"The new MTN Zakhele Futhi (new scheme) has an implied value of R9.9 billion and will soon be open to the public. Qualifying people will be able to invest in these shares. Please get involved, ask questions (ask me Bright Khumalo) and most importantly INVEST your hard earned savings and let it work for you"

To market to market to buy a fat pig Yesterday we saw both our local market and the US markets up slightly. On the local front there were strong moves from Anglo and BHP Billiton, both up over 4%. In years gone by, if those two stocks were up by such a margin, the overall index would not be far behind. Currently BHP Billiton has a 5% weighting in the index and Anglo American has a 2.7% weighting, for context the biggest weighting in the index is Naspers, sitting on 12.8%.

Company corner

MTN Group came out with an interesting announcement that a lot of people have been waiting for with bated breath. To those who do not know what I am talking about, I am referring to the announcement of the new BBBEE scheme now going to be referred to as 'MTN Zakhele Futhi'.

Zakhele = Build it yourself

Futhi = Again

Quick recap on the 'MTN Zakhele (old scheme) deal. This is the scheme that was put together in 2010 and is listed on the JSE's BEE board under telecoms. It holds up to 4% of MTN Group. This scheme is coming to maturity at the end of November and management is in the process of unwinding this scheme. In the process of unwinding current investors have three options:

i) Cash

ii) A mixture of Cash and Ordinary MTN shares

iii) A re-investment option which will allow you to roll over your "MTN Zakhele" (old scheme) into the 'MTN Zakhele Futhi' (new scheme)

In 2010 the shares were offered at R20 per share and according to the SENS announcement management is estimating a fair value of R75.52 after all costs relating to unwinding the structure and paying off all the debt related to it. This is a return of almost 4 fold, yes 4 fold!!! One of my favourite BBBEE specialists uses the phrase "it's better than a kick to the face." I think here he's referring to the fact that the MTN Group has not done all that well compared to the BEE scheme in the same time frame, non the less great returns for black shareholders.

MTN Zakhele Futhi

The new MTN Zakhele Futhi (new scheme) has an implied value of R9.9 billion and will soon be open to the public. Qualifying people will be able to invest in these shares. Please get involved, ask questions (ask me Bright Khumalo) and most importantly INVEST your hard earned savings and let it work for you. If you own the MTN Zakhele (old scheme) and you are not sure which option to pick, or you don't know what it all means, again please bombard me with your questions!

The old and the new scheme together will contribute to an effective indirect "see-through" black ownership of over 30% of MTN's South African operations. Now we wait for the prospectus which will outline amongst other things what price the MTN Zakhele Futhi (new scheme) will be offered at. All we know right now is that MTN is going to sponsor this deal giving the potential BEE shareholders a 20% discount on purchase, very generous management!

The SAB & AB InBev merger is one step closer to being completed, albeit a bit harder going forward. A UK court yesterday ruled that the Altria and BEVCO shareholders(they own a combined 41% of SAB Miller) will be treated as a separate shareholder class when it comes time to voting on the merger. Removing Altria and BEVCO from the vote means it will be a bit harder for the merger to go through. Basically of the remaining 59% shareholders, 75% need to vote in favour of the merger for it to happen. Given that the SAB Miller share price is still around the 44 Pound mark, it tells you that the market thinks this will go through. D-Day or vote day will be the 28 September.

Linkfest, lap it up

Given how central the internet is to my daily life, it is hard to comprehend how having access to the internet means you are part of the minority - The Not So World Wide Web

You will find more statistics at Statista

Sticking with the internet topic. Having access to the internet is important for development in South Africa and even bigger in helping to level the playing field - FNB launches own-branded smartphones. Depending on how good this phone is, it could be huge for FNB both on new banking clients and on data consumption on the network.

Having only the survivors in the financial world appear in long term statistics can make certain asset classes appear more appealing than they otherwise would. Hedge funds and small cap funds come to mind. There is a lot of money to be made in these spaces but there is a bigger risk of blowing up - Survivorship Bias. The blog talks about an interesting WW2 incident where the airforce wanted to know which parts of their planes to reinforce based on the damage on planes returning from the front lines.

Tesla is setting a new benchmark of what electrical vehicles need to aim at. The new battery packs improve the acceleration of the car (2.5 seconds to 60 mph) and increase the range of the car to be over the phycological 300 mile mark - Tesla has maxed out what its current batteries can do

It is amazing some of the areas that science is working on. Sending information outside of the restrictions of space and time is mind blowing - China's new quantum satellite will try to teleport data outside the bounds of space and time

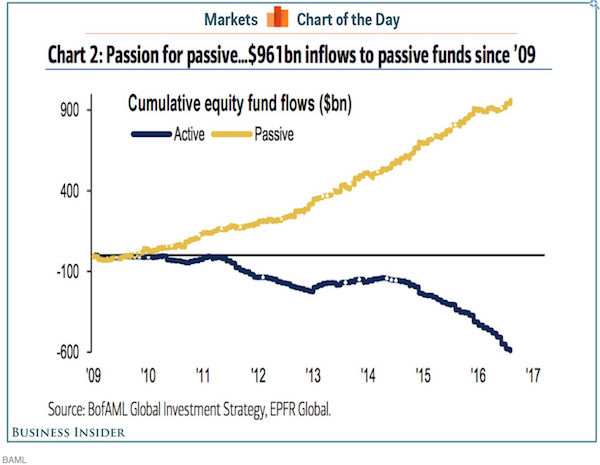

As more people pile into index trackers there will be new distortions in asset prices. Remember how the market reacted last year when there was mass fear and widespread selling of ETF's? Some share prices got klobbered in a very short space of time just because they had a higher weighting in an index - One chart that is sure to give Wall Street nightmares.

Home again, home again, jiggety-jog. This morning the market moves are split by the news last night that Pravin Gordhan has been summoned by the hawks, again. Dual listed stocks are up sharply this morning thanks to the weaker Rand and anything that looks like a bank is down sharply this morning (First Rand currently down 4.3% and Standard Bank down 5%). On the currency front the Rand is at the $/R14.00 level again, we were last here at the beginning of August. I suspect that this is an over reaction spurred due to memories of what happened to the currency and stocks when NeneGate broke at the end of last year. Head down and remember, a large portion of the JSE has offshore profits, so you do have diversification which ever way these political winds blow.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment