"The US markets also fizzled out towards the end of trade, yet stocks still remained in the green, only if just. And it was another record intraday high for the S&P 500."

To market to market to buy a fat pig I would prefer, from a logistics point of view, for all public holidays to be on a Friday or Monday. Period. In that way, productivity can be higher, rather than disruptive to normal events. Politicians may work hard, but offer very little from the view of making stuff or offering a service that we had to pay for. If all government services were at a market related rate, what would the cost of your electricity, water, garbage removal, etc., be if there was a viable, and economic alternative. The flip side of that coin is, if local government didn't offer the service, nobody would live in that place. We are off the point. I suspect that we can celebrate public holidays and vote on days not in the middle of the week.

Overnight Michael Phelps backed his killer stare up and smoked everybody, including our own Chad le Clos. The US markets also fizzled out towards the end of trade, yet stocks still remained in the green, only if just. And it was another record intraday high for the S&P 500. In the end, the Dow Jones Industrial Average and the S&P added fractions of a percent, adding 3.76 and 0.85 points respectively, meaning when rounded to the nearest one decimal place both markets were up 0.0%. The nerds of NASDAQ added nearly one quarter of a percent, Apple still marching steadily forward.

Since Apple reported quarterly numbers on the 26th of July (after the market closed), the stock is up nearly 12 percent. There has almost not been a down day since. And yet the stock still trades on a less than 13x historic multiple. The BusinessInsider had several interesting articles on Apple, including the headphone jack (or lack thereof) for the iPhone 7, this one caught my eye - iPads are doing better than expected, but tablets are still on the decline. The best problem that everyone has is that the tablets all work so well and perform their functions, there is little or no need to upgrade furiously. Until there is a huge form change.

The Pound continues to get smoked, stimulus and low rates and the central bank warning of a slowing economy is at some levels reflected in the numbers, other numbers continue to impress. The tourism sector in the UK continues to benefit from a weaker Pound. Job hires, not so much. We shall see the medium term impacts, we shall see if the economic impacts become more and more noticeable as time goes by. Back where local is lekker, stocks rose a touch on Monday, up just over one quarter of a percent.

Steinhoff was the big news of the day. We will see how that transpires, the acquisition target Mattress Firm shot up over 110 percent to the offer price of 64 Dollars a share, the graph looks like the "El Capitan". Not the operating system, rather the Yosemite cliff. We had rock climbers at school, the club was huge, the teacher in charge always used to say "fully". He had a long red beard and scraggly hair. He was our English teacher too, a heavy lefty with vegan tendencies, he opened our minds to the rest of the world. That could have been the motto for Steinhoff, "fully" Marcus Jooste, "fully". The only fully you don't want to see is fully priced and then overpaying.

Woolies were also in the news, they sold their David Jones head office building in Sydney, which is adjacent to their department store. The head office of David Jones will move to integrate with the rest of the business in Melbourne. The funds received will be to upgrade their department store in Sydney. And no doubt staff will be cheaper in Melbourne. I don't know, let us know, if you live down under. Are the jobs and the cost of living very different from Sydney to Melbourne. One gets the sense that Sydney is more expensive, Melbourne is more attractive. Definitely from a sport point of view. Woolies expects to save 10 million Aussie a year, whilst still rolling out the best of retail in the Southern Hemisphere in an 11 level shopping mecca.

We are "owed" Woolies results on the 25th of August, that is just around the corner. We will review then, the trading statement has pretty much fleshed it out, not too much to expect. Whilst the stock has "done well" recently, year to date the price is down 10 percent. The company doesn't really have a real comparable business here locally, can you really compare them to Pick 'n Pay or Shoprite, or Massmart or the Foschini Group? Whilst they broadly fall in the same space, they are all different offerings. Buy the company, not the share price.

Company corner

At the beginning of the last financial year, 1 April 2015, the website synonymous with online booking, Booking.com (parent company and listed entity Priceline.com), had 670,000 places to visit. On August the 5th, 16 months later, the company announced that they had Added Its One-Millionth Property in Nantucket, Massachusetts. Of those, as you can see from the release, there are 23 million bookable rooms around the globe, with 7.2 million of those being homes, apartments and villas. Half of the total properties are NOT hotels, which in a sense allays many peoples fears that Airbnb will eat their lunch. They are all eating the same lunch. Besides, the biggest listed competitor in its space is Expedia, which is only 11.6 percent the size of Priceline.com.

Priceline has a market cap of 73 billion Dollars as of the last close, that is monumental in itself. And yet, the stock is neither cheap, nor is it expensive. At 27 times historical earnings and with the analyst community predicting over 68 and a half Dollars of earnings, the stock trades forward on just over 20 times. Growing earnings and revenues at a pretty breakneck speed, the same said analysts have the company making nearly 80 Dollars a share next year, and the multiple unwinds to just above 17 times earnings. Currently the company pays no dividends to their stock holders, growth is the current focus.

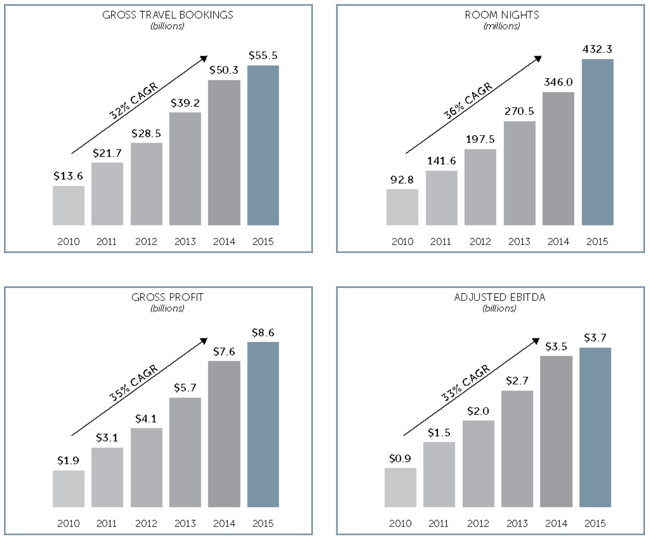

Herewith from the annual report from last year, these are all the key metrics which shows the meteoric rise in bookings and profits over the last 5 years.

So how does Priceline.com earn their money? The annual report breaks it into a few categories, processing fees (on behalf of smaller places of accommodation), commissions earned on the facilitating of accommodations, hires of rentals, ship cruises, as well as advertising revenues earned by KAYAK, one of their multiple platforms. They also recently, having acquired OpenTable, earn reservation revenues. And what do they plan to do, in order to continue to grow their revenues? Providing a great booking experience (they may want to work on that, it is easy, it could be easier), they are going to continue to partner with other travel providers, as well as restaurants (get the complete package), as well as investing heavily in other platforms. For instance, as they point out, they invested in Ctrip, a Chinese mainland operator. CTrip is actually listed in New York, and has a market capitalisation of nearly 20 billion Dollars.

Google and Facebook may well roll out large booking systems. I was quite interested when reading about online booking behaviours. It is different for business travel over personal. In business travel, over half of people in North America book their own business trips - Business traveller booking behaviours.

Tripadvisor (a competitor of sorts) had their 6 key travel trends for 2016, in which Trend#6 was quite important for me: "93% of hoteliers said that online traveler reviews are important for the future of their business" and "Online reputation management is still the biggest area of investment for accommodation owners in 2016, with 59% investing more in this area than they did the previous year."

Which means that more and more travellers will trust websites like Booking.com more than any other platform. The fact that the property is rated 9 out of ten and you can see the comments (petty or not) and the interaction with the management, means that all the dirty laundry is laid out bare. For all to see. The consistently higher you score, the more money you make, the more you are likely to promote your property on the website. All the reviews are for actual guests staying there, you only get a review request if you book through the platform, or are invited by the establishment.

So here goes, the last set of numbers: The Priceline Group Reports Financial Results for 2nd Quarter 2016. Revenues grew by 19 percent to 17.9 billion Dollars, gross profits increased 16 percent to 2.4 billion Dollars. That is nothing though, this is the dominant online business, and global revenues for the travel bookings industry is at 1.3 trillion Dollars. Their, Priceline.com, share is less than five percent. As such, there is plenty of road to run here. We continue to accumulate a growth business at a very reasonable multiple, relative to their growth prospects.

Linkfest, lap it up

Knowing your time frames before committing a cent to the market is important. If you know that you are investing for the long term, when the market plus back it may not feel good but you can still sleep well at night - Rules-based tactical vs wizardry and witchcraft. If you don't know your goals and time frames before hand, statements like this will scare you. "As a result, we downgrade equities tactically to Underweight over 3 months, but remain Neutral over 12 months."

I can see similar technology being used in an Apple watch in the future - An electronic temporary tattoo will warn people if they've had too much to drink. Imagine, your Apple watch senses that you have had too much to drink, it deactivates your Apple car and calls you an Uber instead.

Sticking with the Olympic fever, here an estimation of some of the incentives countries give to their athletes who win Gold. The US incentive may seem low compared to other countries but the athletes that win gold representing the US also generally get larger endorsement cheques - Some Athletes Are Chasing Huge Gold Medal Bonuses

You will find more statistics at Statista

Home again, home again, jiggety-jog. A couple of questions for the loyal readers. Would you like to see more videos done on stocks via the Instagram platform? For the time being they have been sporadic, far and few between. A loose and informal style? Have you signed up for all of our platforms? Do you follow us on Twitter (see below). We have both a Facebook page (like us) and an Instagram platform. And lest we forget the entertaining Blunders videos, the weekly one delivered on Friday - Blunders - Episode 25. Sign up for all these platforms, to never miss a beat. Let us know, more videos or not? We used to be very active in that space, and went a little quiet in that regard. Perhaps all people need nowadays is a 30 second clip of how things are going, is this one a good one, or not. Markets across the globe are a touch higher.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment