"The company is an apparel company that has recently been making shoes. The chief of this business is not short of confidence. Kevin Plank speaks with a lot of confidence, a recent revamp of a prime New York location (the former FAO Schwarz space on Fifth Avenue at the base of the GM Building) led him to say they are going to "build the most breathtaking and exciting consumer experience ever conceived at retail.""

To market to market to buy a fat pig Stocks rose in the city of gold yesterday, from the midday lows to close up one-fifth of a percent. Not financials, mostly everything else in another broad based rally for us. Across the seas and far away, as the sun set on the trading session on Wall Street, something unusual and very strange had happened. 6068 days, if you count that far back, and provided my online web day calculator is correct, that was the last time that the S&P 500, the Dow Jones Industrial and the nerds of NASDAQ all closed at a record on exactly the same day. You need to go back to an era of Pets.com (and so on) in order to get the same record. A record closing level for all three of the major indices on the same day. A rarity it seems.

The last time that happened was last millennium, 31 December 1999. Depending of course when you start counting, depends on where you end. Some start counting from year 1, some start counting from zero. It was all the Y2K rage back then, even the 2nd of January 2000 was an extra global public holiday to make sure that everything worked, if I remember right. According to some low level research that I did, 31 December of 1999 was also a holiday in South Africa, just to be sure. Everything had to be Y2K compliant, the fear was that we were going to wake up on 1 January 2000 and your Nokia 3210 (I had one, so did 160 million other people) wasn't going to work.

Believe it or not, the problem was actually created as a result of efficiencies (Michael would love this), storage space in the real old days was as much as 10 Dollars a kilobyte. Computer programmers dropped the 19 in front of the year, in order to save disk space. i.e. no 1975, just 75. Alan Greenspan even admitted to being part of that problem, suggesting that he wrote some of those programs back in the 60's and 70's. Couch and armchair Fed critics would argue that his destructive nature spilled over into the noughties, the 00's. I don't buy that, people borrowed too much, the lawmakers were asleep at the wheel, whilst loan officers were giving loans like a clown makes those doggie/giraffe/cat balloons. Talking of loan officers, did you see this? This is a BusinessInsider special "chart of the day", this one is titled - Half of US jobs could be taken by robots in the next 20 years - here's how likely it is that yours will be one of them

So does that mean no more financial crisis? No more strawberry pickers with a 500 Dollar a week income getting a loan for a house of 720 thousand Dollars! A long story, if you are interested and the unfortunate poster children for the sub-prime housing crisis - Minorities are the emerging face of the subprime crisis.

A machine wouldn't let that loan fly, no matter what the American dream is or was, or is likely to be. Machines can help us from ourself, excesses will always be a human thing, I suppose that machines are coded to be binary in nature, it either is or it isn't. 1 or 0. And that is probably a good thing, seeing as we are trending in that direction. All records nowadays are digital in nature, there is a copy of your complete register of transition and by extension your credit record. I would like to see a graph of jobs that have been created that never existed 20 years ago. Social media manager. Virtual assistant. Content strategist. App developer. Website copywriter. Ah yes, the good old days, when jobs in demand today didn't exist!

Company corner

We have been promising you some of the results that have been knocking around. There have been some stocks that we promise you a write up on. Under Armour has been one of those. Whilst the stock is not a mainstream holding, it is a company that we do own for enough clients to be more than an interesting side holding. It is true that you cannot own everything, best we all get used to that idea now. This company is in the space of where athleisure overlaps mainstream fashion, and a more health conscious world wakes up to the idea of looking after number 1. That number 1 of course is yourself, there is no plan b for your health.

It is interesting that the best investor known to our generation, Warren Buffett, is both very aware of this fact, saying that your health is your number one and best investment, whilst acknowledging that he consumes a vast number of sodas and peanut brittle. He once told Forbes in an interview that he eats like a six year old. Depending of course which family you come from, it is either junk food or peas and carrots. I guess he means a six year old with no boundaries.

OK, first to a company that is becoming a serious contender to the global forces in this space. Innovative and comfort, from the professional to the amateur, to the pinnacle being the Olympics. Under Armour punches comfortably above their weight in that regard, whilst they haven't been a frontline sponsor of the Olympics (you need to shell out hundreds of millions of Dollars for that), the changing rules from the organising committee means that companies sponsoring the athletes can definitely advertise.

The US woman gymnastics team, and specifically Simone Bile (#winning big) and the US swimming team and specifically Michael "the killer stare" Phelps (#winning bigger with 22 golds now) have been high profile scores for their brand. And Andy Murray, he is still in with a chance, even if Djoko and Serena are gone. Murray has the easiest quarter-final (seemingly) today, a little later. There are of course other high profile athletes like Steph Curry (he is an amazeballs basketball player) and Jordan Spieth (at 23, he has won two majors already). There is ballet dancer extraordinaire Misty Copland and that guy who married Giselle Bundchen, Tom Brady (4 time Super Bowl champion).

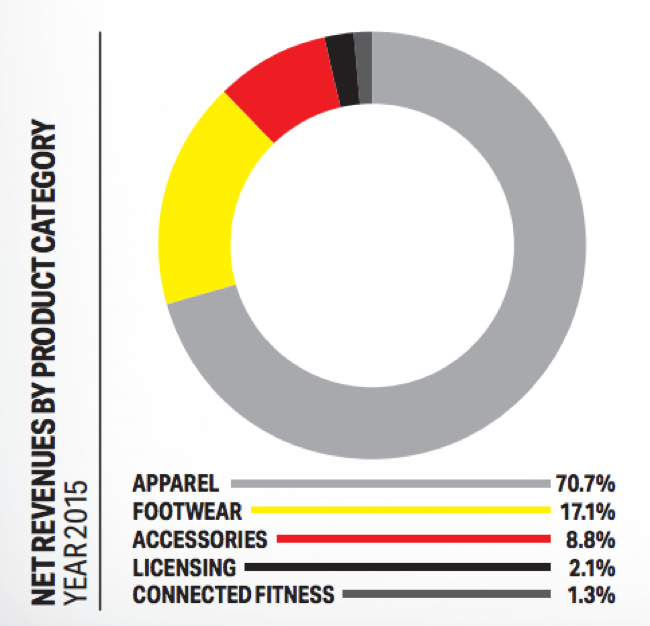

You don't however make a brand like this in a single or even string of Olympics. The company now has revenues expected for the full year, as per the outlook, of just shy of 5 billion Dollars, which represents around 24 percent growth from the prior financial year. For comparisons sake, Nike has annual revenues expected of around 34 billion Dollars this year. Adidas has annual revenues of nearly 17 billion Euros (nearly 19 billion Dollars), Puma of 3.4 billion Euros (3.8 billion Dollars), in that region. So, if you add up all of the competitors of Nike, you are not quite at the same level yet. Are you surprised that Under Armour outstrips Puma? The company sell far more apparel than shoes. The rise of athletic wear has been phenomenal. See, from their last annual report:

The company is an apparel company that has recently been making shoes. The chief of this business is not short of confidence. Kevin Plank speaks with a lot of confidence, a recent revamp of a prime New York location (the former FAO Schwarz space on Fifth Avenue at the base of the GM Building) led him to say they are going to "build the most breathtaking and exciting consumer experience ever conceived at retail." Plans are big, the base has been built over the 20 year history and the 10 year listing.

The stock has done well. And that is part of the issue with wanting to own them immediately, forward the stock trades on a 46 multiple. Whilst revenues and profits have grown sharply, there is a large spend rollout to "get bigger", which may take some shine off earnings. And in that may well lie an opportunity. If you do own it, definitely hold it. If you don't and want to, let us watch this one closely, there will possibly be a few opportunities to buy them in the coming years. Great business, amazing brand, super growth prospects, the price looks rich currently. If you are a multi year holder, the prospects are good enough for you to accumulate at the fringes immediately.

Linkfest, lap it up

The most energy hungry country on earth is the USA, the attached graphic from the Visual Capitalist shows All U.S. Energy Consumption in a Giant Diagram. The numbers are mind numbing. All the energy consumed in the US last year is equal to 36,000,000 tonnes of coal or 25,200,000 tonnes of oil. Or my personal favourite - 970,434,000,000 cubic feet of natural gas. My brain is now fried.

This story is funny, sweet and relevant, being the Olympics right now. There is a US Wrestler, by the name of Jordan Burroughs who kept losing his wedding ring - Rio 2016: A Champion Wrestler ... and a Forgetful Husband. His wife had a solution - Silicone wedding rings for people with active lifestyles.

Staying with the Olympics and the debate around the youngest ever Olympian, the WSJ reports This Boy Might Be the Youngest Ever Olympian - No One Knows Who He Is. An unnamed possible French boy, who in an ancient picture has never been identified. Quite interesting. See the Wikipedia page - Rowing at the 1900 Summer Olympics which lists the cox as "unknown", in both #wins. I am guessing that he didn't actually get a silver medal for his efforts. Unless he did. And it is in someones drawer.

Home again, home again, jiggety-jog. My new motto is "keep on keeping on". Meaning that the longer you do the same thing over and over, the better you become, provided you give it the same attention to detail. That should be all of our mottos, just keep going to the best of your ability. Stocks across Asia are much higher, we could experience a bump here today. Alibaba had results overnight, the stock was up over 5 percent. Famous Brands is out with a cautionary this morning, Steinhoff have upped their bid for Poundland marginally. Oil was up like a beast, the price that is.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment