"When investing you can either look for the exceptional innovator or the exceptional doer. Or both. Innovators can be disruptors of the same technology that exists, and only makes it better. Think about the design team at Apple, Steve Jobs and Jony Ive deliver on both form and function. Nobody would pay that much for a phone if it wasn't a thing of beauty."

To market to market to buy a fat pig Our market went sideways yesterday, flip flopping between green and red the whole day, finally finishing up 0.1% (See graph below). We speak of the market as if there are no moving parts in the index itself. Given that Naspers, the biggest component of the index was up 2.5% yesterday it means that there where many other stocks who were in the red, off setting the large gain from Naspers. So many moving parts make up the market and it is not as simple as just saying one or two events was the reason for the market being green or red. Sticking with Naspers, it closed at an all time high last night, now at R 2 335 a share. It is amazing, you could have bought them as late as May 2014 and still doubled your money. The key with investing is avoiding the companies that blow up and go to zero, which means that you only need to find a couple of stocks like Naspers in a life time to significantly outperform the rest of the market.

Source:Share Data

Source:Share Data

The undisputed greatest investor is Warren Buffett, who built a business over decades, paid a dividend initially and thought to himself, can I do better myself with this money? He suggested that he was a better allocator of capital, and that was what his shareholders wanted. I suspect that Buffett, like his good friend Charlie Munger, will not be around in a decade or so, and he will leave behind him an unparalleled legacy. In investment terms, he is the Bolt, Ali, Bradman all rolled into one. Exceptional concentration and the ability to think on his feet, as well as articulate his mission and game plan in one. He has this uncanny ability to see behind the current noise that prevails, 24/7. He has the same rituals.

And that is what is great about investors and their ability to find something amongst all of the known. Luck, as Gary Player (and his 1000 sit ups) once made known, comes easier the more you practice. It took 50 years of reading the annual report of International Business Machines before Buffett bought any for Berkshire. That didn't prevent him from stopping to have a look. Evaluating and benchmarking yourself daily to the index, or to your peers, or to the global markets in Dollars is all lost if you keep trading and incurring costs.

One of my favourite stories about Buffett is when someone asked him to look at a chart and let him know what was going on, he didn't know which way to hold it. Upside down or not, trading around past information and predicting what is going to happen next is like looking at a scorecard from the past weekend and suggesting this will happen now. No. No two moments in time, let alone in equity markets, are the same. Be they 1929, 1987, 2001, 2008, or whatever. You can quite simple make any data point look like another.

When investing you can either look for the exceptional innovator or the exceptional doer. Or both. Innovators can be disruptors of the same technology that exists, and only makes it better. Think about the design team at Apple, Steve Jobs and Jony Ive deliver on both form and function. Nobody would pay that much for a phone if it wasn't a thing of beauty. Nobody would pay that much for a Tesla if it wasn't that functional and equally beautifully designed. There are the doers and executors, Aspen, Saad and Attridge spring to mind. They have taken businesses that essentially nobody really wanted (or they were not core) and made them great. Sweating the costs and doing the basics right. There are some similarities with the Steinhoff businesses, taking something tired, paying a price that doesn't seem right, and sweating the asset really hard.

Then there are others, like Adrian Gore from Discovery who is someone who challenges the status quo, someone who takes the same old product and uses the changes in technology to shake it up a little. New ways of innovating in health insurance leads to being rewarded as such makes Discovery a more profitable business. Free movies, smoothies, discounted travel and so on, continues to see members push their targets and goals beyond the "ordinary". And we find ourselves competing with each other, saving the business from unwanted costs. I asked the question in the office the other day, how come the French spend less as a percentage of GDP on healthcare and get it more "right" than the Americans? Or perhaps that is just my perception.

You can then get businesses that just do the same thing over and over, better than their peers and capture (and keep) market share. Bidcorp, the food services business, although as a standalone relatively new, have the evergreen Brian Joffe at the helm. Delivering on quality day in and day out can be challenging to say the least and requires exceptionally high standards. It may not seem like a growth business, more and more people are not only eating out, equally they require the "cooked at home" out of home meals. When Paul was recently in New York, a young millennial described how her "home cooked food" was delivered to her apartment for her for a fee. No more cooking, no more need for a big surface in a kitchen. It is time that dictates such things.

Equally, the internet and the delivery speeds have changed a lot. I often say that if I could give a Nobel prize to a "thing", it would be the internet. The internet does more to demystify ourselves from ourselves. If you want to know something, there is either an app for that, YouTube, Wikipedia, blog entries, the works. Google Maps are even filming the Falkland Islands on the back of sheep. Soon, there will be no area of known land that is not visible on the internet. The internet will prove to be the great leveller for humanity. I was amazed to learn that Kenyan silver (once gold) olympic medalist Julius Yego taught himself to throw the javelin by watching YouTube. Who does that? He does, in this day and age. I love that story.

So, with everything in life, portfolio construction is a refined process and we like to think that there is no cookie cutter approach. Trimming the winners for the sake of trimming the winners doesn't feel right, after all Bill Gates was once accused of having too many eggs in the proverbial investment basket, it was all Microsoft and that has turned out OK. I am also mindful that this doesn't always work, Dick Fuld from Lehman Brothers once lost everything and watched as Rome burnt in front of his eyes. Too much leverage.

In the end, you have to trust your own instincts as an investor. Does this feel right, does it look right, will the investment thesis be many years ahead, is the price that I am paying today "just fine" relative to all that I know? How patient am I going to be? It may sound counterintuitive and it almost never works for most investors. If your investment thesis checks all boxes, you should hope that the price falls. Like that, you can get the same thing for less. Yet it never works that way, when the share price of a great business goes down, intuitively we see fear and want to sell, we have after all lost money. Even if only on paper. The other thing that is on your side is time. A year is actually a very, very long time. I have spoken to many people who feel after a mere few months that things are not working out. I get it, equity investing is not for everyone.

To conclude this piece in the continued and extended bits and bobs over the last few days, it is irresponsible for any investor to pretend that they know better than the collective. To presume that the price is going to come down or going to go up as a result of your thesis and the collective is wrong seems misplaced. At least to me. Time, patience, scrutiny, attention to detail, reevaluate and repeat. Keep on keeping on.

Linkfest, lap it up

Having an understanding of history does not give you the ability to predict the future but it allows you to avoid mistakes made by people in similar situations to you - The United States of Market History Amnesia

Stock prices reflect a mixture of current financial numbers and what the future expectations are for those numbers, mostly future expectations. Understanding that stock prices are nothing more than expectations is the first step in understanding why prices move - Three Essential Points Every Investor Should Understand

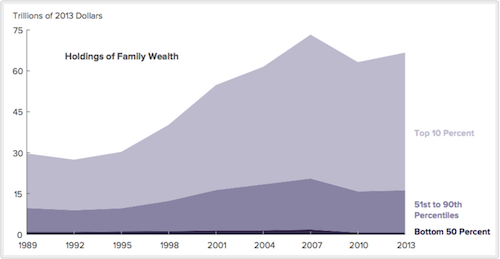

Having a financial base makes it easier for financial generations to grow that base, I suspect that the global graph will look similar to the US graph below - Trends in Family Wealth, 1989 to 2013. So save like crazy now, build a share portfolio that you can live off dividends when you retire and then when you pass on there is a base snowballing for future generations.

Home again, home again, jiggety-jog. Our market is down just over 0.1% today and the Rand has strengthened slightly to the Dollar, now sitting at $/R 13.40. Sasol is down 2% this morning after coming out with their updated report on their capex spend in the US, it looks like the project is going to cost $2 billion dollars more than originally budgeted.

Sent to you by Sasha, Michael and Byron on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment