"There is little that you can do about the currency. There is nothing that you can do about the average British voter, even if 1.2 million of them suffer from voters remorse."

To market to market to buy a fat pig Stocks sank yesterday in the city founded on the largest gold pile known to mankind, at the time. And now, I guess. In terms of single locations, the Grasberg mine in Indonesia may well contain over 100 million ounces of gold, South Deep, just down the highway from our offices has reserves of around 81 million ounces. The bronze medal for gold reserves (nailed it!) goes to Lihir, an island in PNG. Mponeng, a mine owned by AngloGold Ashanti near Jozi, has reserves of just short of 40 million ounces. I declare Jozi the winner! Yes please. Gold buffs, tell me if I am wrong or right, ok?

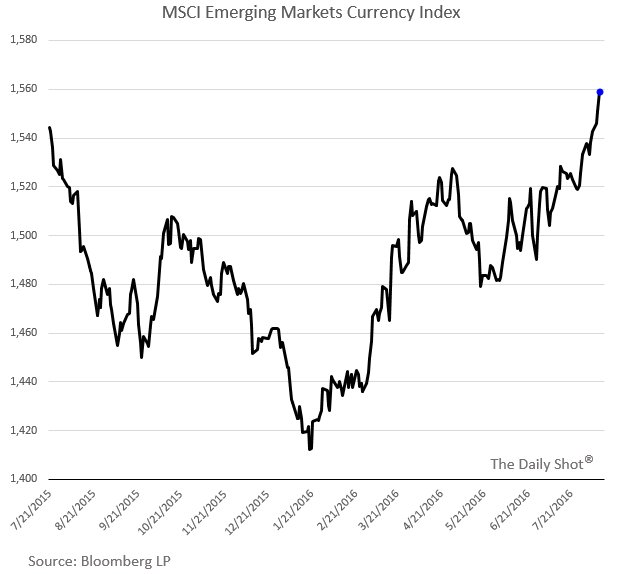

Stocks in the losing column included Brait (a NAV analysis below), South32 (the unbundled assets from BHP Billiton, a beast of a market cap at 106 billion ZAR), in the winners column was Amplats and Mr. Price. Or Senhor Price, if you are looking for the upmarket version. The Rand continues to strengthen, not so much as a result of whatever reason you are looking for, rather this graph from the The Daily Shot. Exhibit one sports lovers:

That is a basket of all emerging markets, courtesy Bloomberg and The Daily Shot, getting thrashed in January (as they were finished) and winning again as the global search for yield emerges again. Yields are going to stay low in the developed world, inflation is low, growth is slow too. The environment will change, for the better, I suspect that this will happen once the confidence returns. We need a few years without a stumbling from Greece. Help us from politicians.

Over the seas and far away, in New York, New York, stocks sank at the beginning of the session and it stayed that way through to the close. The Dow sank one-fifth, the broader market S&P 500 sold off around three-tenths and the nerds of NASDAQ ended the session down 0.4 percent. Energy stocks and the price of WTI (West Texas Intermediate) deflated the market, loads of supply and the market still looking for signs of balance. At least from where I sit. Perhaps I am wrong, we will use it all up before we move to Mars. Then I am reminded of the old saying, the rocks didn't run out when the stone age ended. We are nearing the end of earnings season, a few more stocks left to cover from our side. Alibaba, who report today, Twitter (a way back) and Under Armour.

Investing is not an Olympic sport. Investing makes curling look like the 100m dash. Investing makes the Air Pistol 10m event (I am sure they are the finest in the world at their discipline) look like Modern Warfare/Halo. Or Wolfenstein for your older folks. Investing takes just as much discipline and hard work. The only difference is that the gold medal for investors is obtainable, you only have to do the basics right. Don't speculate, treat every cent earned and saved with the same respect each and every time you make an investment decision. You know how hard you worked to earn it and then save it (instead of spending it), treat it wisely. When you buy a stock of a listed business, you are buying a piece of the future. Nobody can see around the corner. There are dreamers who do, there are doers that dream. Be somewhere in the middle.

Too often I see people look at a specific stock price and suggest that is a good business. If the stock price is doing well, then so must the business. That is often true, sentiment does have a lot to do with valuations. Why did companies with non-existent revenues trade at crazy multiples back in 1999/2000? Businesses with basically little revenue, traded at billions of Dollars of market value. It seemed that people didn't care what the companies did, cynically one would say, if it had a dotcom at the end, it was good to go. That ended badly.

Amazon stock went from 107 bucks to 7 bucks during the meltdown. It didn't mean that Bezos didn't try harder to change the world. He possibly felt bruised and battered. He continued along his merry way, trying everything. Webvan was a concept that failed in the Dotcom era, the idea was brought back to life by the aforementioned Amazon, they became AmazonFresh. Born in 1996, Webvan listed at the top, in March 2000. They raised 375 million bucks and Mr. Market said they were worth nearly 5 billion Dollars on day one. According to Wikipedia, the company had revenue of 395 thousand (that is 395,000) dollars and 50 million Dollars in losses (that is 50,000,000). Why would any investor at scale part with 375 million (that is 375,000,000) Dollars? I suppose greed and fear is hard coded in all of us.

You could argue that if Webvan took small steps and didn't shoot for the stars, they may well be the number one fresh food seller via warehouses with sophisticated delivery and storage mechanisms. I mean, an internet business. Remember that the internet is a service, a tool, simply because a business uses that as a platform does not mean that they are "an internet business". 'nuff said. Pets.com, another high profile example of the dotcom bust, went from internet king and high profile IPO to liquidation in 268 days. Try not be the person that looks for Pets.com.

Be the marathon runner. Time your investments carefully with your life goals. If your life goal is to become the best amateur photographer in greater Johannesburg, then be that person and have enough resources to do that. Just as an aside, I have lived in the city of gold since 1999 and I still struggle to spell it, what is up with that? I stick in two s' and one n. Ignore the short term noise that is associated with equity markets, there are more distractions and more information than at any time in history. There are more formal savers today than at any other point in history. Opinions are like you know what. Have a strategy and stick to it. You may well look left (don't do it Chad) and see someone else #winning, competing is just as important. There is only one Warren Buffett, one Charlie Munger, one John Templeton, one Bill Miller, one Peter Lynch, one Jack Bogle and dare I say it, one Carl Icahn and George Soros. They have had their fair share of Chad moments. That does not mean that they don't try harder next time.

Company corner

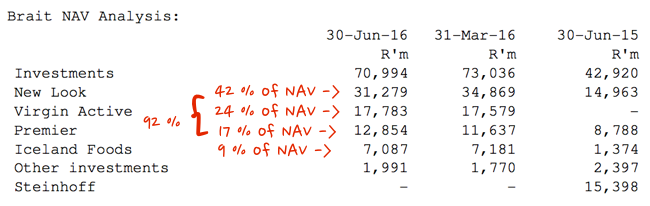

Brait, the investment holding company, released their Net Asset Value update for the first quarter of the financial year. The share price has taken a terrible beating lately as the impact of Brexit takes it's toll. NAV decreased by just over three percent for the quarter, largely due to the Rand. The release fleshes it out: "The impact of the UK referendum vote to leave the European Union resulted in the Pound weakening 7.5% against the Rand from ZAR21.21 at 31 March 2016 to ZAR19.62 at 30 June 2016."

So where is the Rand from there, the end of June? It is another 12.12 percent stronger since then to the Pound Sterling, compounding the matter even more. There is little that you can do about the currency. There is nothing that you can do about the average British voter, even if 1.2 million of them suffer from voters remorse. I read that, there are genuinely voters who thought they were doing x (they were doing an x) by voting for that. Whereas they hadn't really been doing that. The stock is down at the get go this morning, just over 6 percent as the collective mull the implications of the stronger currency.

First, let us look at what they own, and what they value it at. As Michael points out, if you are using a lot of gearing, then a Enterprise Value to EBITDA value is better to use. So cash generation to pay down debt is important. For better or worse, Brait owns mostly retailers, food and clothing. As you can see, New Look is the one investment that has been "not good".

Negative headlines and an outlook that looks a little less rosy means that consumers are likely to spend less. Paul tweeted a link to an article (Internet Of Clothes: Nanny Wardrobe Reminds You To Wear Items, Or It Gives Them Away) that says: "The academics behind it lament that as a society we own four times as many clothes as we did 20 years ago, but regularly only wear about 20 percent of them" What? So it turns out that we buy more clothes than we need and we wear them less often. The likes of H&M, Marks & Spencer, TopShop (the Arcadia Group), Debenhams, Primark (more so) and Next are all competitors, it is not an easy space to operate in. Yet, they should all benefit from this trend.

What to do now? The stock took some heat, ending the day down around 5 percent. Trading below the reported NAV, my sense is that calculating the worst of the recent performance of their main asset and adjusting for the currency, the market has got it about right. I am very sure that the Brait management team are feeling very bruised right now. I wrote to a concerned client yesterday: "The irony was that investors were scrambling to own stocks exactly like this. The Pound has almost everything to do with, equally Brexit sentiment. Whilst New Look will suffer locally (in the UK), the offshore business (i.e. China) will grow quicker. The other businesses are all fine."

Yes, they are weak at the moment, the share price, based on a weak home (UK) looking market. A good space, and they no doubt will sweat their assets even harder. Expect some of the best operators and allocators of capital in the ZA market, and now on a global scale, to drive the wagon harder. We accumulate the stock at these lower levels.

Linkfest, lap it up

Thanks to our old pal, Prof. Mark J. Perry, at the AEI (American Enterprise Institute) for pointing this out, the price of New York City cab medallions is falling fast (see - July 2016 Medallion sales chart). See all of that and more from an excellent post by Prof. Perry about lift sharing, power (of politicians) and general disruption - Some ride-sharing links. Yellow? Can you hear me? It is the Black Uber calling .... we are eating your lunch.

A very long interview with Tim Cook, the Apple CEO, a great read for lunchtime, bedtime, breakfast, heck, all the time. He is quoted and nails the investment thesis in half a sentence: "I've always thought that Apple's primary role is to delight its customers." See - Tim Cook On Apple's Values, Mistakes, And Seeing Around Corners.

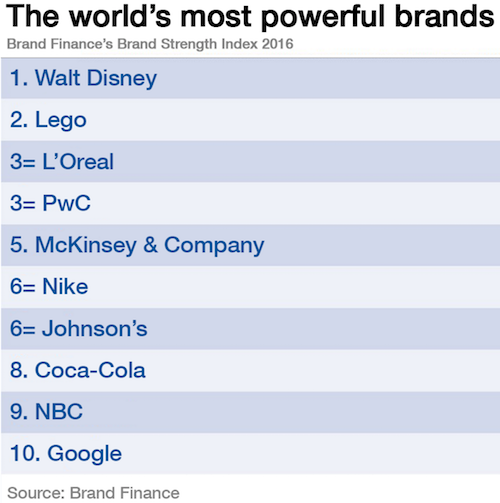

These are the globes top 10 most powerful brands, my question is: "Where is Apple?" - These are the world's 10 most powerful brands. The ranking was based on the following, 'The top 10 is calculated by awarding each brand a score out of 100, based on "factors such as familiarity, loyalty, promotion, marketing investment, staff satisfaction and corporate reputation" '

We have had a number of maps in the links showing how distorted the world map is. Here is another one, highlighting the potential that the African continent has due to it's size - Your view of the world is distorted. This interactive map will show you just how much

The Brexit fears/ jitters seems to have gone quiet, at least in main stream media. This law suit highlights the complexities going forward, where does everyone stand in front of the law? Well people are not sure - A Hairdresser's Lawsuit Could Spell Trouble for Brexit

Home again, home again, jiggety-jog. Stocks are marginally lower on the local front, across the ocean to the north, Steinhoff have marginally upped their offer for Poundland by two percent or so. There Elliot, you are amazing, now take the money and run.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment