"Whether or not you understand what the drugs treat, or whether or not you simply try and understand the specific therapies, that does take a big amount of new reading. Mostly into fields where there could have very little expertise"

To market to market to buy a fat pig On Friday there were more than a few things going on. There are always "things going on", Friday had a disappointing US GDP read, which caused the Dollar to lose value to most of the majors across the globe, including the ZA Rand. Even though politicians were saying the most amazing things over the weekend.

See, the Rand strengthened? Why, oh why, is nobody saying that the brilliant president and the treasury are saying all the right things that foreign investors want to hear? Perhaps it is the fact that politicians have been politicking that they cannot put their foot in their proverbial mouths. Anyhows, we always maintain that it is the lay of the land, the global land, that sets the mood for emerging markets and whether or not the flows are likely to be directed in that direction as a result of the search for yield. That is what we always maintain. So that means it is not us? Nope. As Michael said this morning, when you are small, you are small.

After a tumultuous week of shareholders saying this and that, and AB InBev upping their pound price of SABMiller, the board of that fine institution recommended the offer to their shareholders. See the Bloomberg story - SABMiller Board Recommends AB InBev's New $104 Billion Offer. What I find quite laughable and in almost all of these situations, the board always reckons that the deal hopelessly undervalues the true potential of the company, or almost always should be a whole lot more. Grossly undervalued, blah-blah-blah. The share price of SABMiller was trading below 30 Pounds a share before the deal. And even then the stock looked expensive, right now the stock trades on a 35 multiple.

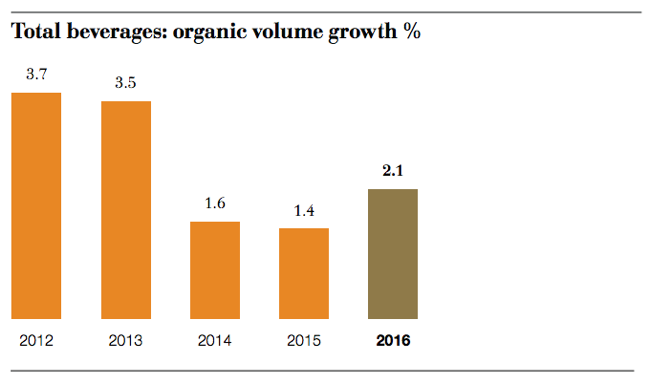

I am happy to buy a business that has top line growth in the high teens on that sort of multiple, here are two graphs from their last annual report. The first one is the growth in volumes. Now, granted, there is only so much beer that customers can consume more of on a year to year basis. In many of these markets the base is still for most intents and purposes quite low, relative to some of the developed world. Here goes, from the last annual report:

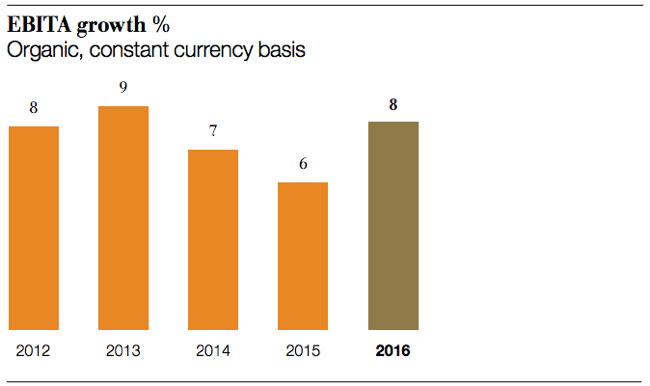

And then more importantly for investors, what about profits? In the high single digits mostly.

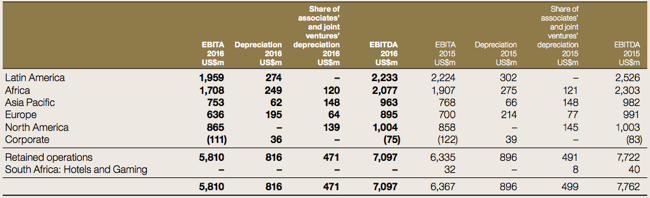

AB InBev are after the two-thirds of the business that is Latin America and Africa. Lager volumes are growing (or grew in 2015) at 6 percent in Latin America, with soft drinks at 4 percent. Across our continent, as per the last annual report, larger volumes grew at 5 percent, with soft drinks at a more impressive 8 percent. Here goes:

No Europe, no Asia, (it would seem) focus on emerging markets and be ruthless on costs. That has always been the style of the controlling shareholders of 3G Capital. They will be ruthless by stealth. They will save costs and make the business meaner. Even before you didn't even know it was there. Either way, this now needs to be put to a vote. And that will come soonest, possibly it cannot come sooner for all concerned.

Quick scoreboard check, locally the market fell away through the session, in part due to a stronger Rand. We lost just over nine-tenths of a percent to close well below 53 thousand points again. Over the seas and far away in New York, New York, stocks closed mixed again, the Dow Jones Industrial Average lost 0.13 percent, whilst the broader market S&P 500 and the nerds of NASDAQ gained about the same amount (as the Dow lost). Big week, all about results. Let us get into it below.

Company corner

Amgen reported numbers last week - Second Quarter 2016 Financial Results. It is not as tough to report on a company that has a very focused consumer front facing business, in many cases we use loads of consumer products like Apple (your phone or computer), Google search (or Android phones), Facebook (Instagram and WhatsApp), Amazon (reading your Kindle, ordering online), Nike (go for a run or to gym), JNJ and L'Oreal (shampoos and consumer products), Netflix even, perhaps even Priceline (Booking.com). Whilst you are wearing your Luxottica (sunglasses) products. Those businesses you know and use, and you are very familiar with.

Somehow, a company that makes very specific therapies that in some cases only have a target for 3 to 4 hundred thousand potential customers, that is harder to get a handle on. In fact, as the therapies are definitely for life threatening illnesses, you pretty much hope that you are not ever a consumer of their product. It may well be easier to be a user of Stryker, to get a new artificial hip or knee than to use the therapies that Amgen manufactures and distributes.

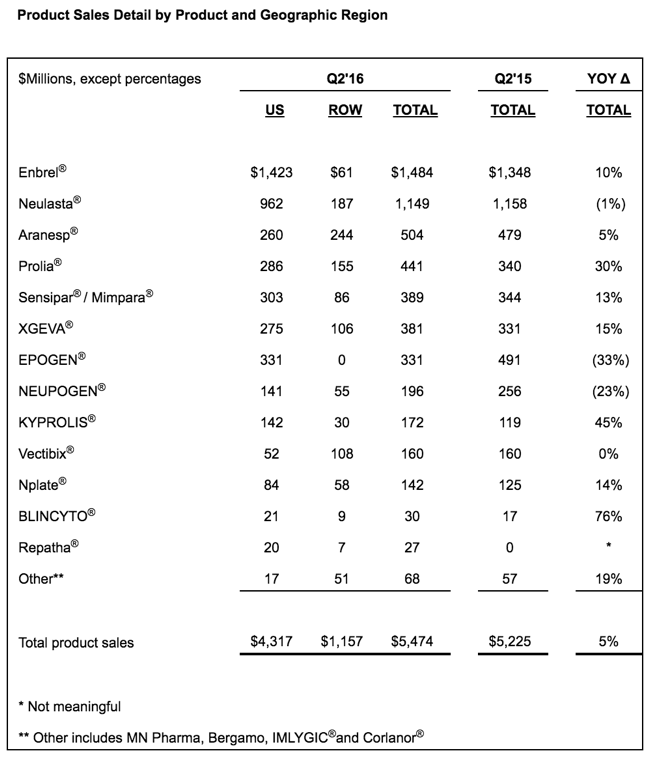

Amgen top sellers include ENBREL, which treats 5 different ailments from Rheumatoid Arthritis to Plaque psoriasis. KYPROLIS treats patients with relapsed or refractory multiple myeloma, who have been treated before. XGEVA prevents serious bone problems. PROLIA helps woman with postmenopausal osteoporosis, specifically with high risk to fractures, to specifically strengthen bones. First, a table of their big hits by sales for the quarter just passed.

Whether or not you understand what the drugs treat, or whether or not you simply try and understand the specific therapies, that does take a big amount of new reading. Mostly into fields where there could have very little expertise. It is funny how we can understand the combustion engine, yet understanding ones own body would take a lifetime. Perhaps we can see the combustion engine, all you need do is to open the bonnet (hood) and peek in. In the same way that you look at an x-ray, you look under at the engine. You really have little idea as to what is going on. Plus, I bet you didn't know that this company (Amgen) has a market capitalisation of 25 percent more than what AB InBev want to pay for SABMiller. I suppose it is easier to drink beer.

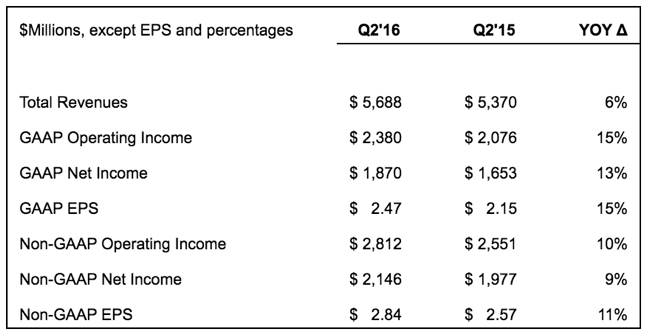

That aside, here is a breakdown of the sales and profit numbers in the associated table with the earnings release:

The company guided higher for the full year, revenues around one percent higher for the full year at the top end of the range, non-GAAP EPS range was pushed higher to a 11.10 to 11.40 Dollars a share range, that is around two percent higher than the prior top end of the range. This is obviously good news for investors. The stock has responded accordingly, over the last month the share price is up nearly 15 percent, in anticipation of good numbers. On a historical basis the stock still looks decent value at 18.2x earnings, forward (i.e. this year), that unwinds to less than 15 times. And to the end of next year, the analyst community has it at around 13 and a half times. Which, as you can see the earnings growth rate, is quite something that it is that cheap! Plus, post tax there is a two percent dividend to boot.

This is not your typical biotech business, they are a lot more mature. You may recall when we introduced the stock as a core recommendation last year in October - Amgen (2015) Q3 numbers we pointed out that they were halfway through their 4th decade of business. I will copy and paste what I wrote back then today, I strongly believe it: I would rather own a company and part with my money to own a piece of a business that is trying to cure humanity. The therapies may be wildly expensive, there may be an ethical argument about the cost of the treatments, without that, the company would not be able to recoup the money spent engaging in finding these cures.

All things being equal, the stock price should continue to gain traction as some strong pipeline therapies add to their already growing business. Finding cures and therapies for breast cancer, inflammatory diseases, migraines, that is what is in the pipeline currently and close to approval. We recommend this company as a strong buy.

Linkfest, lap it up

Some user numbers from last weeks Facebook results, the user base is growing as well as the number of people using the platform daily, instead of a couple times a month - Facebook Users Show No Signs of Tiring. As the number of users starts to get saturated, the growth comes from the amount of time that people spend on the platform. More time per day means more eyeballs for advertisers to pay for.

You will find more statistics at Statista

This graph probably shows you the reason why people voted for Brexit. People in the UK are earning less today than 8 years ago, so they want change - UK & Greece Come Bottom For Wage Growth

You will find more statistics at Statista

Reading about Jupiter reminds me just how small we are on Earth. I am also amazed by how much there is still to learn about our solar system - Jupiter's Red Spot Churns Out Air Hotter Than Lava.

If you don't know the story of Khizr Khan, his wife and family (and personal sacrifices), where have you been? I urge you to try and watch the speech if you haven't (Khizr Khan's powerful DNC speech (Full speech)). The upshot of the speech is that not only did it inspire many, it also caused the U.S. Constitution to become Amazon's best-seller after father's powerful rebuke of Trump.

Home again, home again, jiggety-jog. It is another big week for stocks, reporting all week long to give a clearer picture of what we are likely to expect. Equally, there is a jobs number at the end of the week. I wonder what and how the Brexit thing would have influenced US corporates to hire (or mostly not hire). We still have L'Oreal and Twitter to cover from the numbers from last week. And then of course voting day, that is likely to be fun as always.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment