"Apple is part consumer, part a manufacturer of fine products, part healthcare in the future, part utility. Music, media and the way we consume could turn those more into utilities (like electricity and water). Amazon and Alibaba, are they tech stocks or simply new age retailers?"

To market to market to buy a fat pig I got a message on my phone saying that the oil market was now a bear one. Meaning that from the recent highs, the oil price, or at least NYMEX had fallen by more than twenty percent. And then I had to shake my head at the most ridiculous levels and patterns that humans assimilate with, in order to give them meaning and direction. The truth is that there is not a single human being who can tell you what is going to happen tomorrow, let alone next week or month. The longer it goes, the more likely they are to be wrong when making these predictions.

Prices today are set as a result of the supply and demand fundamentals and the outlook in the foreseeable future, be that the next 18 months or so. The participants (machines too, coded by people) who trade the stock, the bond, the derivative or future or the commodity all take their different views right now. Some may have owned the stock for two minutes, two days, two weeks or two decades, yet may call it quits today, all at the same time. Everyone has their own time horizon and everyone would like to think that they are right. And what I learn every single day is that seemingly every participant in capital markets has their own unique theory on how things are going to pan out. Facebook is this and that as far as earnings are concerned, heck, the valuations may be one thing, the business itself may be completely different by the turn of the next decade.

Ultimately all participants in capital markets have exactly the same goal, not to lose any of their starting capital and to make more money than the last person, so that they can enjoy the spoils. I was talking to my dad the other day about hunters and gatherers in society, the deal makers and the risk takers can be the hunters. The high profile of the mammoth slayers captures the headlines in modern society. CEO x or y or z makes so much, whoa! What you don't see are the late nights, the huge personal sacrifices. The gatherers are more cautious, less leveraged and beaver away, not always winning. There is a lot to be said for both styles, equally investing can be measured against these two styles. In the end, it is all about balance. Not losing any of your starting capital and beating inflation plus your goal consistently.

Technical terms mean little, they take history and tell you what happened. There isn't even a level of recall. Technical analysis sticks lines on a graph and draws other lines. Pattern recognition is great for knowing that you must not eat those berries, they are poisonous, or don't stand directly in front of a charging wooly mammoth (you will lose), it tells you nothing about tomorrow or next week. If you are using a historical graph to tell you what is going to happen next, you might as well go to the mom and pop soothsayer or card reader down the road. They don't know either. Again, there is nothing that I can do about it, people will always look to those that have knowledge. Those who are negative always grab the headlines. I remember someone once said, those that "predicted" the financial crisis were not very good at predicting the subsequent recovery, now were they?

All I can say is that oil prices might have had this very close correlation to market moves around half a year ago, the 20 percent plus fall in oil prices has coincided with stronger equity markets. Normally the comments at the bottom of any news piece are very low on impartiality and very high on the bigot scale. There is one at the bottom of the WSJ article titled U.S. Oil Prices Enter Bear Market that nails it in that style:

"Lets' see... Low oil prices are good for consumers, particularly poor people. Bad for communist dictatorships, socialist dictatorships and devil worshiping barbarian dictatorships. Whoopee!"

Ha ha, thanks for that Harlin Smith. It does reveal the biases that Harlin has, it was definitely worth the share.

Market temperature time. Stocks across the seas and far away in New York, New York ended mixed again, another losing session for the Dow Jones Industrial Average, both the S&P and Blue Chips were off a smidgen. The nerds of NASDAQ continued to climb higher, Alphabet, Apple, Amazon and even Alibaba all contributed to tech stocks gaining on the day. Although, the lines drawn on what is a tech stock and what is not still escapes me. Search may need hardware and software, it is about information. Information has always existed, it is now just more accessible to humanity day in and day out than at any other point in history. And it will be better tomorrow.

Apple is part consumer, part a manufacturer of fine products, part healthcare in the future, part utility. Music, media and the way we consume could turn those more into utilities (like electricity and water). Amazon and Alibaba, are they tech stocks or simply new age retailers? Very different from one another, these two. Tech is too broad and index boxing requires a big re-think in my book. It is for those who like to call the macro outlook, and then decide which sectors are best. We prefer heading directly for businesses.

There was news related to Elon Musk and two businesses that he is very instrumental in. Two becomes one it seems - the WSJ reports Tesla and SolarCity Agree to $2.6 Billion Deal. I read some of the gumpf in the SEC filing yesterday - Merger Agreement. This is below the original price, that is why the Solarcity share price came under pressure. Tesla probably feels like they need to do this, lowball the offer for shareholders to accept. I get the sense that Solarcity shareholders will accept, regardless.

On the local front stocks rallied nearly two-thirds of a percent, off the highs for the day. The rally was pretty broad based, Nedbank delivered results that crushed it. Of course crushed it if you exclude their Nigerian business, across both retail and business banking, as well as Corporate and Investment banking it looked amazing. Well done to Mike Brown and team. He seems like a regular nice guy, I had the opportunity in passing him in-between interviews at CNBC Africa yesterday. Nedbank was up nearly 7 percent, Sanlam added over five percent, Bidcorp was up nearly 4 and a half percent. At the opposite end of the spectrum were companies like Brait and Mediclinic, Brexit after smells still linger.

This morning there is the announcement from AB InBev and SABMiller, they are looking to complete the transaction by October the tenth. It was actually released last evening - Expected timetable envisages completion of recommended combination. What needs to happen is that both sets of shareholders need to vote on the deal, first things first. That meeting for both sets of shareholders is taking place on the 28th of September. The expectations are for cash and the new combined entity to be available to the sellers (SABMiller) and new buyers of Beer-mega-corp on 10 and 11 October.

Linkfest, lap it up

As populations grow and as the urbanisation trend continues property becomes more scarce, meaning prices in major cities have sky rocketed. A bigger part of peoples living expenses is now going to rent - If they're lucky, British millennials will barely earn more than Generation X in their lifetimes. How long will it be until going into an office daily is a thing of the past? Meaning we don't all need to live close to CBD's

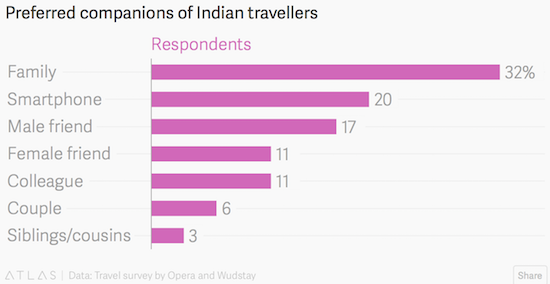

You haven't gone on holiday unless you can put pictures up on social media that you were on holiday - Indian travellers "like" internet access more than a bottle of wine or a hot shower.

Talking of tourism, being a space tourist will soon be something that is possible - Virgin Galactic gets FAA license to start flight-testing its spaceplane

Just wow. Nothing else one can say of this very long read about "The Brazillionaires" - Brazil's Billionaire Problem.

And then on other related matters, Brazil and otherwise, the Olympics are around the corner. There may be multiple concerns, the games will be a success, a roaring success methinks. The satire publication, The Onion has a light hearted look at a map of Rio - Guide to the Rio Olympics. My personal favourite: "125-foot-tall statue of Jesus Christ that can be viewed from every tourist's Facebook album."

Home again, home again, jiggety-jog. I saw some fellow write that he had been blogging for five years, his main reason to start was to clarify his own thoughts and enforce commitment, he says. I thought back to the reasons why I started this daily ritual and why we do it. The same thing, it does a few things, forces commitment to you, your colleagues and most importantly to your clients, without whom you never have a business. We will always remind ourselves that at the core of our business is the client and your ability to deliver long term returns with the correct service levels. It ain't easy, it is why it requires doing the same thing day in and day out.

Many youngsters have this idea that businesses are glamorous places to work. Whilst there can be the pomp and ceremony associated with many client facing businesses, ours aims to deliver superior long term returns with the best possible service levels. You have to do the hard stuff right, and repeat them. We have been at this blog for over 13 years now, since the middle of 2003. The journey continues day in and day out, we enjoy what we do and always appreciate the feedback from the community and our clients. Here is to the next 13 years!

Company news still owed to you. We will get to that, they are not going places (the companies are not moving). You should go places, you should vote tomorrow. Don't forget to do that. Ever.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment