"So, Naspers through their subsidiary own 3,151,201,900 shares of Tencent, we are presuming that Naspers haven't sold any shares. Tencent's share price is trading at 203.4 Hong Kong Dollars. The total amount that Naspers owns is 640.9 billion HKD. At the exchange rate of 1.71 Rand to Hong Kong Dollars (thanks Google), the stake in Tencent that Naspers owns falls just shy of 1.1 trillion Rand. The market cap of Naspers as of last evening was 935 billion Rand. Just saying."

To market to market to buy a fat pig Markets across the seas and far away, in New York, New York, turned it on in the second half of the day. More specifically, minutes from the July FOMC meeting were released to Mr. Market, 2pm East Coast time. Inflation expected to stay low, near-term economic risks have diminished. Labour market continues to strengthen. Tell us all something we don't know. As ever, the Fed watches the data and comes to the same conclusion that Mr. Market does, there is very little reason to raise rates immediately. Sit back on your armchairs please. There was one member, Esther L. George (the Americans love their second names) who wanted to raise rates. She is from Kansas, you know, where Dorothy is from. I bet she has a pair of red shoes and says there is no place like home.

The probabilities markets for rates going up indicate a 50 percent chance in December and that is about it for this year, around 20 percent for the two meetings prior to that, in September and November. Remembering that Federal Open Market Committee (the FOMC) meet every 45 days. Hey Janet (Yellen), how is Rufus, your new puppy, great thanks James (Bullard), I heard your kid made the baseball team, big up there. Anyhows, you know our view on this, we are company specific investors, the Fed are some of the smartest economic academic minds on the planet, they will do what they have to, when they need to. We don't spend all day and night worrying or trying to anticipate what it is that the Fed are likely to do. Even if we did, file that in the category of cannot change a darn thing. Even if Esther George wants to raise rates, the others are not likely to budge until later.

The reaction of the equities markets to this release was positive, the Dow Jones Industrial Average added 0.12 percent, the broader market S&P 500 closed the session nearly one-fifth of a percent better, led by Utilities and Non-cyclical consumer goods. Procter & Gamble, Coke, PepsiCo and Philip Morris, those types of stocks. Sodas, ciggies, batteries and nappies. I am not a fan of sodas and ciggies, I think that bottled water will become a huge part of their businesses, ciggies, not too sure when those businesses will become "full" and hit profitability and sales levels unlikely to be repeated. Let us face it, you used to be able to smoke in an airplane, a shopping mall, a restaurant, in fact any darn place you wanted. Nowadays, less of that, increasingly less in future is my guess. We may have reached peaked cigarette intake in the developed world.

Back home, where local was lekker, stocks finished the session mixed, the only notable stand out was Naspers, in amongst a sell off of financials and banks. Amplats had a bad day, down around five percent, Discovery equally incurred the wrath of the sellers, that stock was down 3.2 percent. We all know of their intentions to start a bank, that could happen sooner rather than later, stand by. There was slim picking amongst the advancers for the day, like we said, Naspers was at the top of that list, up 4.45 percent by the time the bell had rung. The reason was well received results from Tencent, check that below!

All eyes were turned to the EFF and DA (and others) media briefings on who they would work with and who they wouldn't. All sides seemed to agree on who they wouldn't work with, ironing out the dynamics will take another few days. It looks like the city that I call home will likely be splashed with Red and Blue rather than the tricolours of the ruling party. Politics, do not get involved in any of that. And religion. And family politics. And wrestling with pigs on twitter, you will get tied down and mostly very dirty, with nothing to show for it. Don't do it, OK. Don't feed the trolls.

Company corner

Tencent are very important to Naspers. Possibly more important to the share price than all the other parts put together. The South African company owns over one-third of a percent in the Chinese "internet" company. In the last annual report that is available to investors to read, MIH, a subsidiary of Naspers, owned 3,151,201,900 shares or 33.51 percent of Tencent. Ma Huateng or Pony Ma as he is better known, owns 855,446,400 shares, or 9.1 percent of the company through an entity called Advance Data Services Limited.

Tencent are really an entertainment and media company, providing online gaming through mobile and desktop, as well as messaging and retail experiences through the various platforms that they operate. The segregation for the purposes of reporting is Value Added Services (VAS), Online Advertising and "Others", which includes online retail. QQ, online gaming, partnering with content providers (including the NBA, HBO, Paramount, Warner and Sony Music, as well as making sure that they develop their own content). The one platform you will know the best of the lot will be WeChat, which has also introduced WeChat pay (and Weixin Pay with Weixin, the international version of WeChat). Except, in all likelihood, you are using WhatsApp.

You and I may not engage in playing Leagues of Legends, the most played online game in the world (account for a little less than one in four hours of games played), there are even people who watch online how other people play the game. True story. According to Gamoloco, the most hours of games watched last month via Twitch (owned by Amazon.com) is 77 million hours of League of Legends, 52.5 million hours of Counter-Strike was watched last month. Dota 2 was third at 32.3 million hours and HearthStone was fourth with 31.4 million hours. Counter-Strike has been gaining sharply on League of Legends.

The most watched sports game is in 14th place, NBA 2K16, with 5.265 million hours watched. There are 30 teams in the NBA. I selected the Chicago Bulls, there are 82 normal matches in a season for that team. A match is 48 minutes, the real time taken, including breaks etc. is around 2 to 2 and a half hours. That is roughly 205 hours of basketball by just the Chicago Bulls. If one multiplies the season by the number of teams, you get 6150 hours of watchable basketball. Now, obviously the 5.265 million hours are being watched by many people online, whilst they are doing "other things", the point I want to make is that you can watch ten matches a day online if you wanted, you would NOT know the result, seeing as you are also watching that live. Online gaming watching, there is a very different kind of entertainment, try and explain that to the oldest person in your family.

The numbers of users are staggering. What I find pretty impressive is that we have known that the Chinese have been on an extraordinary spending and building exercise that humanity has never seen before, much of that has slowed in recent years. So this business is in a phase of operating in a market where consumers are the next engine growth for the economy. Now the second biggest economy in the world, with the biggest population, China is certainly stepping forward as a world power.

Revenues for the 2nd quarter (See the release Tencent announces 2016 second quarter and interim results) were 35.691 billion Renminbi, or 5.382 billion US Dollars. Annual revenues in 2011 clocked a total of 28.496 billion Renminbi. The last quarter revenues were significantly higher than a whole year five years ago. For the half year, revenues were 67.686 billion Renminbi, or 10.207 billion Dollars. Revenues for the entire year of 2014 were 78.932 billion Renminbi. A half of 2016 compared to an entire year of 2014.

So I am guessing that you wouldn't be surprised to learn that quarterly revenues, relative to the last reported corresponding quarter in 2015, grew 52 percent, the first half revenues grew 48 percent when compared to the corresponding half. First half profits increased 43 percent year-on-year to 27.272 billion Renminbi, or 4.181 billion Dollars. Basic earnings for the first half registered 2.28 Renminbi. The price of course is listed in Hong Kong, in Hong Kong Dollars, even though the business is headquartered in Shenzhen. And believe it or not, incorporated in the Cayman Islands. And the Hong Kong Dollar is pegged to the US Dollar at 7.80 Hong Kong Dollars to the US Dollar. Which explains why, as the Dollar has weakened, there hasn't been a noticeable increase in the Naspers share price, the stake in Tencent is less valuable in Rands.

So, for the purposes of our investments in Naspers (we don't own any Tencent directly), let us turn to our trusty "what is their stake worth" relative to what the market values the entire business. Of course, it is a simplistic way of looking at it, a measurement relative to the entire Naspers market cap. So, Naspers through their subsidiary own 3,151,201,900 shares of Tencent, we are presuming that Naspers haven't sold any shares. Tencent's share price is trading at 203.4 Hong Kong Dollars. The total amount that Naspers owns is 640.9 billion HKD. At the exchange rate of 1.71 Rand to Hong Kong Dollars (thanks Google), the stake in Tencent that Naspers owns falls just shy of 1.1 trillion Rand. The market cap of Naspers as of last evening was 935 billion Rand. Just saying. So whilst Tencent never looks cheap, trading on a 33 multiple forward, it certainly looks a whole lot cheaper to own Naspers. This is pleasing to see, Naspers will still have a whole lot of reliance on the performance of that business, whilst they continue to roll out other businesses.

Linkfest, lap it up

Financial freedom or early retirement is something most people strive for. Ben Carlson explores how you would go about this - What It Takes to Retire Early. The basic summary is, spend less than you earn (not always very easy).

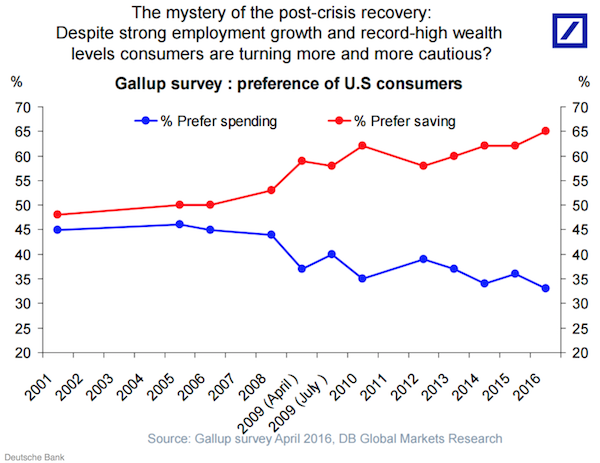

Sticking with spending habits, due to the financial crisis more people remember what it was like to be under pressure financially with the result being that saving becomes more important. The same trend was seen after the great depression - The financial crisis changed how people spend money - and corporate America is having trouble figuring it out.

Trying to forecast what the market will do over the short run is a fools errand. Knowing your strategy and time frames is important to help you avoid the noise in the market and the temptation to buy/ sell based on market momentum in the short run - Don't Let What You Cannot Do Interfere With What You Can.

This was my favourite link yesterday. Does it have to do with location, not that the London Borough of Islington is the most desirable area? Check it out - Premier League: home to the priciest season tickets. Arsenal? Not only are the fans long suffering in terms of a major trophy drought, mind you, I must not be so cheeky, they have recently acquired two more FA Cup titles to share the record for most titles, at 12. Premier league, not so much.

Home again, home again, jiggety-jog. Markets are about flat to begin with, some stocks are catching a bid. Emerging market flows again, I suspect. Keep on keeping on, remember that mantra.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment