Hey, why haven't you watched last week's addition to humanity, the Blunders weekly release. So that means 6 months of blunders that have been rolling around. Do yourself a favour, watch it - Blunders - Episode 26. It features Fish Paste Oreos, a volcano eruption that threatens humanity, judge us by our car sales rather and lastly, Egypt on the skids again. Subscribe so you don't miss a thing - Blunders - Vestact TV.

"Remember, you do not have to own every single stock out there, you are going to miss periods when other companies share prices are doing better and you feel you are missing something. Stick to the plan, go for what you know. Try and avoid FOMO. Good, I hope that makes sense."

To market to market to buy a fat pig Stocks locally were at their best levels just before midday, financials slipped away, the Rand weakened against all of the majors and the all share ended the session down a fraction. In fact, not even a couple of points lower, which is too small to register a percentage change. The scoreboard will show that the market ended the session lower, yet the percentage calculation suggests a "negative" move of 0.00 percent. That doesn't happen every day, and feels like a tie and three-way silver medal. That was cool. Construction stocks recently have seen a small comeback, albeit from deeply depressed levels.

Murray & Roberts clocked a 12 month high, closing at 15 Rand. For those who missed the hurrah of the greatest football tournament on the planet, which graced our shores in 2010, all construction related stocks caught a serious bid. Rewind 11 years, Murray's (as affectionately known by Mr. Market) was trading at exactly the same price as it is now. By October 2007, a mere two and a bit years later, the stock was at 105 Rand a share, reaching a high of nearly 112 Rand during the financial year to end June 2008. Turnover went from 10 billion Rand in the year ending June 2005 to 26.6 billion Rand in the financial year ending June 2008. The company makes 2 billion Rand worth of profits on 32.6 billion Rand worth of turnover in the financial year to end June 2009. Earnings per share clocks 685 cents a share. The dividend was 218 cents that year (back when there was no dividend withholding tax).

And then everything changes. The financial crisis arrives, every territory catches a bad bout of flu. The company reports a loss in their financial year that ends June 2011. Turnover actually remains steady for the next few years, margins are razor thin and although turnover regularly exceeds 30 billion Rand, profits are patchy (another loss in the 2012 financial year) and the best the company can do is 847 million Rands of profits in the 2014 financial year. Oh yes, and I almost forgot, the company is forced to raise cash at a deep discount (at the time), shares in issue balloon from 331 million to 444 million in the 2012 financial year. Still, although you are diluted (if you didn't follow your rights), the stock price bottoms at 22.95 ZAR that financial year. The next three years are horrible for stock holders, a lack of spend by their clients leaves the construction group fighting in a drying pool of work, forced to compete on price.

In January this year the stock price bottoms out at 6.51 ZAR. The company has been fingered in the collapsed bridge on the M1 here in Jozi. They are fined for further collusive tendering related to a now distant memory of the World Cup football back in 2010. So what has changed between January and now? The stock is up from the worst level seen since 2002, 14 full years ago. And more shares in issue of course. I guess the price has recovered with the rest of ZA inc., thanks to a global belief that emerging markets are not finished in part and secondly that some green shoots are appearing, albeit small and facing tough growing conditions. Does one now believe that the worst is past and you can buy the same company from an era when there were no smartphones, no tablets, no broadband, no Facebook, no Twitter, that era?

Is the construction sector, as an investor, a whole segment of the market that should just be ignored? It sounds crazy, some of the smartest people I know work in the industry. They build tangible things, improve peoples lives along with the architects that design amazing "stuff". The roads and infrastructure they build are invaluable to society. We cannot live without the motorways, the electricity and water infrastructure that makes modern living so convenient. Along with all the economic activity that goes with it. Or is it a case of project risk and changing goal posts being too difficult for investors to understand, most especially retail investors.

Feast or famine. For long only institutional shareholders, like the top four shareholders, Allan Gray (18.86 percent), The Government Employees Pension Fund (17.75 percent), Coronation (15.03 percent) and the Public Investment Corporation (13.44 percent), who collectively own 65 percent of the business, their investment time horizon is forever. For a retail investor that perhaps cannot live with the volatility and does not need to be that widely diversified, the sector is an avoid. Too cyclical, too volatile, margins not good. Remember, you do not have to own every single stock out there, you are going to miss periods when other companies share prices are doing better and you feel you are missing something. Stick to the plan, go for what you know. Try and avoid FOMO. Good, I hope that makes sense.

To add to this piece, I was chatting to an old school, varsity and digs mate pal about the commodities market, something that he knows intricately, having mined in Brazil. Yes, he speaks the language and has been deep in the jungles. I sent him an email suggesting that there were various reasons why we didn't invest in commodities companies either, that is for sharing:

"I wish I understood the commodity markets better, I understand human nature and their desire to want more things, I understand engineers who are motivated by profitability to do more with less. Hence the same goods will be made of significantly fewer resources in the future and not more. i.e. lower commodity consumption per capita over time, we will also get far better at recycling, of that I am sure. As humanity we are also acutely aware of fossil fuel usage means it is gone forever, ironically this should be your favourite kind. There is of course rich people adoption of alternatives, which is driven more by ethics than economics, as they are rich and can afford it. The greater the adoption, the lower the price will be, without a doubt alternatives will compete with old energy technology more favourably in the next decade. Like most companies and humans, when there are excesses, we fail to provision. We get stuck with recency bias. i.e. if it is bad, it is never going to get better, if it is good, it is never going to get worse."

Again, I would be interested in getting your opinion on all of this! Recency bias is another whole debate, the inability to see past last week and extrapolate forward. In other words, Syria is always going to be a place of conflict (history suggests this may be right), Greek people are always going to have too many benefits and not pay their fair share of taxes, the older generation in Italy and Japan are going to place fiscal strain on government finances, and of course the list could go on. Interest rates in the UK, Europe and the US are never going up and we are stuck with negative rates forever. That sort of thing. We tend to take the moment and immortalise it. No. Things change, and they creep up on you slowly. Like HD TV, like high speed broadband, like smartphone technology, like cloud computing, like different transportation methods (driverless cars). Like robotics. Like Uber. That is a discussion I am sure for another day.

Over the seas and far away, stocks on Wall Street sank towards the end of the session, down between half to two-thirds of a percent for all the majors. why? There are some moments in stock markets that you do not need a reason. An inflation read from earlier in the session showed what we know, there is little or no chance of that keeping the Fed up at night. There were comments from one of the Fed team members, William Dudley, who said that he thought that the labour market was looking good, and by extension they could raise rates.

Jeepers, I have heard this a lot over the last umpteen months, if not years. Joe Weisenthal, aka the Stalwart on Twitter and Instagram, who now has his own show on Bloomberg called "What did I miss" suggested in a tweet exactly that: "Is there any economic debate in which finance twitter was more ahead of the curve than in calling for more fiscal stimulus?" To which he replied (I think snarkily) to his own tweet: ""Like probably 5 or 6 years ahead of the curve.

Twitter finance knows and doesn't know everything, all at the same time. Sorry Twitter, you may want this and that, and scream from your study or desk in your sweats (desks littered with coffee stained papers you should read) that the Fed must do this or that, be sure that someone else is in charge. No matter how much ranting and raving you do, or have done in the past, the Fed will move when they are ready. Their network goes beyond Twitter, the tentacles are more like the lion's mane jellyfish.

Check that one out, 37 metre long tentacles are the largest known to man, longer than a blue whale. The Fed are all like lion's mane jellyfish tentacles, you should shout when someone tells you that you know nothing about the way of the world. That ought to put them in their place. Anyhow, spending valuable time worrying about the Fed is time not spent reading blogs and annual reports about companies. That is our view, and we are sticking to it.

Company corner

Twitter is a company that we have small holdings in for a few people. Which is a good thing, it is small in part as a result of the initial weighting and the fact that the rest of the market has done better whilst the Twitter share price has taken loads of heat. To be perfectly frank, the stock has been a bitter disappointment, the company hasn't managed to get the traction on subscriber numbers that they should have, perhaps it is more niche than we thought. The stock listed with much fanfare, the product is pretty amazing in my opinion.

It is the only customisable news feed any where that exists, small snippets with links to longer stories if needs be. There are images too. There is a whole lot of sarcasm, opinions, humour and unfortunately attacks on individuals. That is a big gaping hole in their armour, the inability to "protect" users. Hatred is normally spewed by unknown people (you can be anonymous) and your tweets can be read and heard by all and sundry.

So there are problems with the platform, the interface isn't all that clear to new and first time users, it is hard to build a network of people to follow. Plus, the advertising roll out method isn't all that clear either, trust me, I have used the interface in order to promote tweets. You do definitely get more bang for your buck with Facebook advertising, you certainly get a much bigger reach with Twitter. Twitter gets far more "roll", it is quicker and sharper.

The inability of the platform to grow the user base is possibly a function of the aforementioned difficulty in understanding how it works. Perhaps Twitter should tell you, as a new user, what to do, who to follow and how to use it. It is second nature to me, I open that app first on my phone to find out what is going on. I also understand that the reason for the plateauing user base is that it is more niche. Some people couldn't be bothered to read the news this way, there is an app for that. For me, to be able to follow individuals and different organisations around the world is very valuable. I would pay for it, if needs be.

So that is the user experience, what about the profitability of the business? Twitter dishes out too much stock to their employees, heavily diluting you the share holder. I understand that competition is tough out there for quality. Revenues at the last quarterly report beat expectations, as did earnings per share. The quarterly revenue topped 600 million Dollars, this is by no means a world beater.

There is a wonderful bull case made for the company in this blog - Twitter Earnings Revolution. The real change will come from videos and the ability for advertising to come through content generated by the networks. Twitter have signed multiple deals for sport and other content, including the aforementioned Bloomberg show by Joe Weisenthal.

Twitter will live stream two Bloomberg TV programs, as well as Football (of the American kind), Baseball, Basketball, Soccer (that is football to others), Ice Hockey and Wimbledon, as well as some European football (of the feet and head kind, no hands involved). Perhaps this is the future, I thought Periscope would be bigger by now, it is the live streaming TV effectively. Perhaps that is harder than tweeting.

This is not for everyone. The stock price has actually rallied hard since results, notwithstanding the fact that we fell hard post the event. Over a year the stock is down 30 percent. Since it listed, it is down 51 percent. The expectations are for the company to make 50 cents of earnings in the current financial year, which means it trades on around 40 times earnings. With the growth not seen as tearaway, perhaps that is at the top end of the valuation metrics. Part of the reason for a stronger share price recently is that they may well be a takeout target. Someone would have to pay a premium over and above the current 15 billion Dollar market cap, unlikely with the direction fuzzy.

Having said that, I like the platform, it is very valuable to their core users. It becomes indispensable. Unlike Facebook, they only have one platform. The main reason that they haven't succeeded (and have succeeded, they have 312 million monthly users) is as a result of being direct. Paul pointed out this Vanity Fair article - Twitter is betting everything on Jack Dorsey. Will it work?, where the author points out: "From the moment it was born, 10 years ago, it has existed in a near-constant state of chaos."

A stable management team will no doubt put the business on an even keel. If you hold them, keep them. There could suddenly be major traction in another business shift phase, higher advertising, more structure. Perhaps Twitter needs their Ruth Porat (Alphabet CFO from Wall Street), their Sundar Pichai (internal professional Google person, who is now the CEO of that division). Stability and professionalism needs to rule the roost. Legendary investor Peter Thiel suggested that it was horribly mismanaged and there was a whole lot of pot smoking going on. Talk about taking green to a whole new level. There is nothing like a very soft share price to remind you that with an idea and a community comes hard work. User adoption of another network means you lose. I suspect that Twitter will crack it. It is a solid hold at best, meaning that if you have them, keep them. Until there is a sign of improved management of resources, that is the furthest I am willing to go.

Linkfest, lap it up

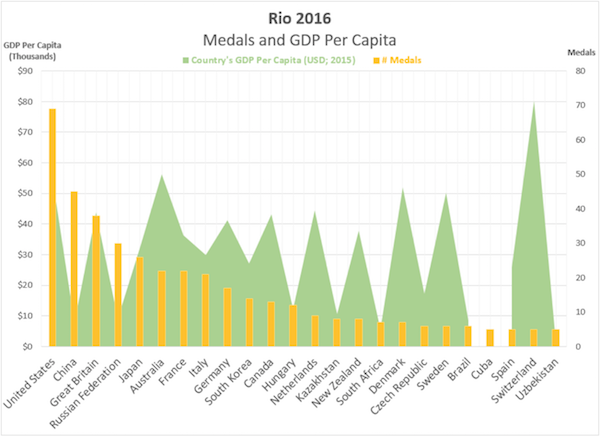

Which nations get the most medals? Well the nations that spend the most on athletics, which seems obvious. There doesn't seem to be much of a link between medals and GDP Per Capita - Medals, GDP, and the 2016 Rio Olympics

Having a water proof iPhone will be a great feature addition, especially for those of us who use the phone as an exercise performance tracker - Rumor has it Apple's next iPhone may be waterproof. My current phone survived a swim while ridding my bike, so they are durable to a degree.

A quick video showing how Olympic winning performances have progressed over the last 100 years. How much more can technology help in breaking records? - It isn't Olympians who have evolved. It's sports.

Home again, home again, jiggety-jog. Yech, can you believe it. We spelt Wayde wrong. Sorry. One of the things I was taught early is not to get the spelling of a name wrong, equally, not to ridicule a name. That is one of the things that is difficult to change and many people are reluctant to do that. Let me share a story, I took my dog to the vet for inoculations when she was a little puppy. The woman behind the counter said "name" to which I replied "Sasha". She then said, "no-no, your name?" I said, "that is my name" to which she proceeded to hide under a pile of paper that existed on her desk. Sasha is a diminutive for Alexander, which is my only given name. The second part, Sander somehow became Sasha. Like I say, don't ask me, I just work here. When people ask "how is that possible", I normally say, well, how do you get Dick from Richard?

Markets are mixed with to start, at the get go we are a smidgen higher. Good work Alex/Sasha .... the Alex column? The Lex one dates back to just after the end of the Second World War in the FT. The Alex blog dates back to 2003 sadly, there is some way to go. Luckily there was no war event preceding it, at least at a global level.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment