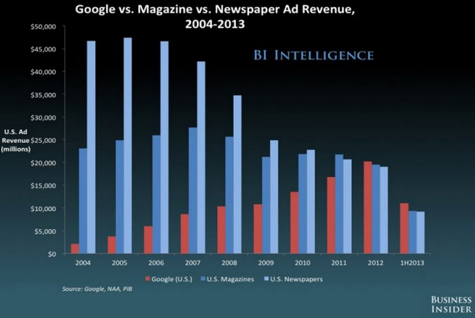

Interesting. And anyhow, I prefer like I said above in the first place to focus on companies, their earnings and whether their products/services are what consumers and businesses want. Some products are timeless, building materials, transport methods (horse buggy then, Airbus A380 or Dreamliner now), food, clothing and of course the list goes on. More recently healthcare has become a massive industry, the FT had an article this morning suggesting that global pharma sales could clock 1 trillion Dollars next year, driven by emerging markets: Global spending on drugs to exceed $1tn. Wow. And newspaper advertising? Just a week ago from the daily BusinessInsider chart of the day: Google Is Now Bigger Than Both The Magazine And Newspaper Industries. The red line is Google, and the last numbers is for the first half of the year.

The simple conclusion is that you must buy the best companies and not just blanket it with the same thoughts as the index. There are technologies that are going to be adapted to tweak the way we do many "things" (remember the Cisco internet of everything) and new disruptive technologies. Driverless cars, I think that is pretty disruptive, imagine being able to take a snooze, read a book, or simply catch up with tasks. Markets failed to keep ahold of those levels, Carl Ichan said something along the lines that he was worried that cheap borrowed money (by companies) was sprucing up returns. And then another Carl Ichan story where he was pushing Apple to borrow more money (in their domestic market) to buy back more shares. I see. Thanks Carl. Which one is it Carl (Fellow's voice scolding Eugene from the Nedbank adverts), which one is it?

Locally we had a slew of results, Telkom had results, revenue flat, minutes spoken on fixed lines going backwards, fewer employees, slight increase on ADSL subscribers, but with fixed line penetration (those Telkom lines into businesses and houses) at 7.2 percent and that hardly shifting, how are people going to change their minds on consuming the internet? Where are the majority of South Africans likely to access the internet? On a fixed line at their home, or on their handsets? Handsets is the answer, and if you needed reminding, Telkom sold the crown jewels. Lastly, on the Telkom issue, beware the company that reports recurring once offs, that is not what I said, that is what Benjamin Graham said. In fact this is what he said in the Intelligent Investor (I urge you to read it when you get the time):

If "nonrecurring" charges keep recurring, "extraordinary" items crop up so often that they seem ordinary, acronyms like EBITDA take priority over net income, or "pro forma" earnings are used to cloak actual losses, you may be looking at a firm that has not yet learned how to put its shareholders' long-term interests first.

That applies to all businesses, but the massive write downs on some weird (and that is being kind) transactions at some stages and poor execution. And the fact that the main shareholder cropped up in the SENS announcement, how do you read this:

Defining our role clearly as a listed national incumbent will allow us to address the dichotomy in shareholder expectations. Through its people, technology and infrastructure, Telkom has the unique opportunity to meet the needs of all its stakeholders: our shareholders, customers, employees and the broader society in which we operate.

The shareholders expectations should be clear. Make us money. The customer will decide whether there is value for money with the product offering. Telkom has so much to offer the country, let us hope that their long term strategy enables individuals and businesses to access broadband and unlock potential. We certainly need it, confidence is at a two decade low, or so says the FNB/BER survey. Are things that bad?

Michael's musings. Money that you can't see

The value of a Bitcoin has soared recently, and even more so since yesterday when the US Department of Justice said that it was a legal means of exchange. What is a "Bitcoin", how does it work and is it an investment option?

Bitcoin is a virtual currency, which you can use for online purchases. The reason for using it is because there are less transaction costs compared to using conventional methods, and all transactions are anonymous. Being anonymous when doing your purchases is great for buying illegal/ frowned upon items, which is one worry of the authorities.

The process for buying something is you use an e-wallet that stores your Bitcoin's, which then you transfer your Bitcoin to the person who you are buying something from. The transaction is then processed by a whole host of very powerful computers on an open network.

The open network means that anyone can add their computer to the network, and if you add your computer to the network, you get paid in Bitcoins for adding to the processing power of the network. Due to having many computers processing the transaction, it means that government officials will struggle to trace/ track any transactions because the transaction doesn't go through a central computer (one computer is easier to hack).

The price of a Bitcoin also fluctuates with supply and demand, where the supply of Bitcoins is limited to there being 25 new coins created every 10 minutes, the 25 coins are paid to the computers doing the processing; at the moment there are about 12 million Bitcoins in circulation. As the demand for Bitcoins increases, so do their value. The price of a Bitcoin in October was around $200 and yesterday the price was around the $800 mark.

Would you want to invest in something that has a very limited supply, is in demand and is part of the technology revolution taking place? In this case, no. The first reason is that you can lose your investment if there is a computer error, or if your personal computer is hacked (conventional money has insurance and backups to prevent that from happening).

The second reason is due to the extreme value fluctuations; investments shouldn't be that volatile in value. My third reason is just a theory of mine; I think that due to the rapid rise in the price, people who currently have coins won't use theirs and new people who want to ‘invest' by buying and holding a Bitcoin will soak up the extra coins created every day. The value of a Bitcoin lies in that people can buy things with it, but if no one is buying then the system fails and the coins that you hold become worthless.

Becoming worthless is an extreme scenario, but the system only works if the coins are used and not hoarded, and if the system doesn't work, less people will accept them as payment, resulting in them being worth less. There are many other places to put your money, Bitcoin isn't one where I would put mine.

Home again, home again, jiggety-jog. Markets have sold off, there was an OECD downgrade of global growth not so long ago, perhaps they can upgrade it in 6 months time. Or not. German Zew economic sentiment numbers were mixed. Always pay attention!

Sasha Naryshkine and Michael Treherne

Follow Sasha on Twitter

011 022 5440

No comments:

Post a Comment