"If you add the entire market capitalisation of all the mining companies together (including Anglo and BHP Billiton, as well as Glencore) together, you get to 1.83 trillion Rand. Remove those three from the mix and you have collective market caps from African Rainbow Minerals to Wesizwe Platinum of 766 billion Rand. All 44 of them. And that number is less than 82 percent of the size of Naspers as a whole"

To market to market to buy a fat pig Stocks went slip sliding away yesterday in the city founded on a pile of gold, it is still there and a long way down. Will we get it out? Yeah, possibly over a long time. It may have to be done with the minimum of human intervention. According to the Twitter account This is Gold, 60 percent of all gold annually mined is used for jewellery. That is a theme I like a lot, it is far easier however to own one of the majors in luxury, it may come with high costs, it seems easier and less stressful.

Another fact from that Twitter account is that 40 percent of all the gold ever mined comes from Mzansi, we still have the third largest reserves after Russia and Australia. And they have more gold medals than us, even though you know that only 5 percent of the gold medal is actual gold. A medal yields (if you melted it down and sold the raw material) less than 600 Dollars US. A few more facts about gold and gold mining, 1 gram of gold can be strung into a thread 165 metres long. It is ductile, which is a chemistry term for being able to be drawn out into a long wire. Last one, at nearly 4km under the earth the pressure and temperatures are intense, with rock temperatures at 55 degrees Celsius about the same as your geyser. Hot!

Hot like the gold sector as a whole, collectively that index is up 155 percent year to date. If you had the foresight to call and go long the index and use a large amount of gearing, you may have found yourself in a position to throw in the towel for a few years. And to think about things deeply. The other sector that is also on fire, YTD is the platinum sector, up 131 percent. Why is the all share index only up 3.37 percent? This is 2016 and there is a distinct absence from the majors of the single commodity mining stocks. Tiger Brands has a larger market capitalisation than Gold Fields. Mr Price is about the same size as Sibanye Gold, and that is after all their heavy lifting. Richemont is six times the size of Gold Fields and they have had a horrible no good year. Netcare has a market capitalisation the same size as Impala Platinum. Coronation and Harmony Gold have the same market capitalisation.

If you add the entire market capitalisation of all the mining companies together (including Anglo and BHP Billiton, as well as Glencore) together, you get to 1.83 trillion Rand. Remove those three from the mix and you have collective market caps from African Rainbow Minerals to Wesizwe Platinum of 766 billion Rand. All 44 of them. And that number is less than 82 percent of the size of Naspers as a whole. Think about that for a bit, all the mining houses in South Africa, that have their primary listings here in South Africa, as a collective are smaller than Naspers. The 101 year old company, now headquartered at the top of Republic Road in Randburg (or is it Cape Town?) made an incredible investment over a decade ago in Chinese internet company, and that single investment is bigger than the whole primary listed JSE mining investments. Notwithstanding the incredible performance year to date.

In every comparative case here above I would rather want to own the alternative companies, Richemont over the collective, Mr. Price, Tiger Brands and Netcare. It is very hard to understand what drives the price of the underlying metal, be it inflation expectations, monetary policy from reserve banks (and their buying). I would rather be in that investment tracking consumer trends from soft luxury in Nike and L'Oreal to Richemont. You will never be able to own everything and you certainly WILL NOT be able to time the market on a consistent basis, even if you are armed with a thousand charts representing history of "what happened next". Stocks locally closed the session down just over three-quarters of a percent.

Stocks in New York, New York, over the oceans and far away started the session better and ended off the highs, still in the green however. The Dow Jones Industrial Average added just shy of one-third of a percent, the broader market S&P 500 just over one-quarter of a percent on the day, whilst the nerds of NASDAQ added over half a percent. Apple is nearly at 110 Dollars a share, up 21 percent in the last three months, still down over five and a half percent over the last twelve months. And still down nearly 15 percent from the all time highs.

The reason why I mention this is that the largest company by market capitalisation in the world has yet to reach any all time high, whilst the rest of the market has been touching new intraday highs at will. And in case you forgot, Apple is the largest company in the world, with a market capitalisation that is approaching the 600 billion Dollar mark again. Yowsers, that is huge.

It is that time of the year again, when the quarterly filings of investment companies get scrutinised by the broader community. They take their chances like everyone else and whilst they may be seen as masters of the universe on the trading and investing front. There is a reason that they got to that position in the first place, they were smart enough to attract capital to invest, based on their investment skills. And Berkshire Hathaway has plenty of those skills, Ted Weschler and Todd Combs are fund managers picked by the Oracle of Omaha.

Berkshire announced yesterday that they had increased their stake in Apple, adding over 5 million shares during the quarter. The stake is now worth 1.675 billion Dollars. Which sounds like a lot, then again the company managed around 133 billion Dollars in equities at the end of June 2016. Apple is up 14 percent since then, the S&P 500 is up 4.35 percent. Quo vadis Carl Icahn on this one? Icahn expressed concerns about China and Apple, Ted and Todd (and Warren and Charlie) looked over the horizon.

Expect the same outlets to tell you how awesome this is, the same people who told you how terrible it was that Icahn had sold his shares in the last set of filings from investment managers. For interests sake, Berkshire cut their stake by just over one-quarter in Wal-Mart, they also cut their stake in Deere and Co, the maker of fine green machines. Berkshire also has been buying oil refining business Phillips 66. It is a tough ask to manage those investments, the number is just shy of 100. It is however their full time job, to manage money on behalf of their stock holders, you had better hope that they are good at it.

Olympics insert! I have been having this debate with my family again last evening, my wife was a sprinter at school and held several regional school records, so she was fast and can't fathom why people would want to run too far. If you ask Siri who is the fastest person on the planet, she will tell you that it is Usain Bolt. Yet what about Mo Farah, or David Rudisha or Wade van Niekerk? Nobody can beat those folks, based on their last performances, at their respective distances.

Did you know that Michael Johnson (the fellow, who held the 400m record until yesterday) still holds the record for 300m, set in Pretoria of all places (at altitude) in March of 2000. The second fastest person at that distance is Usain Bolt, and our new wunderkind, Wade van Niekerk, holds the third fastest time in history. American LaShawn Merritt holds four of the ten fastest times at that distance. I am sure he wishes that the race was a sanctioned Olympic event. Although he may find himself up against the aforementioned two.

Like everything in life, perspective and a little thought must go into quantifying what is fast and what is a good investment. A share price reflects the respective market forces between the buyers and sellers and their view on the company. Some people only see a price and liquidity, they have different time frames. Others see companies with real assets, factories, human capital, ideas, products, deep and broad quality management. Others see the future differently.

For each and every seller, there is a buyer, that term more buyers than sellers or more sellers than buyers refers to the sheer weight of the selling or buying volumes. Invest in a business in the same way that you would commit to a job, or a home purchase, or even a private business. You wouldn't own any of those things (you can own a job) if you didn't commit for a length of time. Neither should you only commit to a business for a few weeks, a few months or even a few years. Grow Bonsais, do not fixate on managing the weeds. Or if you will, don't water the weeds and prune the roses.

Linkfest, lap it up

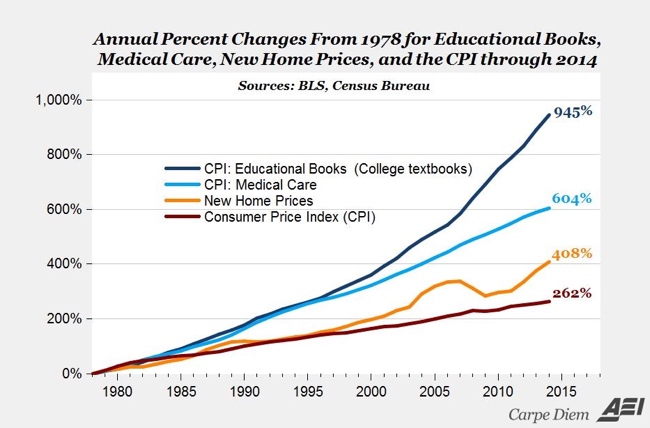

University fees are a very contentious area for many. As most of the audience that we write to are possibly in a position to service these (not without sweating) fees, it is less of an Everest moment each and every year. We need to have as much investment in education as possible. If it is for "free" (no such thing as free, except the wind, the sea, surf and sun), then does it dilute the meaning? I know this is a US study, it must have some significance here too (and part of the high costs) - The new era of the $400 college textbook, which is part of the unsustainable higher education bubble. Graph courtesy of AEI and Prof. Perry ->

With every disruptive technology there are winners and those who become obsolete - Uber's Cash Service Fuels Tensions in South Africa. Uber is easy to use and a fraction of the costs of metered taxis, no amount of violence is going to stop the trend of people moving towards Uber.

I like this lady's logic, find an expensive gym so that the opportunity cost of not going is very high. There is also the added benefit that expensive gyms normally have a better experience - The economic case for joining an expensive gym

We only learn and progress when we admit to ourselves that we don't know something. This is very relevant when investing, it helps avoid being over confident in your assumptions about a stock, it helps you avoid the big train wrecks that can occur when dealing in the stock market - How Progress Occurs

Home again, home again, jiggety-jog. Stocks across Asia are lower, the Japanese markets are much lower, the stimulus methods (the kitchen sink) are not believed to be working. In part the strong Yen doesn't help Japanese exports. I guess that is what happens when you have a mature society and negative birth rates, although there is some evidence that recently things are changing. US futures are marginally lower.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment